Bank of Queensland – Sell

Bank of Queensland is under Algo Engine sell conditions and we expect selling pressure to build below the $10.00 resistance level.

Short BOQ with stops above $10.00

Bank of Queensland is under Algo Engine sell conditions and we expect selling pressure to build below the $10.00 resistance level.

Short BOQ with stops above $10.00

The current weakness in the Crown share price could be a buying opportunity. It’s unlikely that the current COVID-related operational impacts are going to deter the interested parties who have put forward takeover offers.

Continue to track the CWN share price and wait for a cross above the 10-day average.

12/8 update: CWN is now trading above the 10 day average.

18/10 update: Crown recovery continues, buy with a stop loss below $8.75

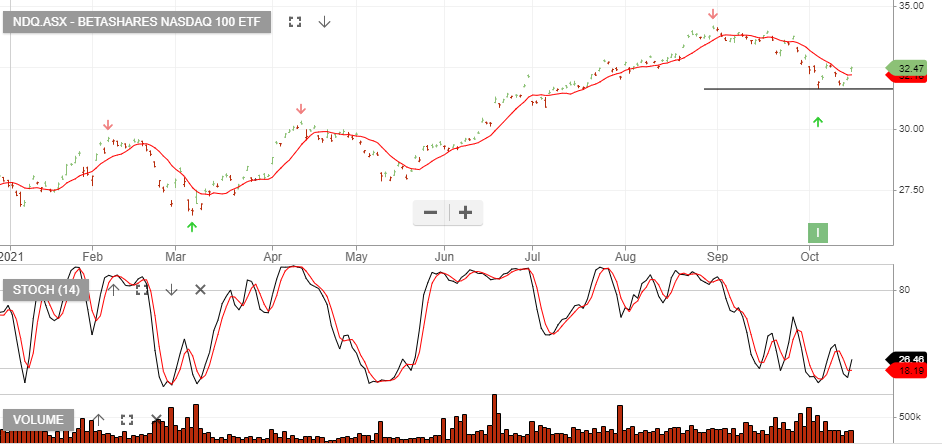

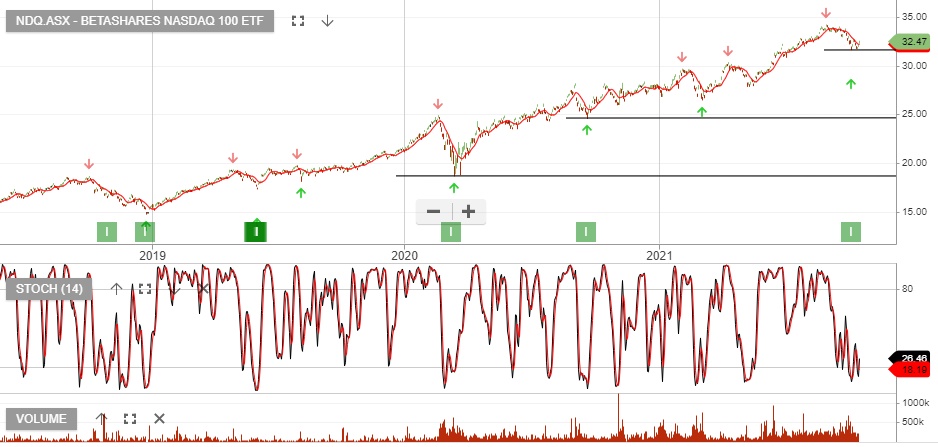

BetaShares Nasdaq 100 is under Algo Engine buy conditions and is among the best performing ETFs in our ASX ALL ETF model.

The ETF was added in January 2016 and is now up 216% after 2105 holding days.

InvoCare is under Algo Engine buy conditions.

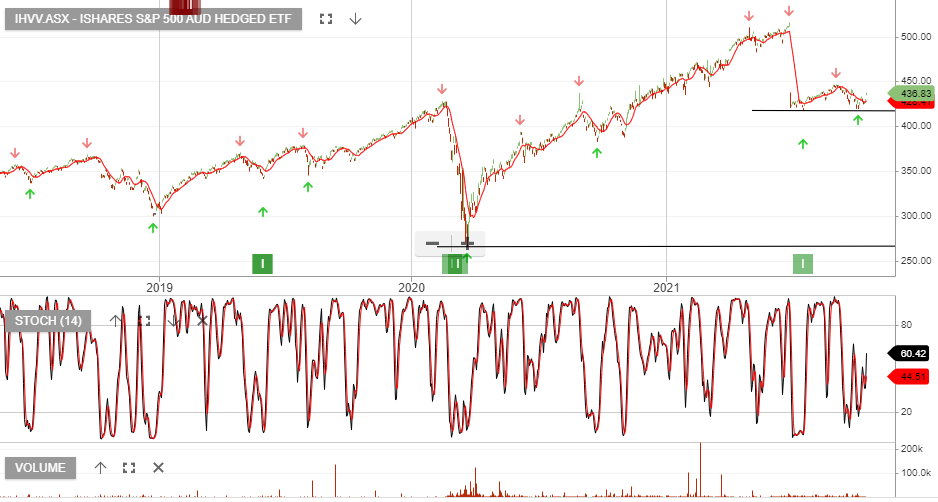

iShares S&P 500 AUD Hedged is under Algo Engine buy conditions.

The fund aims to provide investors with the performance of the S&P 500 Hedged AUD Index, before fees and expenses. The index is designed to measure the AUD hedged performance of large capitalisation US

equities.

Breville Group is under Algo Engine buy conditions and we see price support building at $26.50

Machine learning and AI specialist Appen (APX) has downgraded its earnings guidance due to the COVID-19 pandemic downturn.

The company’s guidance is for EBITDA in the range of $100 million to $110 and the company anticipates a return to strong growth in FY22.

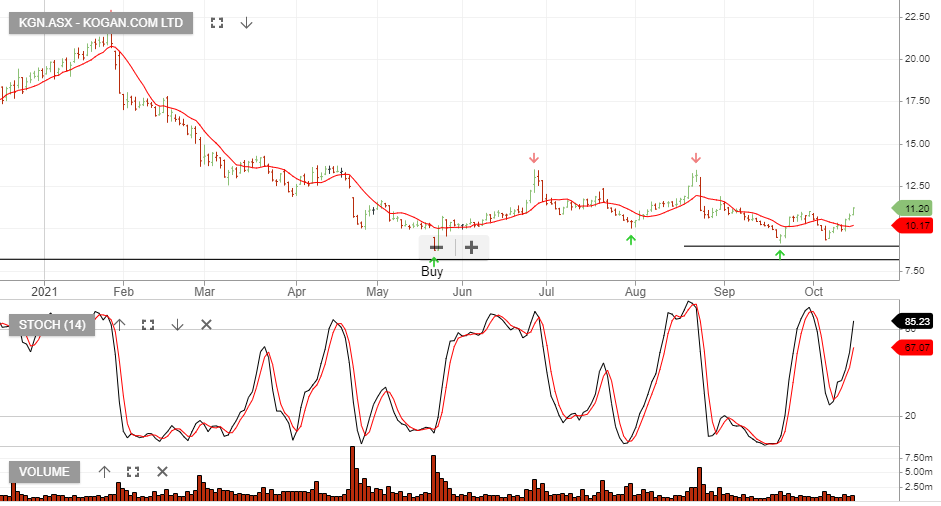

KGN:ASX is under Algo Engine buy conditions following the correction from $25 down to $9.

Brambles is under Algo Engine buy conditions and has now been added into our model portfolio.

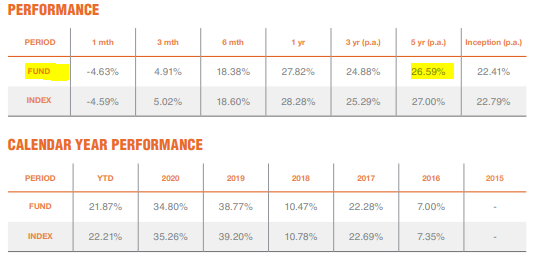

VanEck Vectors Global Health Leaders is under Algo Engine buy conditions.

HLTH invests in a diversified portfolio of leading international developed markets (ex-Australia) companies with the best growth at a reasonable price (GARP) attributes from the global healthcare sector with the aim of providing investment returns, before fees and other costs, which track the

performance of the Index.