Oil

Posted on | by Leon Hinde

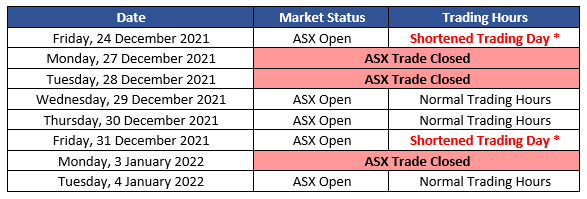

ASX Trading hours over the coming Christmas and New Years period.

A shortened trading day * will be in effect on Friday 24th December and Friday 31st December.

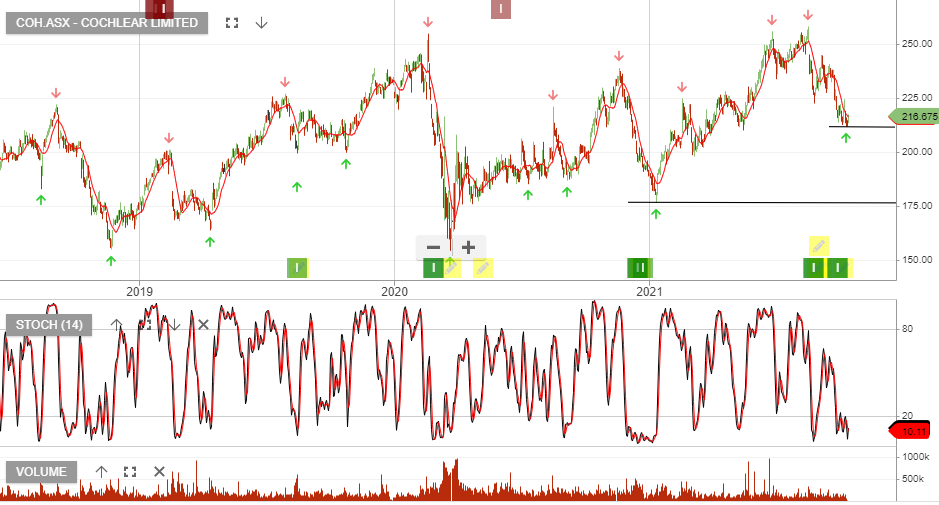

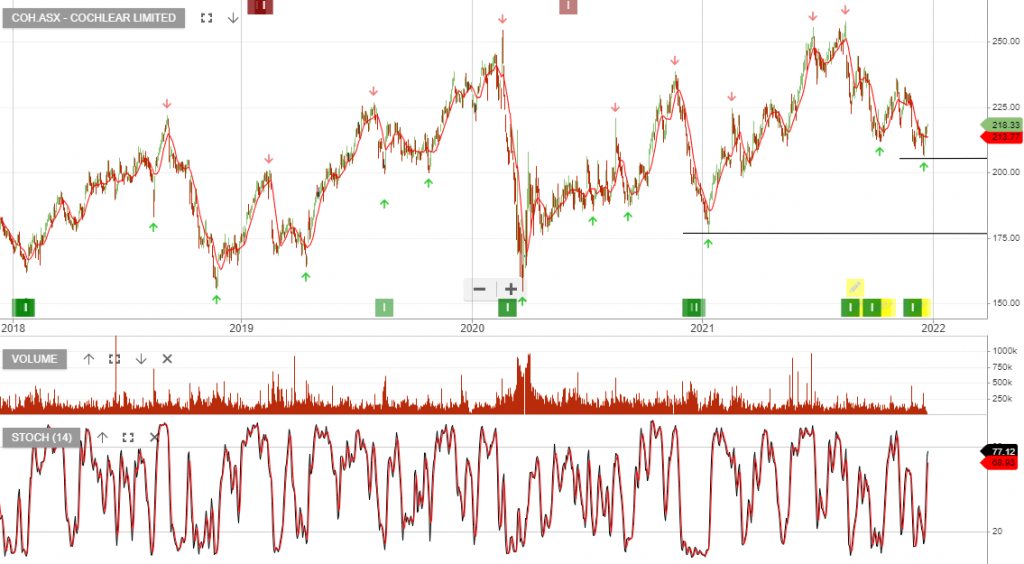

Cochlear is now under Algo Engine buy conditions and has been added to our ASX 100 model portfolio.

We expect 10% EPS growth over the next 12 months. Although, the stock remains expensive at 40x earnings and trading on a 1.8% yield.

Since writing the above post in Dec last year, COH has rallied from $175 to a high of $257. The subsequent pullback has seen buying interest rebuild at the higher low of $210.

This is the second cluster of Algo Engine buy signals and we’ve taken the opportunity to add to our original allocation.

16/12 Update: COH remains a buy at $215.

24/12 Update: Buy COH @ market price $218

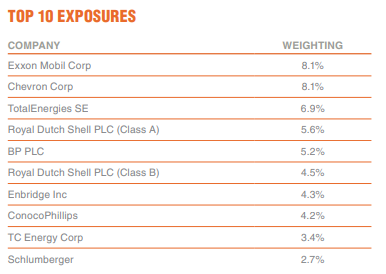

WPL:ASX is under Algo Engine buy conditions and is a current holding in our ASX model portfolio.

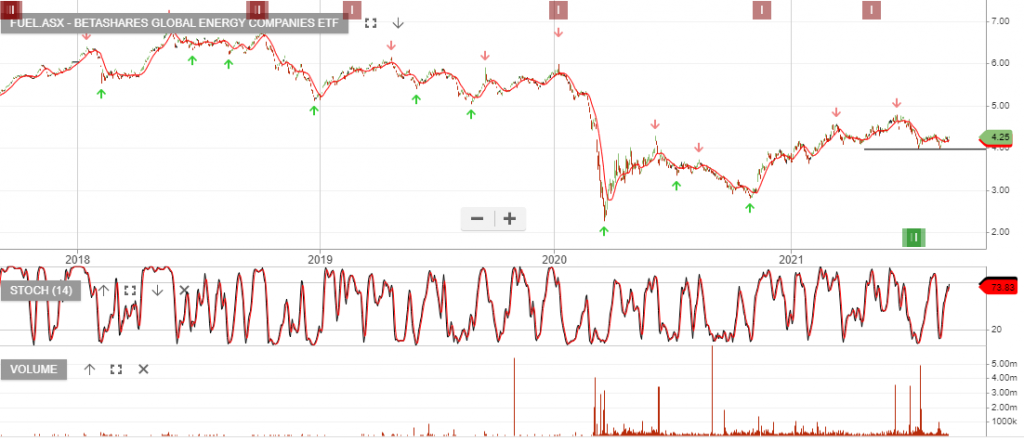

BetaShares Global Energy Companies is under Algo Engine buy conditions.

Fuel aims to track the performance of an index that comprises the largest energy companies (ex-Australia), hedged into Australian dollars.

23/12 Update:

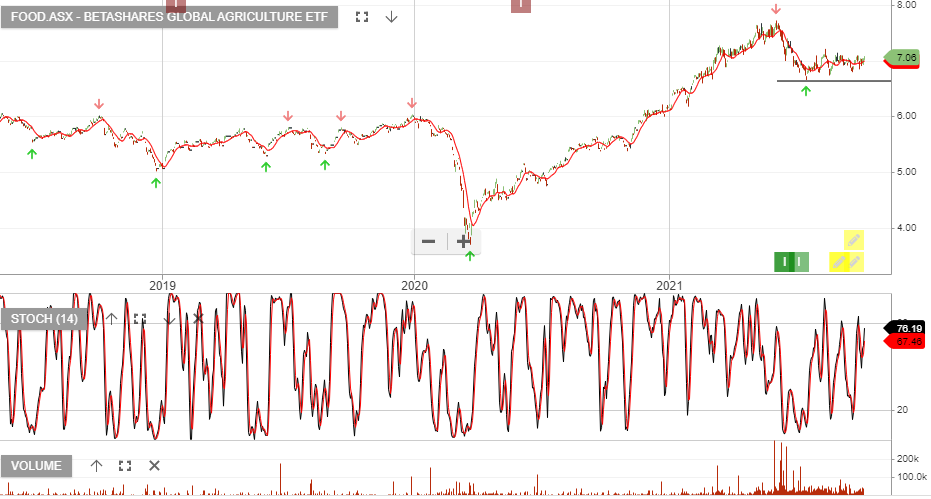

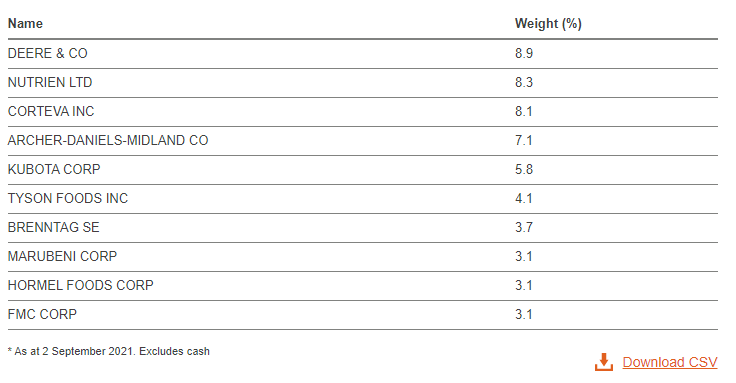

BetaShares Global Agriculture is under Algo Engine buy condition.

FOOD aims to track the performance of an index (before fees and expenses) that comprises the largest global agriculture companies (ex-Australia), hedged into Australian dollars.

31/12 Update:

Domino’s Pizza Enterprises is under Algo Engine buy conditions.

Orica is under Algo Engine buy conditions.