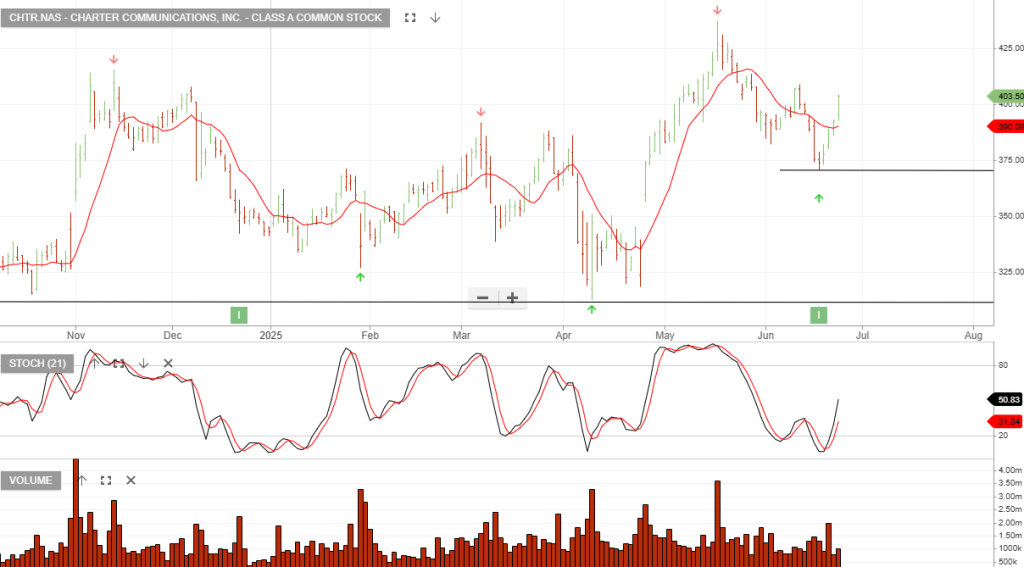

Charter Communication

Charter Communications, Inc. – Class A Common is a new holding in the US S&P100 Trade Table

Charter Communications, Inc. – Class A Common is a new holding in the US S&P100 Trade Table

The index is positioned at the top side of support, and long trades are now open with a stop-loss on a reversal down through 8530.

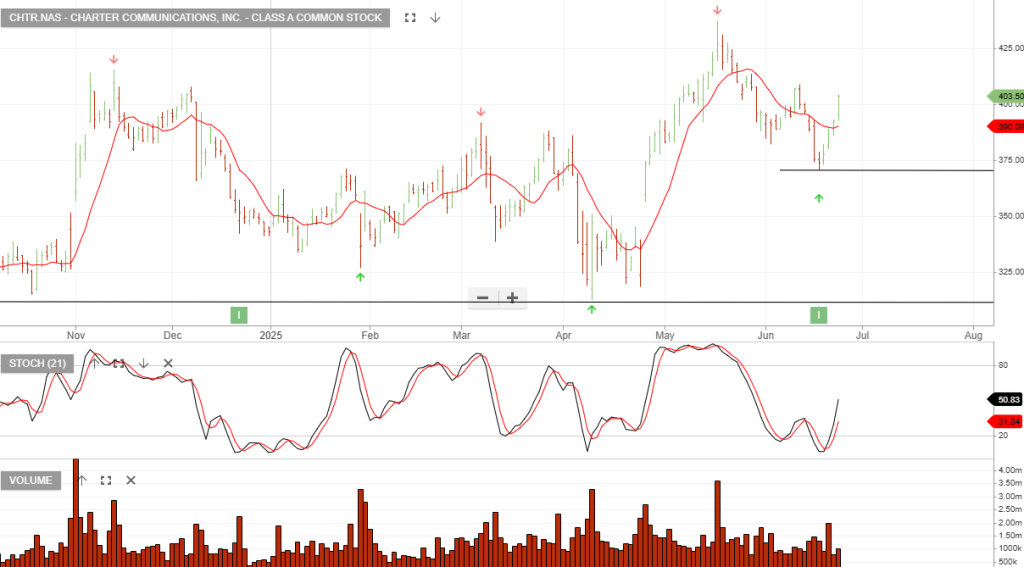

VanEck Morningstar Wide Moat : With US indices breaking through resistance, traders may wish to consider the long side of the market with a stop loss in place.

Buy MOAT with the stop loss at $123

AMP is rated a buy with the stop loss at $1.18

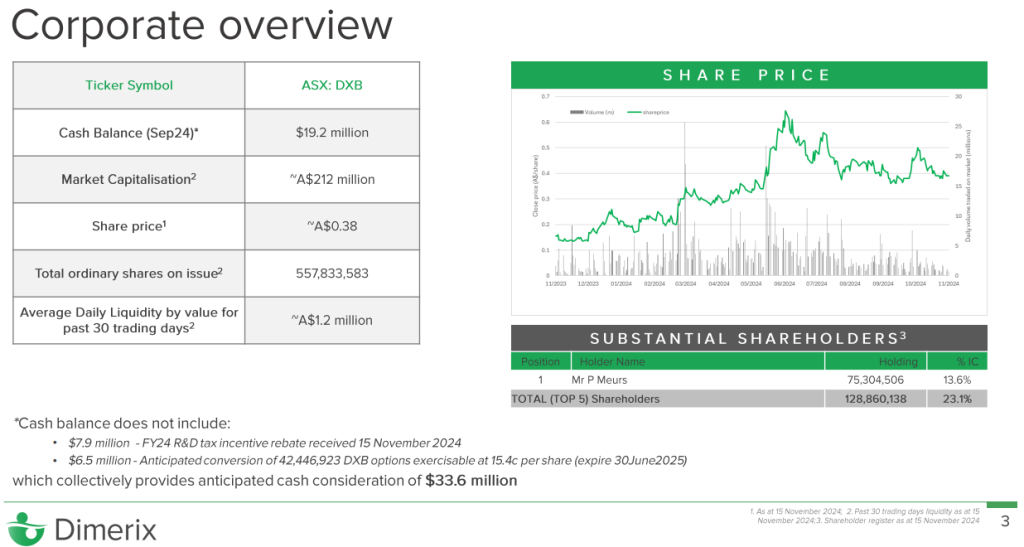

Dimerix is under Algo Engine buy conditions.

Bitcoin needs to trade through 107,750 to re-establish the uptrend.

Amcor Add to watchlist and wait for a close above the 10-day average.

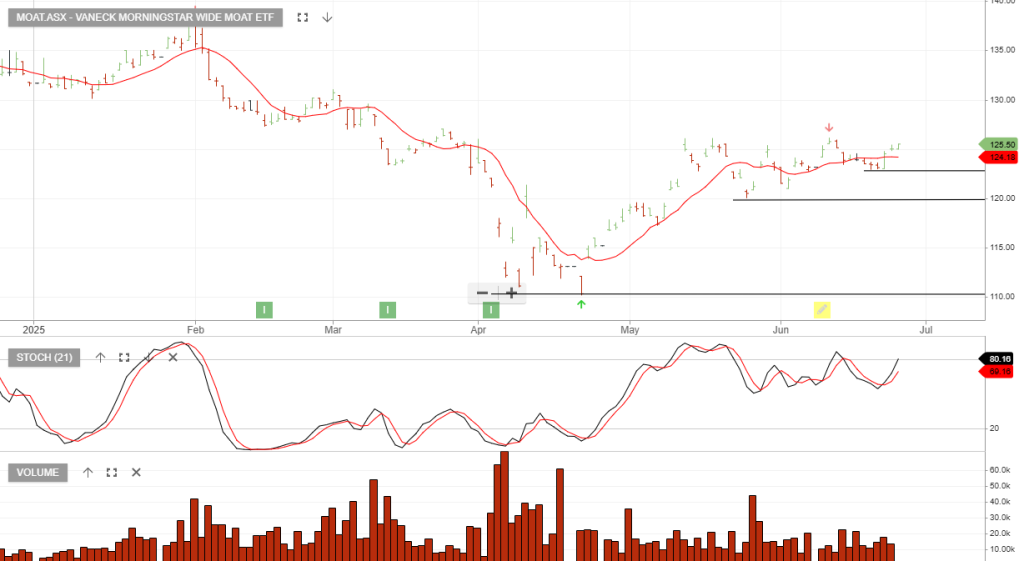

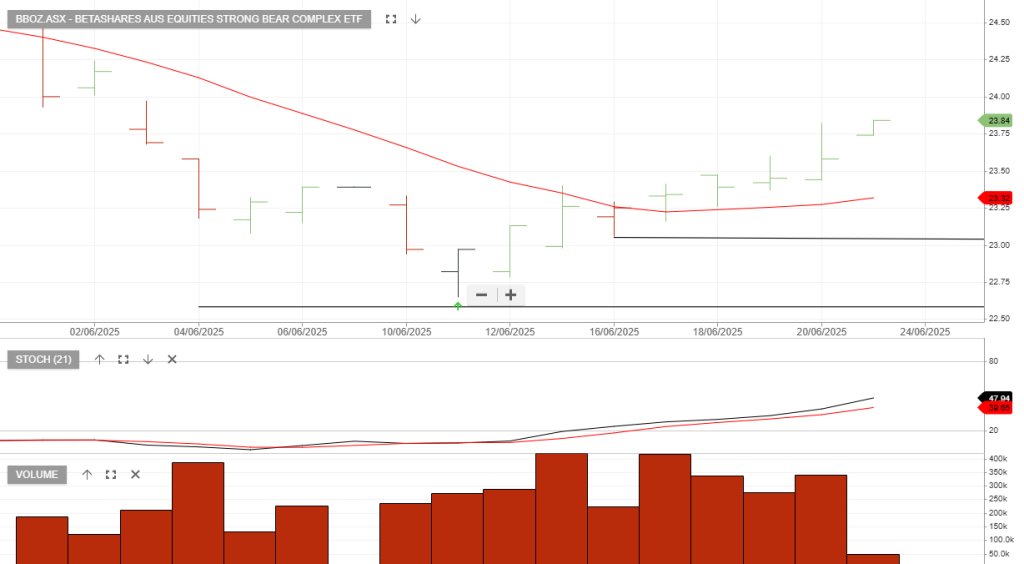

Betashares Aus Equities Strong Bear Complex : The inverse ASX200 ETF trade is trending with the stop loss in place at $23.06

Ansell is under Algo Engine buy conditions.

Dimerix : Buy with a stop loss at $0.50

Dimerix Limited operates in the biotechnology industry, focusing on the development and commercialization of innovative therapies for unmet medical needs. The company is primarily engaged in creating pharmaceutical solutions that target specific diseases

Investor Summary – Dimerix Limited (ASX: DXB)

June 2025

Company Overview

Dimerix is a clinical-stage biopharmaceutical company focused on developing and commercializing innovative treatments for inflammatory diseases, with a lead focus on kidney disorders. The company’s flagship asset, DMX-200, is in Phase 3 trials for Focal Segmental Glomerulosclerosis (FSGS), a rare and serious kidney disease with limited treatment options.

Lead Program: DMX-200 for FSGS

Market Opportunity

Strategic Partnering

Investment Highlights

✓ Global Phase 3 trial targeting rare disease with high unmet need

✓ Validated by multiple licensing transactions and regulatory alignment

✓ Strong IP protection with composition and use patents

✓ Experienced leadership team with a proven track record in biotech commercialization

✓ Pipeline expansion opportunities in broader inflammatory conditions

Leadership & Governance

Led by CEO Dr. Nina Webster, supported by a board and management team with decades of experience in drug development, commercialization, and strategic partnerships (ex-Pfizer, Roche, Mayne Pharma, etc.).