BHP – Algo Buy Signal

BHP Group is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

BHP Group is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

OZR:ASX is under Algo Engine buy conditions and we anticipate buying support to increase near the $12.50 support range.

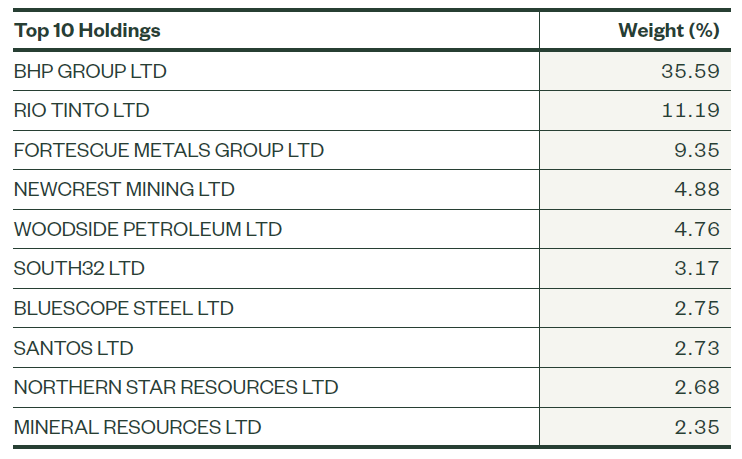

A sector sub-index of the S&P/ASX 200 Index, this index provides investors with exposure to the Resources sector of the Australian equity market as classified as members of the GICS® resources sector. Resources are defined as companies classified in the Energy sector (GICS® Tier 1), as well as companies classified in the Metals and Mining Industry (GICS® Tier 3).

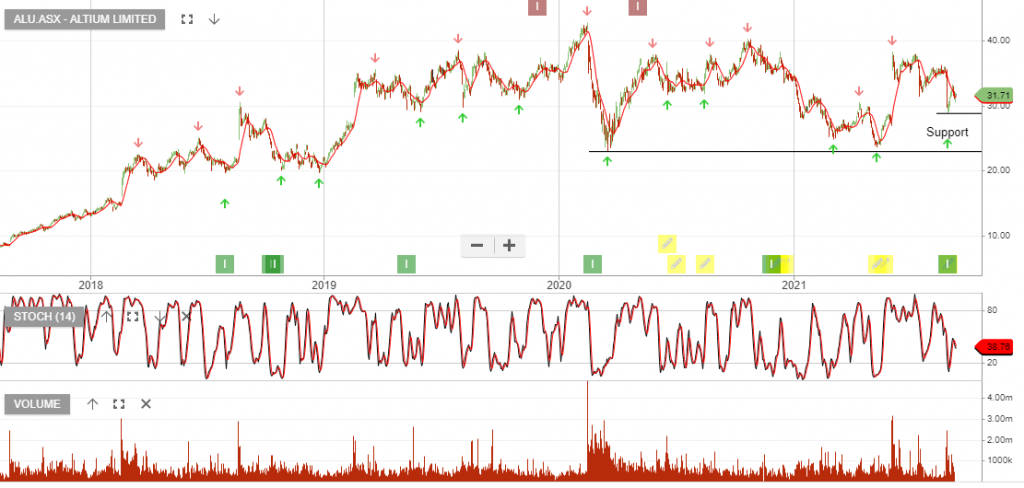

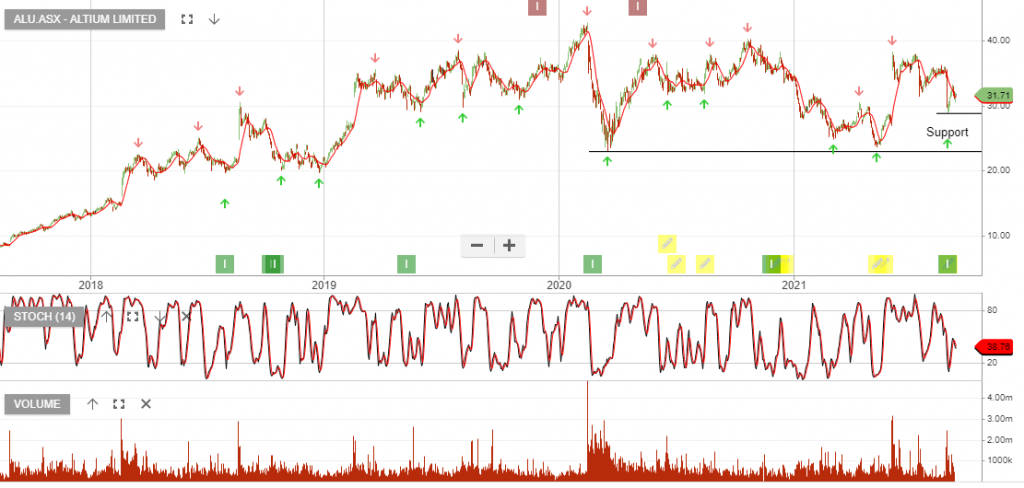

Altium is under Algo Engine buy conditions.

If you’re an Investor Signals member and have been joining us on Monday night webinars, you would have made some changes to your portfolio allocations.

To protect portfolios we’ve taken the following approach (for members only)…

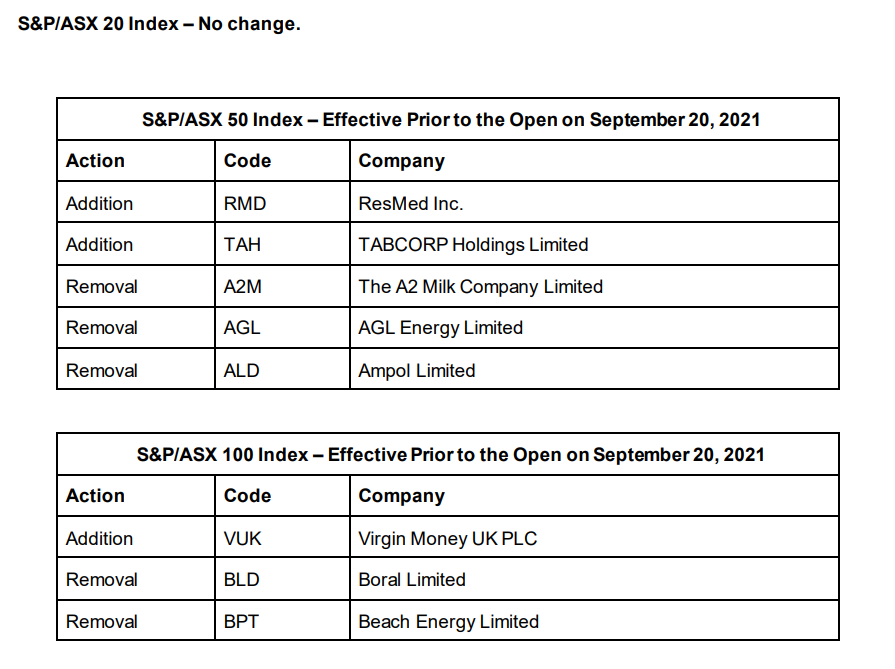

Index rebalance RMD and TAH are added to the top 50 index, both are under Algo Engine buy conditions.

A2M, AGL and ALD are removed, all three are under Algo Engine sell signals.

Coles Group is under Algo Engine buy conditions.

Investors should look to accumulate a position in Coles, within the highlighted price range.

BHP Group is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

Altium is under Algo Engine buy conditions.

Aurizon Holdings is under Algo Engine buy signals.

Aurizon reported underlying earnings before interest taxation depreciation and amortisation (EBITDA) of $1.48 billion and told investors to expect underlying EBITDA of between $1.42 billion-$1.5 billion in fiscal 2022.

Zip Co is under Algo Engine buy conditions.

PayPal Holdings said it would acquire Japanese buy now, pay later firm Paidy in a $2.7 billion largely cash deal, taking another step to claim the top spot in an industry experiencing a pandemic-led boom.