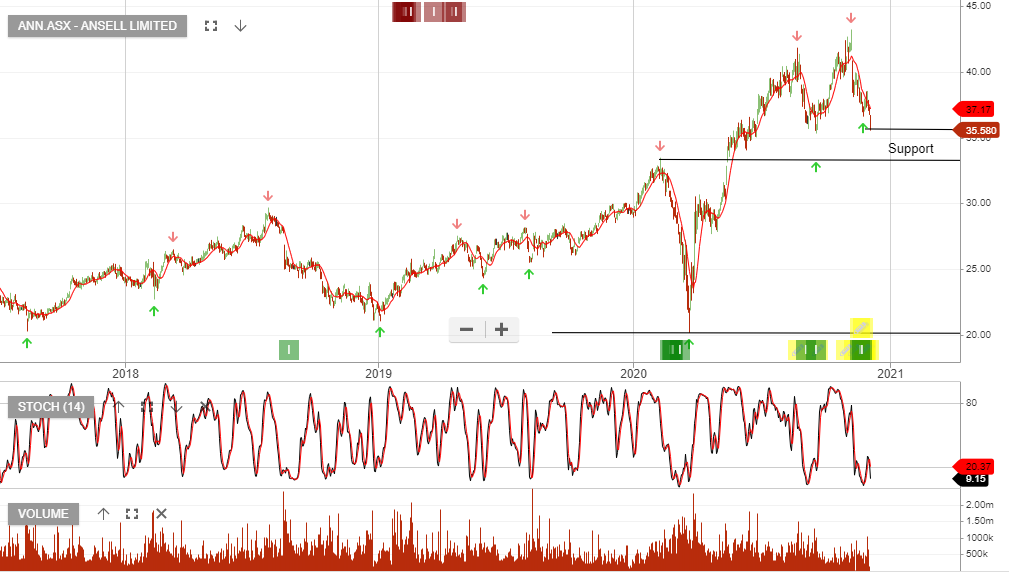

Ansell – Buy

Ansell is under Algo Engine buy conditions and we see support building within the $33 – $36 level.

Ansell is under Algo Engine buy conditions and we see support building within the $33 – $36 level.

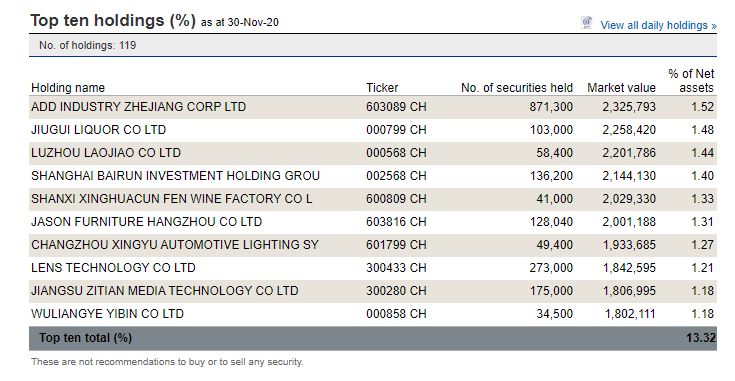

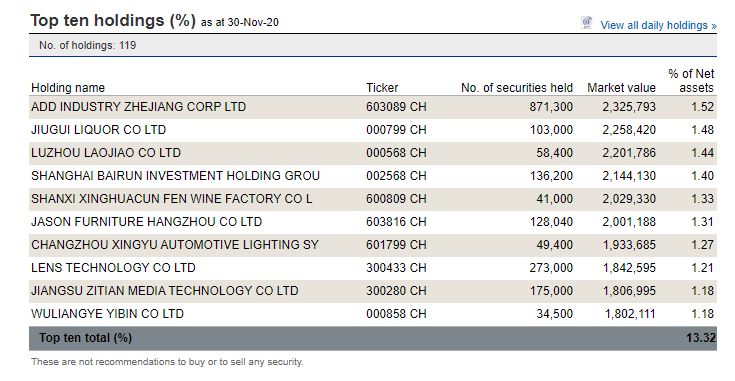

CNEW gives investors a portfolio of the most fundamentally sound companies in China having the best growth prospects in sectors making up ‘the New Economy’, namely technology, health care, consumer staples and consumer discretionary.

{AXW:CNEW) is now under Algo Engine buy conditions and we add this to our long-term model portfolio.

Pro Medicus is now under algo engine buy signals after rallying 40% from the original buy signal back in July.

The current retracement from $35 to $29 means investors should be watching the short-term momentum indicators for a turn higher and apply a stop loss on a break below support or a turn lower in the momentum indicators.

For more detail on the strategy, please call our office on 1300 614 002.

The chart below shows the range where we will be watching for the short-term momentum indicators to turn higher.

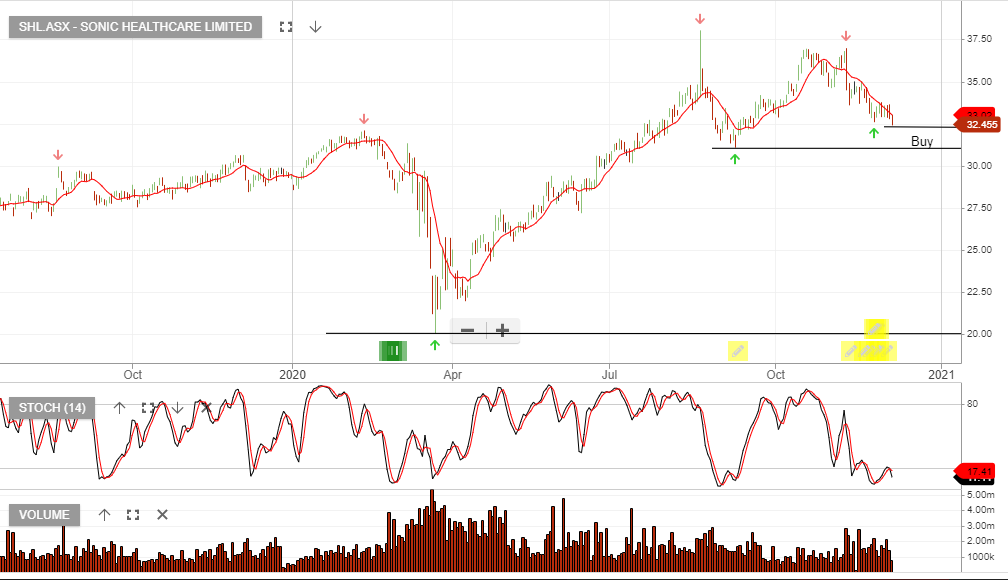

The price action now sits at 50% retracement of the March to November range. We expect to see buying interest begin to rebuild.

CNEW gives investors a portfolio of the most fundamentally sound companies in China having the best growth prospects in sectors making up ‘the New Economy’, namely technology, health care, consumer staples and consumer discretionary.

{AXW:CNEW) is now under Algo Engine buy conditions and we add this to our long-term model portfolio.

AusNet Services is under Algo Engine buy conditions.

Pro Medicus is now under algo engine buy signals after rallying 40% from the original buy signal back in July.

The current retracement from $35 to $29 means investors should be watching the short-term momentum indicators for a turn higher and apply a stop loss on a break below support or a turn lower in the momentum indicators.

For more detail on the strategy, please call our office on 1300 614 002.

Sonic Healthcare is finding buying support and we’re likely to see an improvement in the short-term indicators as the stock price stabilizes near the $32.50 level.

Ansell is under Algo Engine buy conditions and we see support building within the $33 – $36 level.

Transurban switched to Algo Engine buy conditions on 30 October at $13.10. The stock has since rallied to $15.60 and has now retraced back 50% to find support at the current price of $14.00.

Investors should watch the short-term momentum indicators as we’re likely to see a pick up in buying interest, supported by an attractive defensive dividend yield.

Or start a free thirty day trial for our full service, which includes our ASX Research.