Bitcoin

Bitcoin needs to trade through 107,750 to re-establish the uptrend.

Bitcoin needs to trade through 107,750 to re-establish the uptrend.

US May retail sales missed consensus amid a pullback in auto sales. May industrial production also unexpectedly declined as manufacturers struggled for traction against cooling demand.

NASDAQ: holding above support.

S&P500: Lower high in place and stop loss required on a reversal through 6059

Okta, Inc. – Class A Common : Add to your watchlist & wait for the price to close above the 10-day average.

Gain exclusive access inside the investing mind of Investor Signals CEO Leon Hinde. Become a wiser investor with real-time access to Leon’s Monday night webinars, and his daily portfolio advice.

Learn investment strategies from Leon Hinde and get a behind-scenes look at his investment portfolio. Get an investing advantage with benefits like industry-leading expert research and analysis, and proprietary technology built on AI algorithm models for both long-term investing and short-term trading.

Start your free trial today, click here

RTX Corporation Common is under Algo Engine buy conditions. It’s a top 5 holding in our US fund, which is now up 29%

For more information on our managed fund, click here or call 1300 614 002.

The impacts of the pandemic-era government spending and monetary policy that helped support the U.S. economy have faded, and that makes the country vulnerable to a downturn in the coming months

“I think there’s a chance real numbers will deteriorate soon,” Dimon said at a Morgan Stanley conference on Tuesday, according to a transcript from FactSet.

The Organization for Economic Co-operation and Development downgraded the US growth outlook to 1.6% in 2025 and 1.5% in 2026. The OECD previously expected a 2.2% expansion in 2025.

Nvidia reported better-than-expected earnings and revenue on Wednesday, as the company’s booming data center business recorded year-over-year growth of more than 73%.

Overall revenue grew 69% during the quarter.

EPS FY25 = $3.00: FY26 =$4.25: FY27 = $6.00: FY28 $7.30

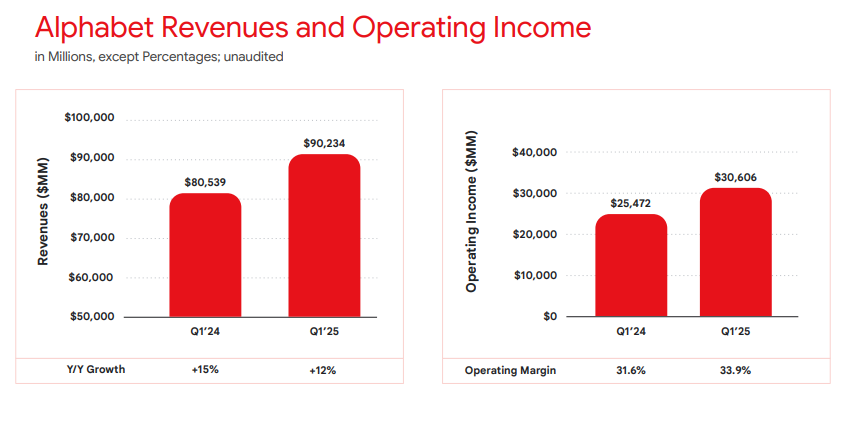

Alphabet Inc. – Class C Capital is under Algo Engine buy conditions.

A $70 billion stock buyback program was unveiled.

Revenue up 12% to $90.23B , operating income up 20% to $30.61B, with operating margin climbing to 34% from a year-ago 32%.

Google Search and other, $50.7B up 9.8%

YouTube ads, $8.93B up 10.3%

Google Network, $7.26B down 2.1%

Google subscriptions, platforms and devices, $10.38B up 18.8%

Google Cloud, $12.26B up 28.1%

Other Bets, $450M down 9.1%.

ABT:NYS is a new position opened in the US S&P 100 Trade Table.

The entry price for this position is $127.96.

Abbott Laboratories is a global healthcare company engaged in the discovery, development, manufacture, and sale of a diversified range of health care products, including cardiovascular and diabetes devices, nutritional products, diagnostic equipment, and branded generic drugs.

Invesco KBW Bank will likely find buying interest within the $47 – 52 price range.