Bega – Algo Buy

Bega Cheese is under Algo Engine buy conditions and is a current holding in our ASX model portfolio.

Accumulate within the $5.00 – $5.25 price range.

Bega Cheese is under Algo Engine buy conditions and is a current holding in our ASX model portfolio.

Accumulate within the $5.00 – $5.25 price range.

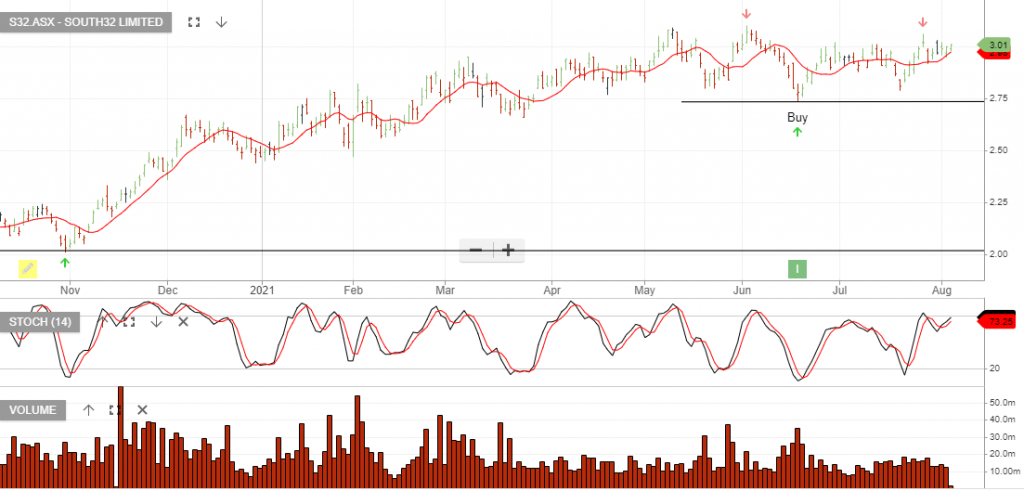

South32 is under Algo Engine buy conditions and is a current holding in our ASX100 model portfolio.

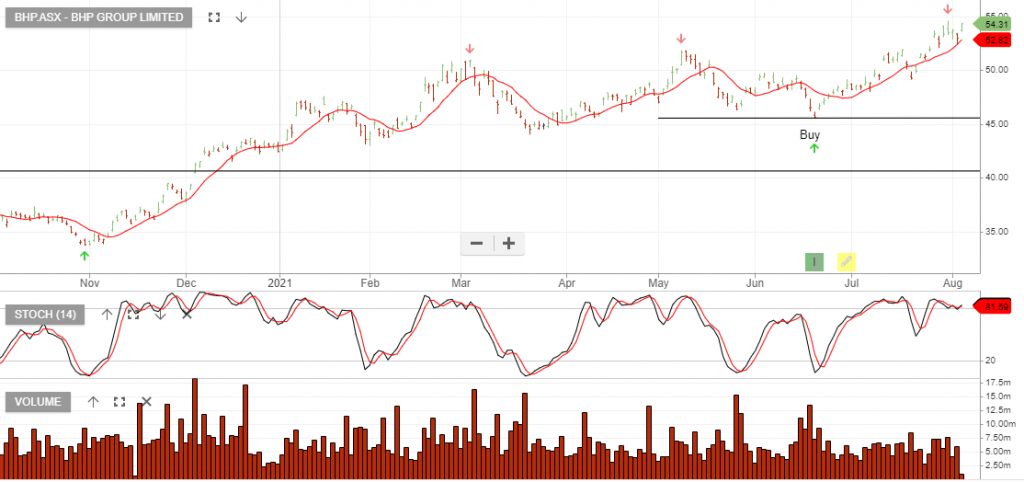

BHP Group is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

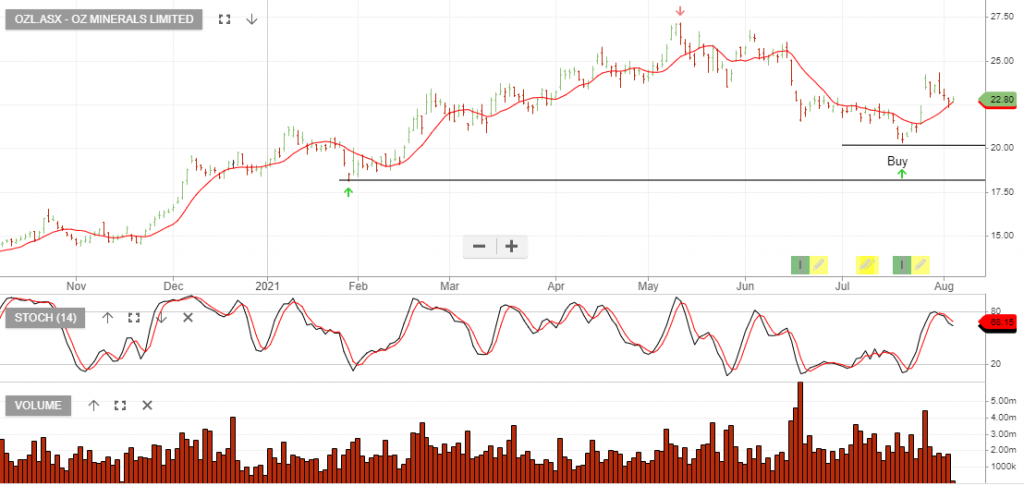

OZ Minerals is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

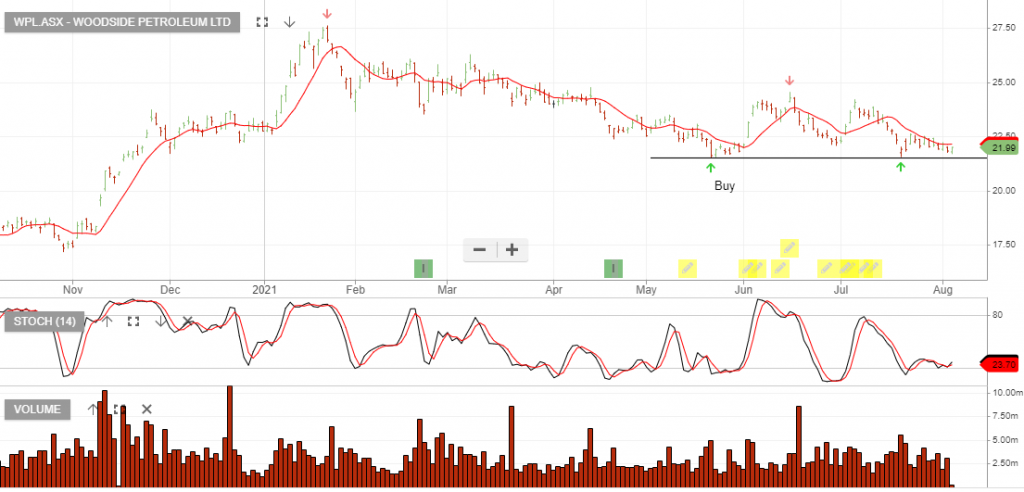

WPL:ASX is under Algo Engine buy conditions and is a current holding in our ASX model portfolio.

The recent pullback and higher low at $22.00 provides another opportunity to buy the stock.

Lynas Rare Earths is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

Sales revenue hit $185.9 million in the June quarter, up from $110 million in the three months to March 30.

Lynas said the result reflected users and governments around the world recognising the need to diversify the rare earths supply chain, which was dominated by China.

Lynas has started work on a new cracking and leaching plant in Kalgoorlie, and the rare earths material from the Kalgoorlie plant will be sent to both Kuantan and a planned heavy and light rare earths downstream processing plant in Texas.

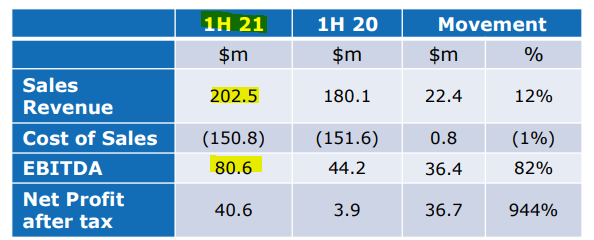

The 1H21 investor presentation released in February 2021 shows the strong sales growth from the 1H20 comparison. We’ll review the 2H21 numbers when released in late August.

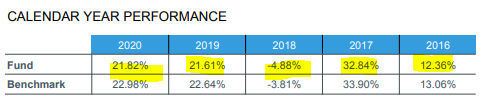

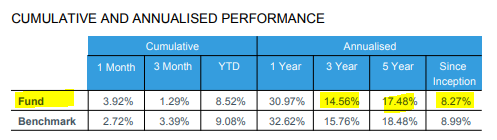

BetaShares Global Robotics And Artificial Intelligence is under Algo Engine buy conditions.

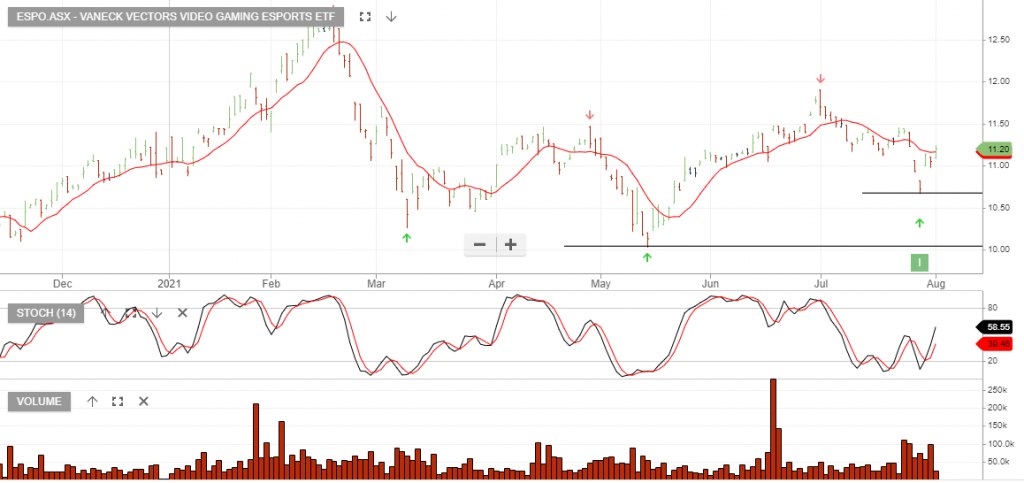

VanEck Vectors Video Gaming Esports is under Algo Engine buy conditions.

iShares Asia 50 is under Algo Engine buy conditions and is a current holding in our iShares ETF model.

INVESTMENT OBJECTIVE: The fund aims to provide investors with the performance of the S&P Asia 50TM Index, before fees and expenses. The index is designed to measure the performance of the 50 leading companies listed in China, Hong Kong, Macau, Singapore, South Korea and Taiwan.

Gold Road Resources is now under Algo Engine buy conditions.

Gold Road anticipates gold production for the 2021 calendar year will be within the lower half of guidance (260,000 to 300,000 ounces on a 100% basis).

AISC for the 2021 calendar year is anticipated to be between $1,325 and $1,475 per attributable ounce, with lower June 2021 quarter production and higher maintenance and labour costs the main contributors to an increase from the guidance of between A$1,225 – A$1,350.

FY21 revenue forecast is for $300mil generating EBIT of $100mil.