Amcor Q1 Earnings

Amcor provides a defensive buy-write option play.

The company reports Q1 earnings on Friday where the market will be looking for confirmation on the 5 – 10% EPS growth outlook.

Amcor provides a defensive buy-write option play.

The company reports Q1 earnings on Friday where the market will be looking for confirmation on the 5 – 10% EPS growth outlook.

Nat Gas prices continue to rebound from the historic lows reached mid this year.

Origin share price remains under selling pressure but is likely to soon find buying support.

Origin’s September quarter revenue of A$374m was down 39% from the prior quarter. Lower prices were in part offset by higher production volumes.

APA is under Algo Engine buy conditions and we see support building at the recent $10.50 higher low formation.

Newcrest Mining remains under Algo Engine buy conditions. NCM has reported an in line 1QFY21 result with group production of 503koz.

The company expects an improved production performance in 2Q.

We suggest investors accumulate NCM above the $29 support level.

After recently taking profit in the CURE ETF, we again add the name back onto our watchlist and identify the range where we expect buying support to rebuild.

Buy $58.50 target.

Separate to the above opportunity, we see upside in the large-cap biotech stocks in the US. In particular, we like Abbvie, Biogen, Gilead, Johnson & Johnson, Merk, and Pfizer.

If you’d like to discuss setting up a US broking account with Investor Signals, please call me on 1300 614 002.

iShares Global Healthcare is under Algo Engine buy conditions and we see price support building near the current $96.50 level.

Vaneck Vectors Gold Miners is under Algo Engine buy conditions.

GDX provides broad exposure to the leading global gold producers. After the recent sell-off from $65 down to $51.50, we expect to see buying support begin to rebuild.

Ansell is under Algo Engine buy conditions and is a current holding in our ASX model portfolio.

ANN has upgraded its FY21 EPS guidance to US$1.35‐ US$1.45, implying 10%+ growth on the prior year.

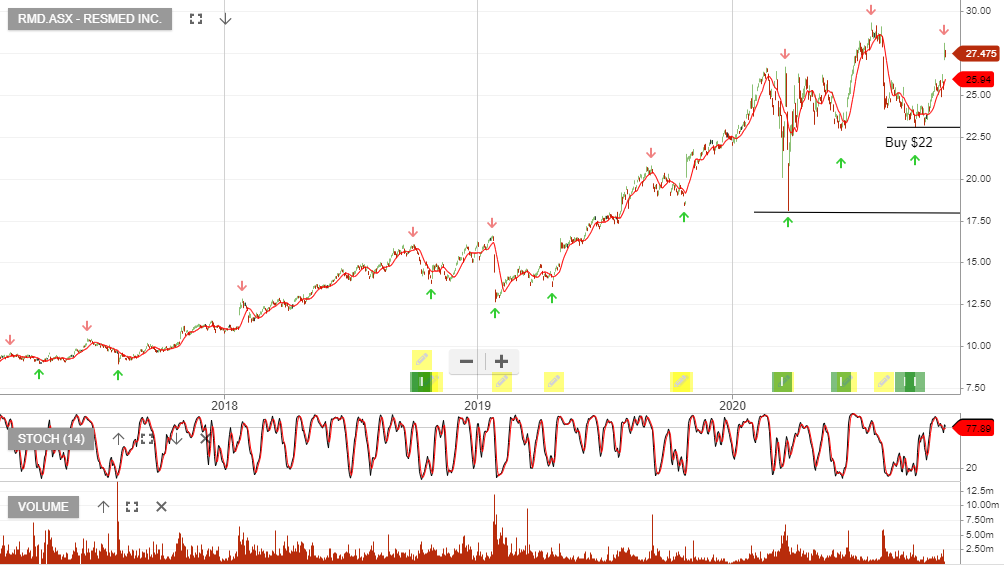

ResMed is under Algo Engine buy conditions and is a current holding in our ASX model portfolio.

Resmed reported better than expected 1Q21 earnings with group revenue up 10% and NPAT up 37% on the same time last year.

At 35x PE Resmed remains expensive and will need to maintain double-digit earnings growth to sustain the current valuation.

Buy on future share price weakness.

The chart below shows the range where we will be watching for the short-term momentum indicators to turn higher.

Or start a free thirty day trial for our full service, which includes our ASX Research.