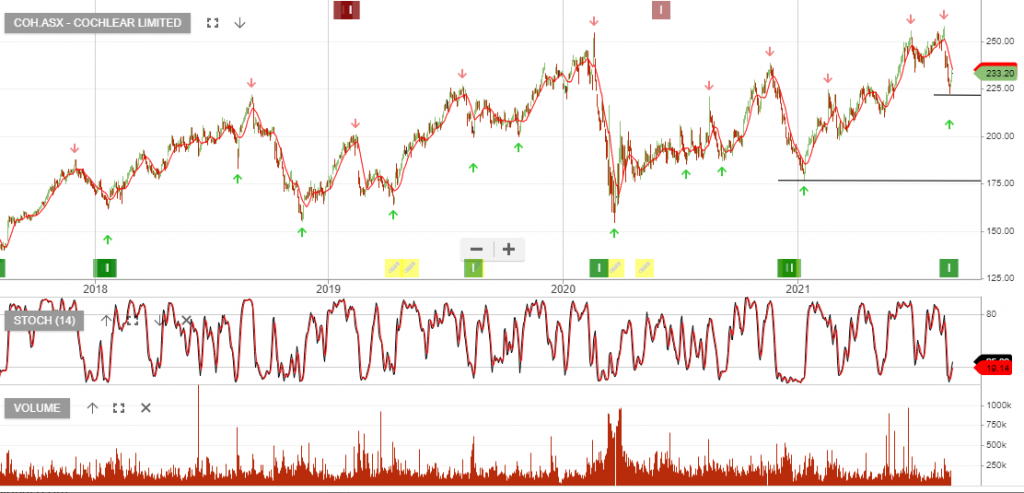

COH – Algo Buy Signal

Cochlear is now under Algo Engine buy conditions and has been added to our ASX 100 model portfolio.

We expect 10% EPS growth over the next 12 months. Although, the stock remains expensive at 40x earnings and trading on a 1.8% yield.

Since writing the above post in Dec last year, COH has rallied from $175 to a high of $257. The subsequent pullback which bottomed on Monday this week has seen buying interest rebuild at the higher low of $222.

This is the second cluster of Algo Engine buy signals and we’ve taken the opportunity to add to our original allocation.