GE Healthcare

GEHC:NAS is rated a buy with a stop loss at $74.51

GEHC:NAS is rated a buy with a stop loss at $74.51

IHI:ARC is rated a buy with a stop loss at $54.17

OKTA:NAS is rated a buy with a stop loss at $85.80

AMD:NAS is rated a buy with a stop loss at $153.64

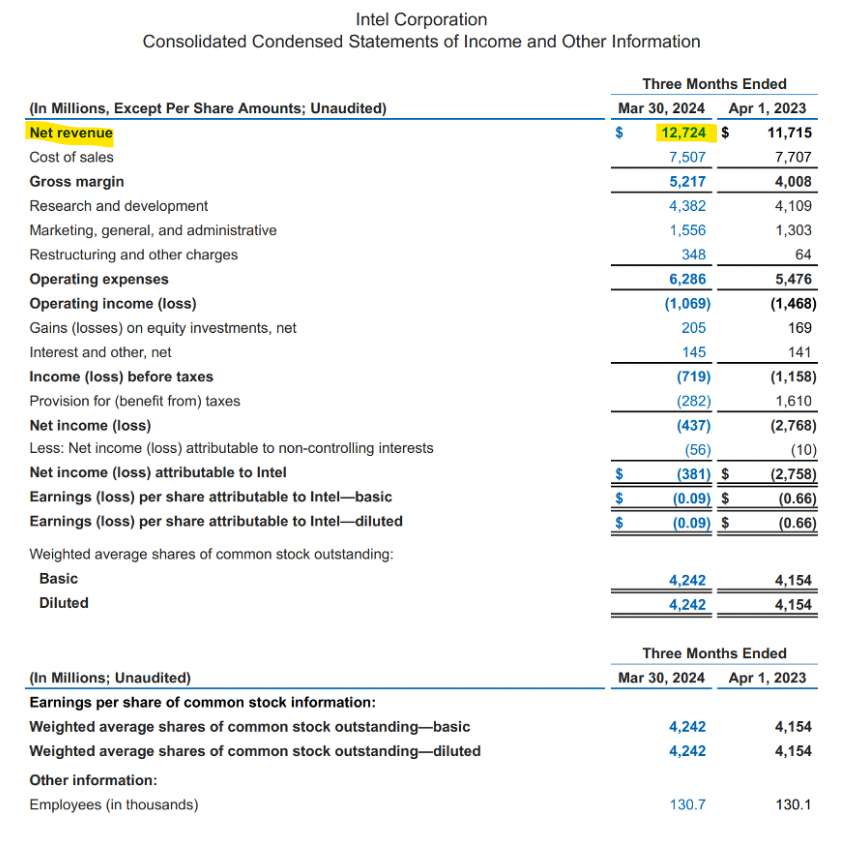

Revenue increased from $11.7b in Q1/23 to $12.7b in Q1/24, resulting in 8.6% year-over-year growth.

Intel is now reporting in two major segments – Intel Foundry and Intel Products.

The chart pattern shows support at $30.00

The long-term chart suggests investors should accumulate the stock within the $25 – $35 range and look for a multi-year recovery starting in 2025.

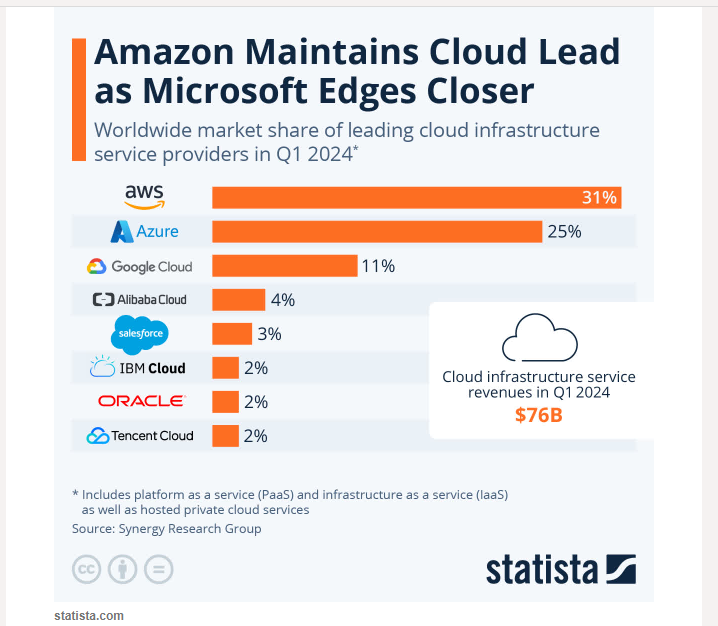

Alibaba Group Holding Limited American Depositary Shares each representing eight Ordinary Alibaba’s investments in cloud & AI sets up the company for significant future gains.

We rate Alibaba a buy with a stop loss at $71.80

Amazon, Apple, Alphabet, Meta, Microsoft, and Nvidia are projected to grow earnings by 30% in Q2, compared to the remaining 494 stocks, which have a 5% profit growth rate.

Based on the average S&P500 earnings increasing 8 – 10% in 2024, EPS should hit $240.

ASX Welcomes First-Ever Spot Bitcoin ETF as Speculation Grows for SOL and ADA ETF Applications

VanEck has extended its reach Down Under, offering Australians the opportunity to purchase their ASX-traded spot ETF, VBTC.

The new exchange-traded fund is being introduced by US investment management firm VanEck, with live trading planned for June 20th. The fund (ticker VBTC) will hold Bitcoin directly on behalf of investors, which the institutions’ APAC CEO believes will be a huge milestone for adoption Down Under.

“VBTC also makes Bitcoin more accessible by managing all the back-end complexity. Understanding the technical aspects of acquiring, storing and securing digital assets is no longer necessary.” – Arian Neiron, VanEck’s Asia-Pacific CEO and Managing Director

It will be interesting to see if the renaissance of crypto ETFs in the US will make its way to Australia. Popular US products like BlackRock’s IBIT smashed trading records after a month or two – can VanEck’s VBTC follow suit?

Intel Corporation – Common is under Algo Engine buy conditions.

The launch of Intel’s Gaudi 3 AI accelerator and the reorganization of its foundry business are positive signs for future growth. During the first quarter, Intel’s revenues increased by 8.5% Y/Y to $12.7 billion.

The launch of Intel’s Gaudi® 3 AI accelerator in Q3, which appears to be more powerful than NVIDIA’s flagship H100 GPU, should also help the company improve the performance of its data center business, revenue to total $56 bln (+3% y/y) in 2024, and jump to $65.3 bln (+17% y/y) in 2025. Adjusted EBITDA is set to total $13.8 bln (+7% y/y) in 2024, and rocket to $20.3 bln (+47% y/y).

Effective from 1Q 2024, the company modified its segment reporting, with revenue now coming from the following business units:

1. Intel Products

2. Intel Foundry

3. All other

Client Computing Group (CCG) – this segment generates about half of the company’s revenue. It supplies central processing units for desktop PCs and notebooks.

Data Center and AI (DCAI) – The key products in this segment are CPUs, GPUs and Gaudi AI accelerators.This segment has accounted for just under 30% of the company’s total revenue in recent years

Intel Foundry – the segment that includes chip manufacturing for Intel’s own needs as well as for external customers. Intel entered the market of contract manufacturing of semiconductors in 2021 as Intel Foundry Service (IFS) to capitalize on the growing demand for foundry capacity. To provide transparency in the segment’s operations, the company in its reporting separates revenue generated from external customers and revenue from inter-segment sales within Intel. As of the end of 2023, revenue from external customers totaled $953 mln (+96% y/y), or 5% of total IFS revenue of $18.9 bln (-31% y/y).

Even though IFS revenue from external customers is relatively small, Intel has ambitious plans to expand the plants by investing its own funds and with the help of government subsidies (Under the CHIPS Act the US government has given Intel $8.5 bln in grants and the option to draw $11 bln in federal loans).

CrowdStrike Holdings, Inc. – Class A Common delivered strong Q1 FY25 results with 33.5% ARR growth and 41.8% free cash flow growth.

CrowdStrike raised its full-year revenue guidance and is expected to continue delivering 30%+ growth in the near-term