Inghams Group – FY21 Upgrade

Inghams Group is now under Algo Engine buy conditions following recent signals within the $3.10 to $3.30 price range.

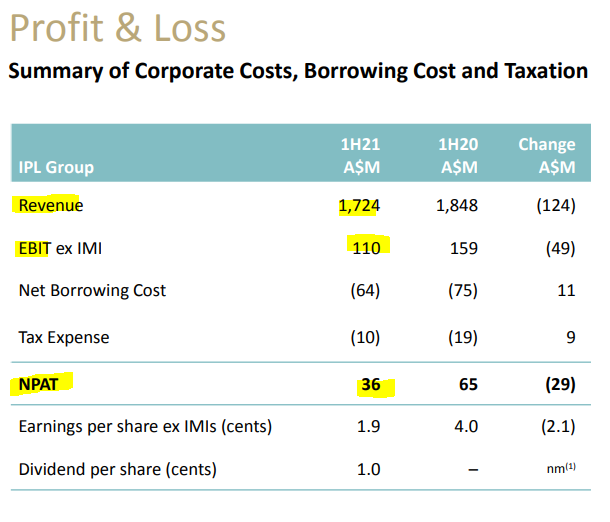

The rally in the share price on Friday was the result of the company upgrading FY21 guidance to EBITDA 203-$213m (statutory $438-448m) and NPAT to be $96-103m.

We have ING trading on a forward yield of 5% and we expect to see mid-single-digit EPS growth over the next 2 – 3 years.