S32

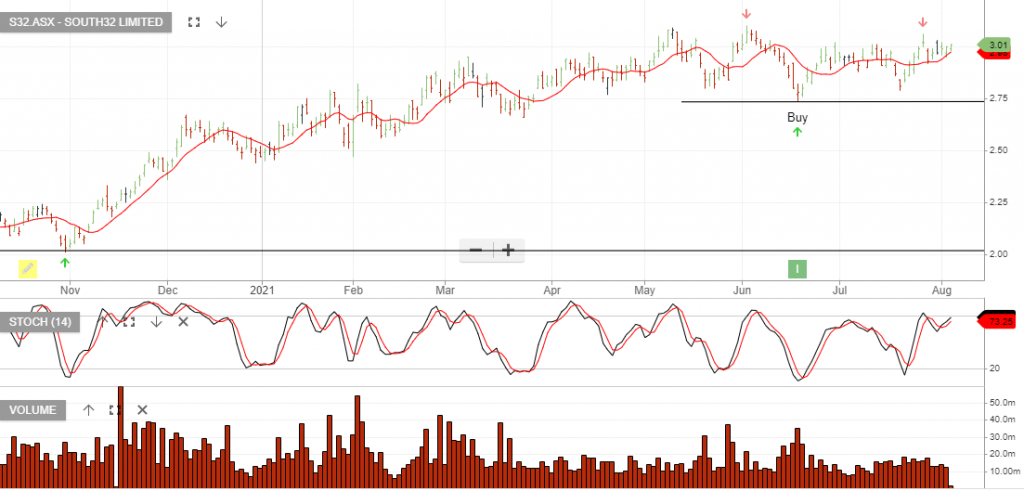

South32 is under Algo Engine buy conditions.

South32 is under Algo Engine buy conditions.

South32 is under Algo Engine buy conditions and is a current holding in our ASX100 model portfolio.

South32 delivered a strong start to FY21.

S32 reported 1QFY21 net cash of US$368m and lifted the suspension on its on-market share buy-back. The outlook remains soft for S32 earnings, as the key commodities face headwinds.

The buy-back will provide downside support, with US$121m remaining under the current program, which is set to expire late next year.

South32 remains under Algo Engine sell conditions, but we continue to monitor the buying activity following increased speculation that the company could be a takeover target.

S32 reported June quarter production numbers which were in line with market expectations. Manganese and Cannington surprising to the upside and Met Coal disappointing.

June quarter manganese ore production was up on recent revised guidance.

2020 earnings will be down significantly on 2019, caused by lower commodity prices. EBIT will fall by 30 – 40% and EPS falls from $0.20 to $0.05. It’s not until 2022 that markets expect S32 earnings to recapture the levels of 2019.

A slow down in global economic growth would adversely impact prices across aluminium, alumina, manganese, nickel, silver and coal.

South32 is a globally diversified mining and metals company producing bauxite, alumina, aluminium, energy and metallurgical coal, manganese, nickel, silver, lead and zinc in Australia, Southern Africa and South America.

Earlier this week, Citi sent a note to clients suggesting Fortescue may look at a mega deal to buy the $9.7 billion diversified miner.

S32 remains under Algo Engine sell conditions, however, the opportunity is worth keeping an eye on, following the correction in the share price from $4.30 to $2.05 over the past 2 years.

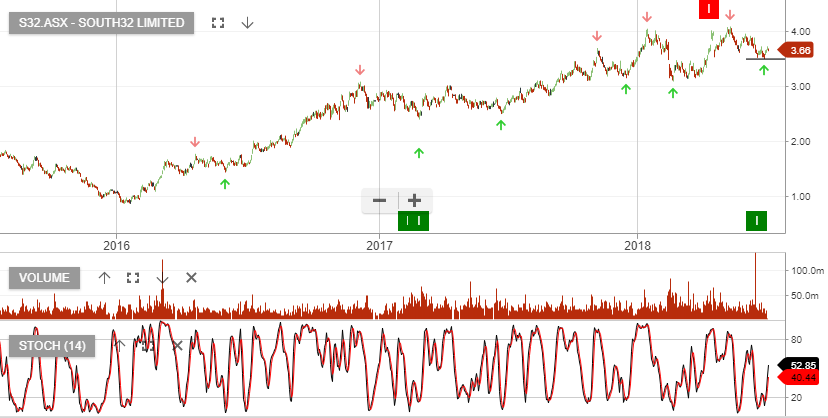

South32 has been under Algo Engine sell conditions since forming a lower high pattern back in February at $4.00.

Weak alumina and coal prices saw 3Q19 earnings miss analysts forecasts. We now downgrade the earnings outlook by 15% and remain cautious on the prospects of a near term turnaround.

Ongoing declines in spot alumina and thermal cost prices, combined with rising costs, will translate to weaker earnings over the next 2 -3 years.

Our ALGO engine triggered a buy signal for S32 last Friday at $3.51.

This “higher low” patterned is referenced to the intraday low of $3.35 posted on September 5th.

After a solid quarterly report two weeks ago, the share price spiked to a new all-time high of $4.28.

Since then, the share price has dropped over 17%, which is what triggered the ALGO signal last week.

S32 is a diversified miner and exports a range of minerals from Alumina to Manganese.

As such, we believe that S32 shares will find investor support above $3.00 for another run at the $4.00 handle over the medium-term.

S32

Our Algo Engine triggered a buy signal in S32 recently at $3.60. With the stock creating a new “higher low” formation, it has now been added into the ASX Top 50 model.

S32 goes ex-dividend for 8 cents on the 14th September. Adding a November $3.80 call option will generate an additional 20 cents of income per share.

South 32

Our ALGO engine triggered a buy signal for South 32 into yesterday’s ASX close at $3.61.

The “lower high” pattern is referenced to the low posted on April 12th at $3.34. The stock has been added to our ASX Top 20 portfolio.

The share price has dropped about 8% since announcing an all-cash offer to acquire the remaining 83% of Arizona mining; a Canadian resource company which they own 17%.

The transaction does not need Canadian regulatory approval and should begin showing profits in the zinc and copper area by the September quarter.

We see solid support in the $3.40 area with an upside target in around $4.15 over the medium-term.

South 32

South 32

Following the Algo buy signal, S32 was added to the ASX50 model portfolio in February 2017 at $2.50.

The stock price rallied to $4.00 this year, then sold-off and created a “lower high” formation; an Algo sell signal was generated last week.

We continue our technological research in algorithm trading and remain encouraged by historical testing results.

We’re increasingly applying the rule -based model into our broader portfolio management style.

S32

Or start a free thirty day trial for our full service, which includes our ASX Research.