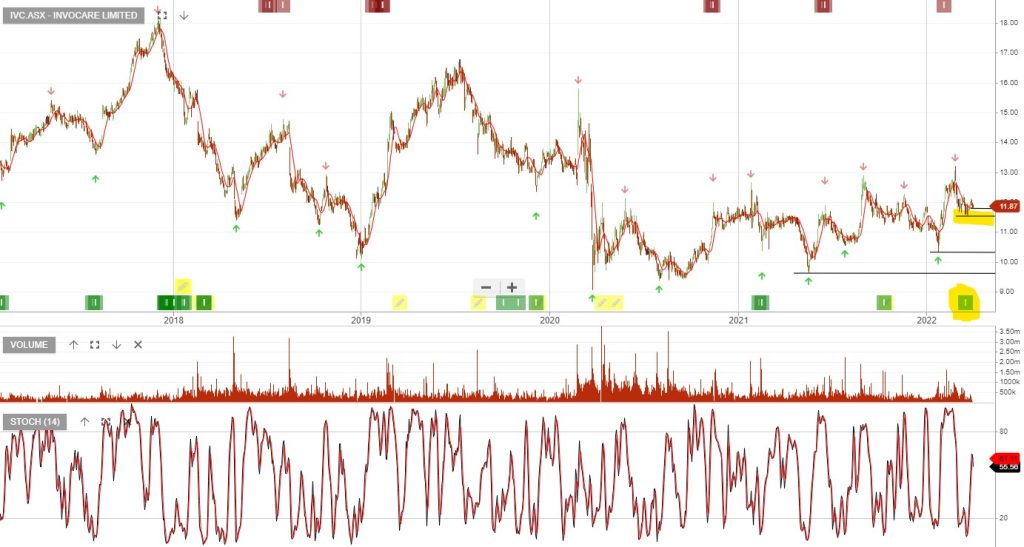

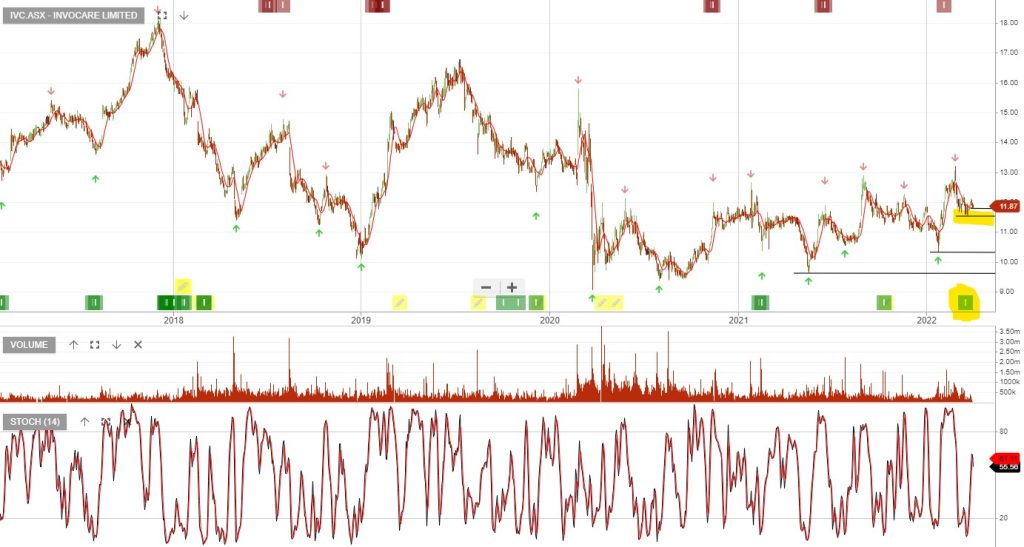

Invocare – Algo Buy Signal

InvoCare is under Algo Engine buy conditions.

InvoCare is under Algo Engine buy conditions.

InvoCare is under Algo Engine buy conditions.

InvoCare is under Algo Engine buy conditions.

In mid-April IVC announced up to $250m equity raising

at $10.40/share.

April revenue was down 13% and we’re seeing costs higher than

anticipated. Improvement in trading conditions should occur as the partial easing of restrictions take place.

We assume 2020 earnings will be down 10% and see a recovery into 2021 & 2022.

We’ll revisit IVC if it trades back below $10.00

InvoCare announced it will raise up to $250m in equity at $10.40 through an underwritten institutional placement plus up to $50m through a SPP.

The funds will be used to pay down debt and shore up the balance sheet.

InvoCare is under Algo Engine buy conditions and the short-term indicators are now turning positive.

We see buying support building near $12.50

FY20 EPS growth should be 6%+ and we have the stock on a forward yield of 3.2%.

InvoCare comes onto our watchlist following the 1H19 result which showed 10% revenue growth and NPAT up 9%.

The stock is nearing our entry-level following recent retracement in price.

Look for the next Algo Engine buy signal.

InvoCare is under current Algo Engine sell conditions, following a recent lower high formation at $15.00.

Invocare’s balance sheet will be strengthened following the announced raising of up to A$85m, via institutional placement which will include $20m via a share purchase plan. We expect this to be done at around $13.30.

We anticipate the next signal to be a Algo Engine “buy” and we’re likely to see this before the end of April.

We see long-term value in IVC and suggest investors watch for an entry signal between $13.30 & $13.80

Invocare has under performed following their recent earnings report, in which the company indicated flat forward earnings and an increase in capital expenditure.

Technically, a “higher low” formation remains in place and we flag to our readers the strength in today’s price action.

IVC

IVC’s FY17 result overall was slightly above our market expectations, although FY18 outlook guidance was disappointing.

FY17 underlying EBITDA increased 8% to $124 million, the result was driven by 2% revenue growth.

Based on FY19 EPS of $0.68 and DPS $0.48, IVC now trades on a forward yield of 3.4%.

IVC

Our Algo Engine triggered a recent buy signal in IVC and the stock has continued to drift lower.

The next range of support is $14.30 , followed by the up trending support line marked as “support 2” in the graph below.

The negative price action over recent days is being driven by the market’s reaction to a change in industry competition in the UK and concerns that similar challenges may emerge in Australia.

IVC reports full year earnings result on 19th February.

InvoCare

Or start a free thirty day trial for our full service, which includes our ASX Research.