Gold & Silver

Gold and silver are trading near record highs as traders bet that the US Federal Reserve will need to ease monetary policy further to shore up the economy.

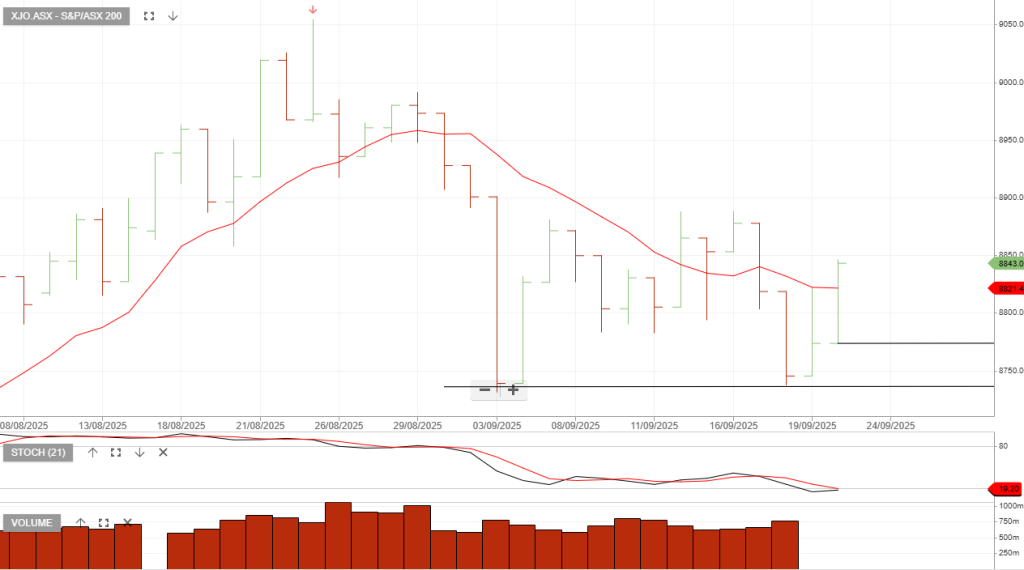

ASX200

A strong jobs report dampened hopes of another interest rate cut by the Reserve Bank of Australia next year.

Softbank

Japanese conglomerate Softbank said Tuesday it has sold its entire stake in U.S. chipmaker Nvidia for $5.83 billion.

The firm said in its earnings statement that it sold 32.1 million Nvidia shares in October. It also disclosed that it sold part of its T-Mobile stake for $9.17 billion.

US Bonds

The Fed cut interest rates by 25 basis points on Wednesday while cautioning about persistent inflation, casting doubt over the pace of future easing.

ASX200

XJO analysis to be provided in tonight’s webinar.

Click here to start your free trial and gain access to tonight’s live event.

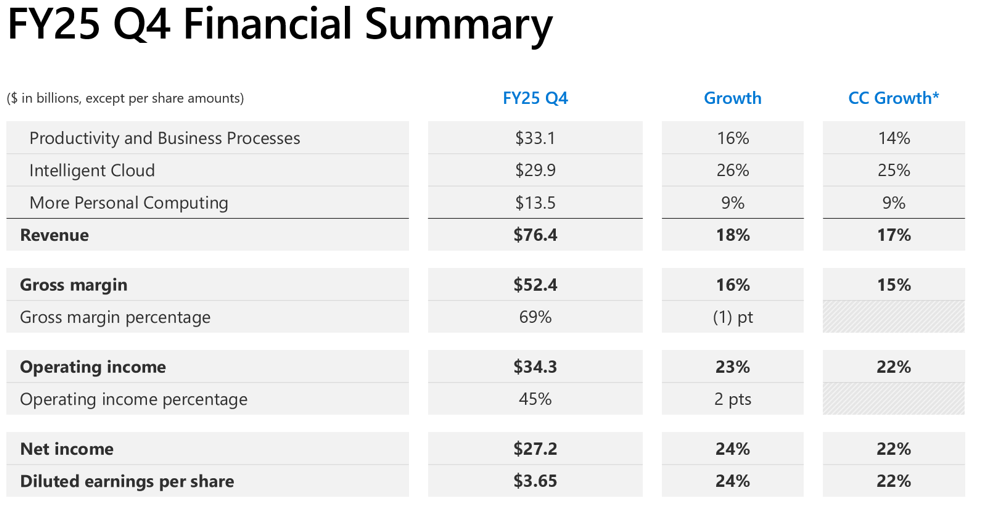

Microsoft

Microsoft Corporation – Common

Microsoft Cloud and AI Strength Fuels Fourth Quarter Results

REDMOND, Wash. — July 30, 2025 — Microsoft Corp. today announced the following results for the quarter ended June 30, 2025, as compared to the corresponding period of last fiscal year:

· Revenue was $76.4 billion and increased 18% (up 17% in constant currency)

· Operating income was $34.3 billion and increased 23% (up 22% in constant currency)

· Net income was $27.2 billion and increased 24% (up 22% in constant currency)

· Diluted earnings per share was $3.65 and increased 24% (up 22% in constant currency)

“Cloud and AI is the driving force of business transformation across every industry and sector,” said Satya Nadella, chairman and chief executive officer of Microsoft. “We’re innovating across the tech stack to help customers adapt and grow in this new era, and this year, Azure surpassed $75 billion in revenue, up 34 percent, driven by growth across all workloads.”

“We closed out the fiscal year with a strong quarter, highlighted by Microsoft Cloud revenue reaching $46.7 billion, up 27% (up 25% in constant currency) year-over-year,” said Amy Hood, executive vice president and chief financial officer of Microsoft.

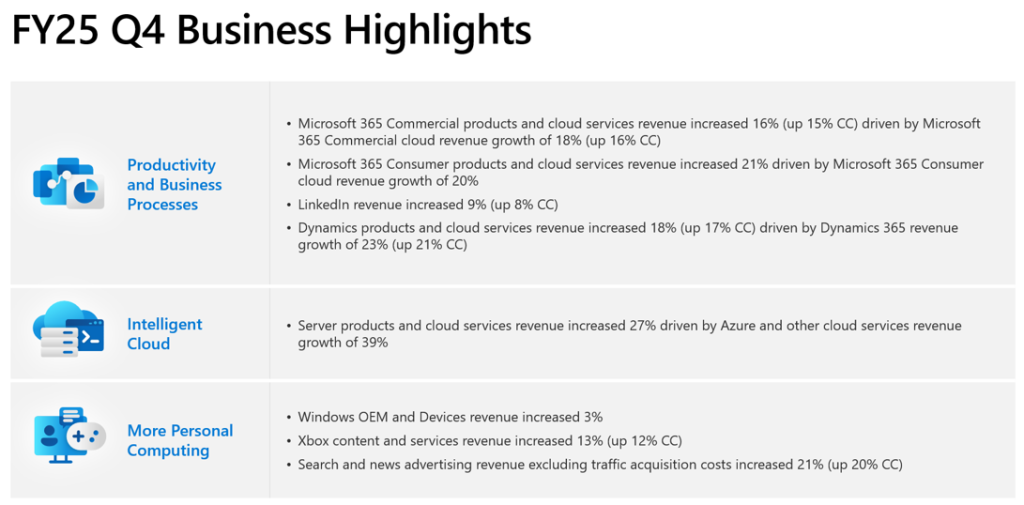

Business Highlights

Revenue in Productivity and Business Processes was $33.1 billion and increased 16% (up 14% in constant currency), with the following business highlights:

· Microsoft 365 Commercial products and cloud services revenue increased 16% (up 15% in constant currency) driven by Microsoft 365 Commercial cloud revenue growth of 18% (up 16% in constant currency)

· Microsoft 365 Consumer products and cloud services revenue increased 21% driven by Microsoft 365 Consumer cloud revenue growth of 20%

· LinkedIn revenue increased 9% (up 8% in constant currency)

· Dynamics products and cloud services revenue increased 18% (up 17% in constant currency) driven by Dynamics 365 revenue growth of 23% (up 21% in constant currency)

Revenue in Intelligent Cloud was $29.9 billion and increased 26% (up 25% in constant currency), with the following business highlights:

· Server products and cloud services revenue increased 27% driven by Azure and other cloud services revenue growth of 39%

Revenue in More Personal Computing was $13.5 billion and increased 9%, with the following business highlights:

· Windows OEM and Devices revenue increased 3%

· Xbox content and services revenue increased 13% (up 12% in constant currency)

· Search and news advertising revenue excluding traffic acquisition costs increased 21% (up 20% in constant currency)

Microsoft returned $9.4 billion to shareholders in the form of dividends and share repurchases in the fourth quarter of fiscal year 2025.

Fiscal Year 2025 Results

Microsoft Corp. today announced the following results for the fiscal year ended June 30, 2025, as compared to the corresponding period of last fiscal year:

· Revenue was $281.7 billion and increased 15%

· Operating income was $128.5 billion and increased 17% (up 18% in constant currency)

· Net income was $101.8 billion and increased 16% (up 15% in constant currency)

· Diluted earnings per share was $13.64 and increased 16%

Alphabet

Alphabet Inc. – Class C Capital June quarter revenue grew 14% year over year, higher than the 10.9% Wall Street expected.

Revenue: $96.43 billion

Earnings per share: $2.31

YouTube advertising revenue: $9.8 billion

Google Cloud revenue: $13.62 billion

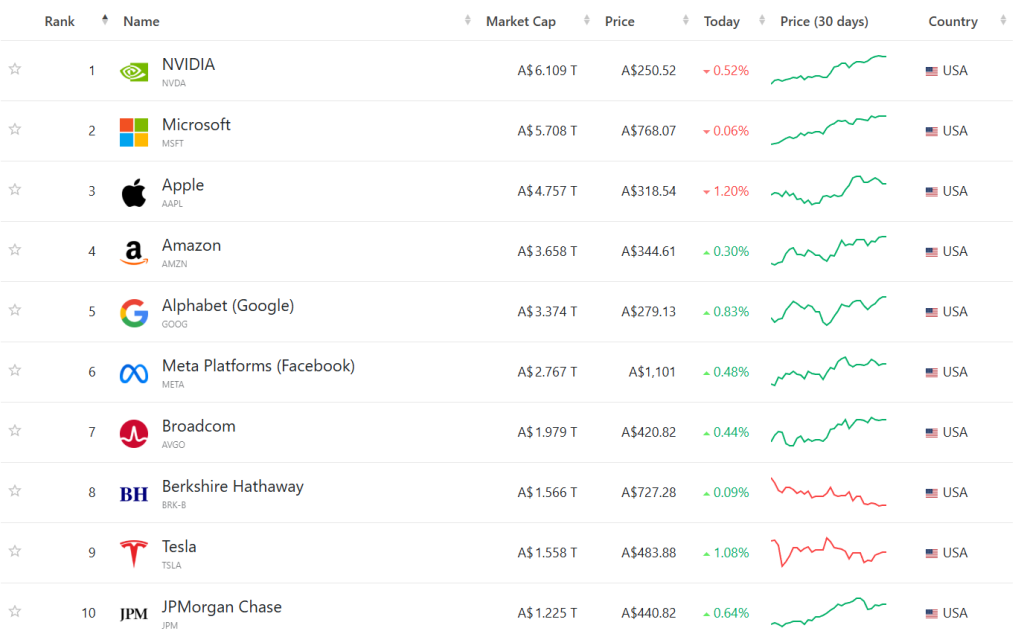

US Top 10: By market cap

The following list captures the top 10 companies in the US measured by market capitalization.

AliBaba Group

Alibaba Group Holding Limited American Depositary Shares each representing eight Ordinary is under Algo Engine buy conditions.