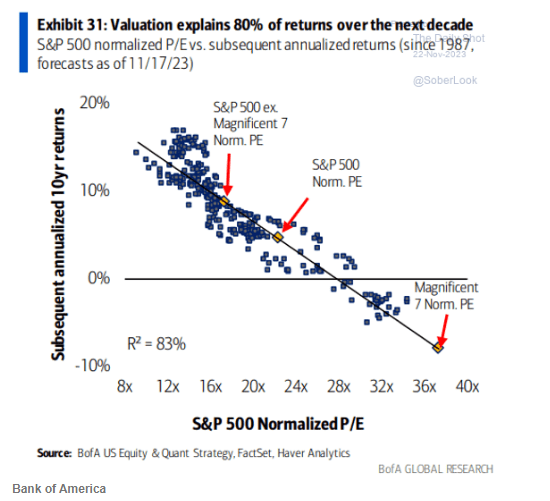

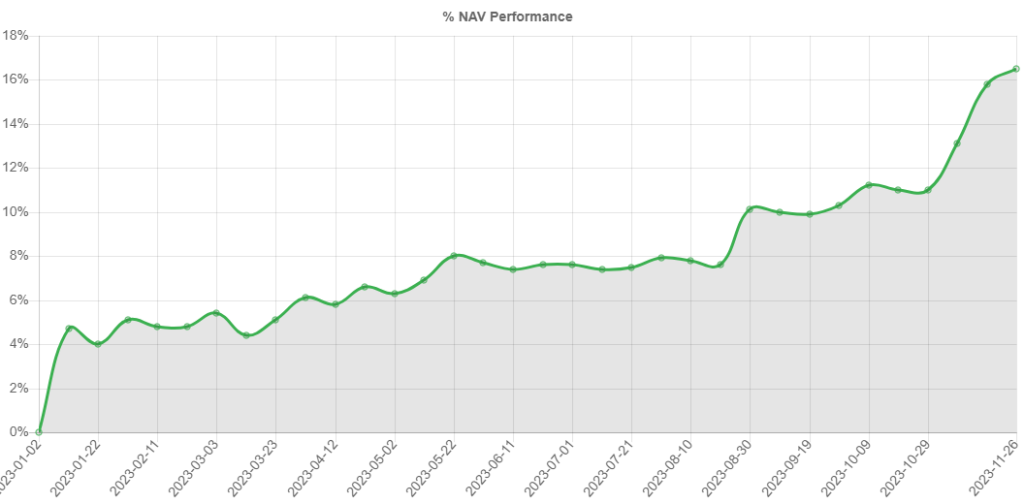

S&P500 Magnificent Seven

The biggest contributors to the S&P 500’s banner year have been the usual suspects, currently dubbed the Magnificent Seven, which are Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla. This group is up 75% in 2023, while the remaining 493 companies in the S&P 500 are about 12% higher.