Alphabet Q1 2025 Earnings

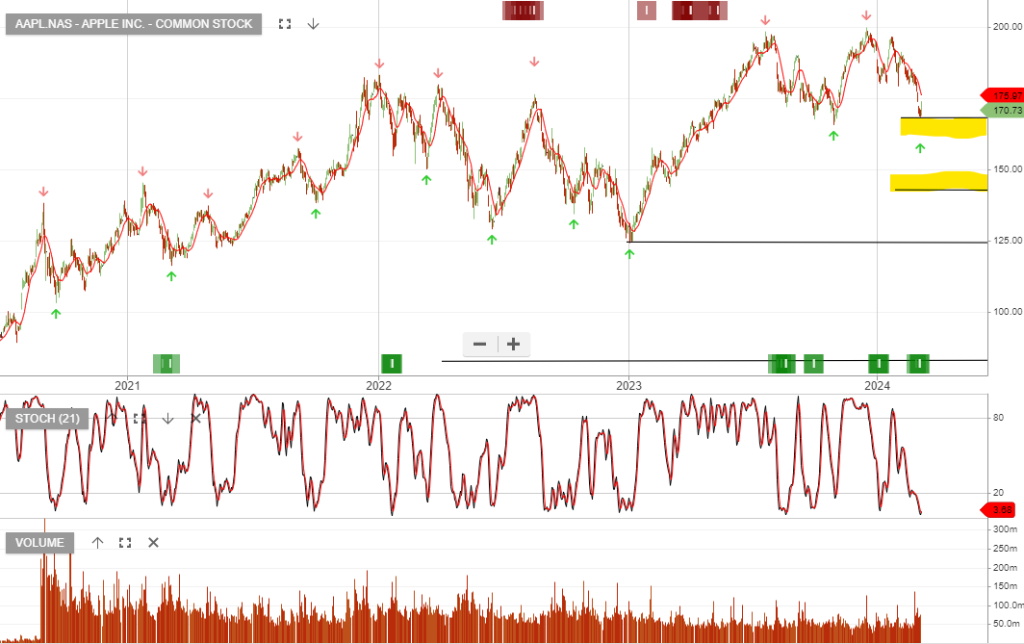

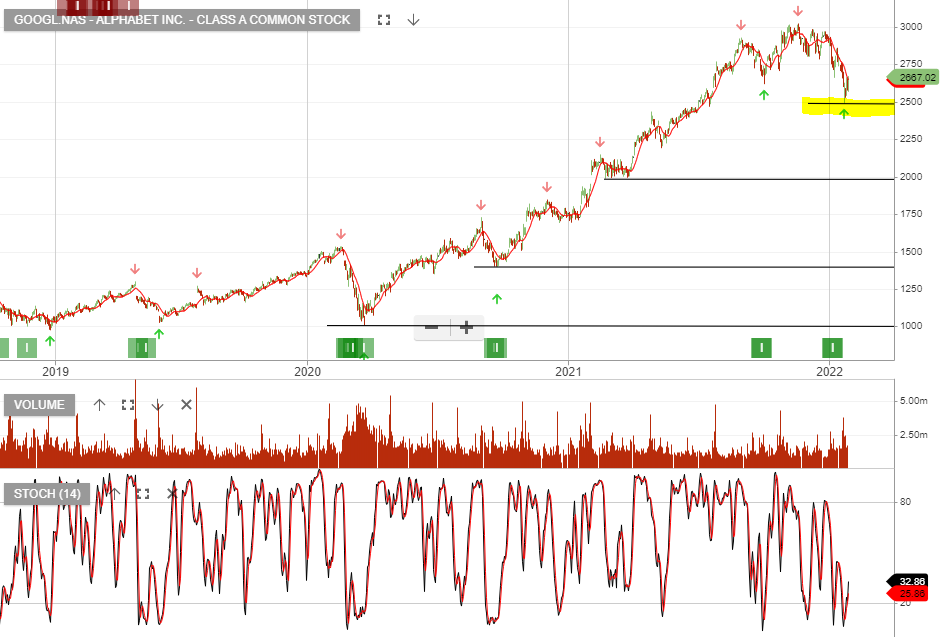

Alphabet Inc. – Class C Capital is under Algo Engine buy conditions.

A $70 billion stock buyback program was unveiled.

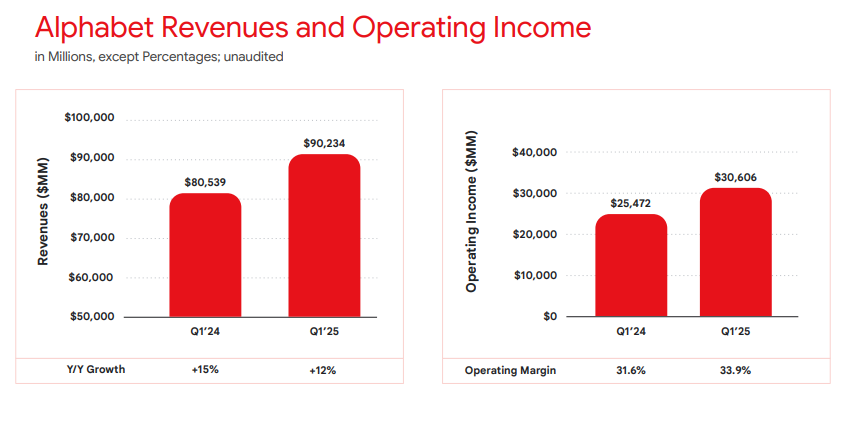

Revenue up 12% to $90.23B , operating income up 20% to $30.61B, with operating margin climbing to 34% from a year-ago 32%.

Google Search and other, $50.7B up 9.8%

YouTube ads, $8.93B up 10.3%

Google Network, $7.26B down 2.1%

Google subscriptions, platforms and devices, $10.38B up 18.8%

Google Cloud, $12.26B up 28.1%

Other Bets, $450M down 9.1%.