China New Economy ETF

VanEck China New Economy is rated a buy.

VanEck China New Economy is rated a buy.

VanEck Global Healthcare Leaders is rated a buy.

Global X S&P Biotech is under Algo Engine buy conditions.

ASX:LYN is under Algo Engine buy conditions.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

The S&P 500’s forward annual earnings per share are tracking at $260, $100 higher than six years ago. The P/E on a forward estimate is 23x. The earnings yield is 4.39%, nearing the June 2020 low of 4.11%.

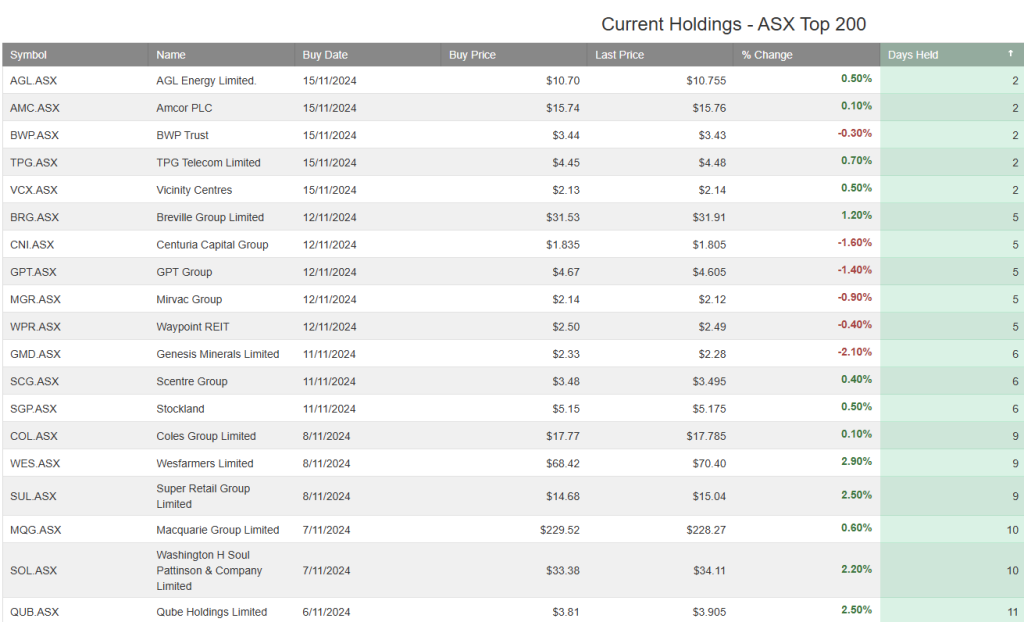

In the last 30 days, the following positions have been added to our longer-term investor model portfolio. We’ll take a closer look at the opportunities in tonight’s webinar.

Many positions have built up in the trade table, and we’ll review them during tonight’s webinar.

November 18 – Trip.com Group, Symbotic, AECOM, BellRing Brands, and Brady Corp.

Tuesday, November 19 – Walmart, Lowe’s, Medtronic, Keysight Technologies, and Viking Holdings.

Wednesday, November 20 – NVIDIA, TJX, Palo Alto Networks, Target, and Snowflake.

Thursday, November 21 – Intuit, Deere & Company, Ross Stores, Construction Partners, NetApp, and BJ’s Wholesale Club Holdings.

Friday, November 22 – The Buckle, and Global Blue Group Holding.