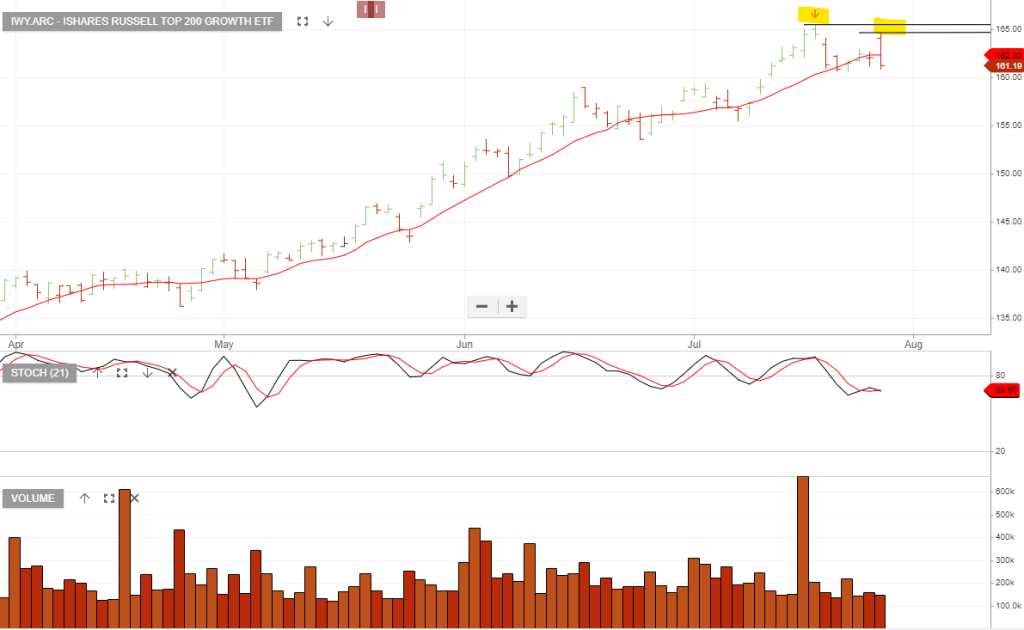

Russell Top 200 Growth ETF: Short Position

iShares Russell Top 200 Growth offers one way to capture short exposure to a correction in overpriced US growth stocks.

The iShares Russell Top 200 Growth ETF seeks to track the investment results of an index composed of large-capitalization U.S. equities that exhibit growth characteristics.

Consider the short side with a stop loss on a break above $165.

Russell Top 200 Growth ETF: Short Position

iShares Russell Top 200 Growth offers one way to capture short exposure to a correction in overpriced US growth stocks.

The iShares Russell Top 200 Growth ETF seeks to track the investment results of an index composed of large-capitalization U.S. equities that exhibit growth characteristics.

Consider the short side with a stop loss on a break above $165.

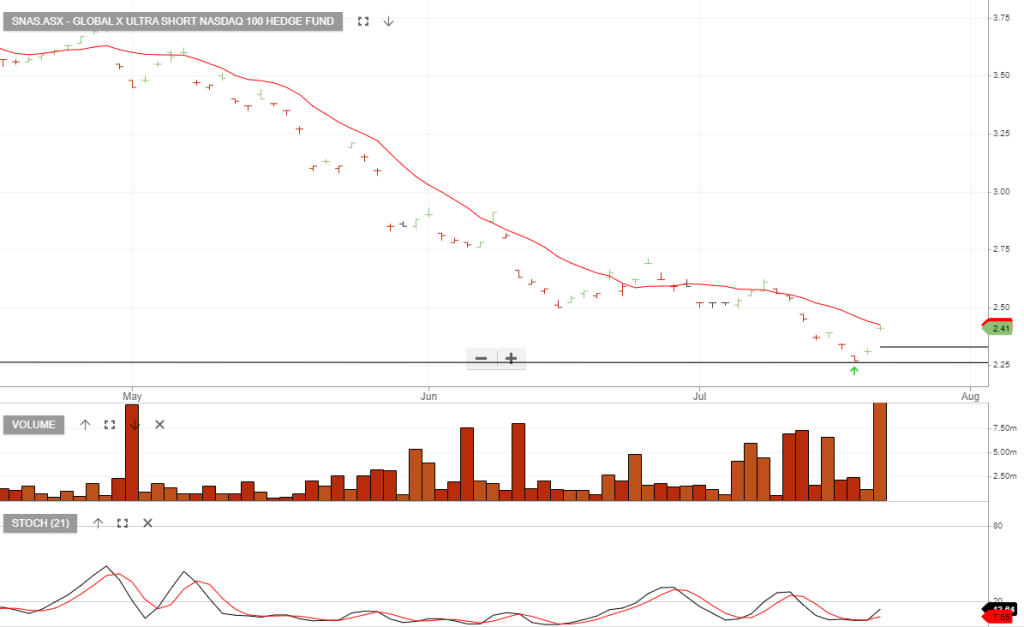

NASDAQ

Global X Ultra Short Nasdaq 100 Hedge The Global X Ultra Short Nasdaq 100 Hedge Fund (SNAS) is an actively managed fund that aims to provide investors with geared returns that are negatively related to the returns of the Nasdaq-100 Index by investing primarily in a portfolio of short E-mini Nasdaq-100 Futures contracts listed on the Chicago Mercantile Exchange.

The NASDAQ 100 index now has a pivot high of 14,446 points and FTFF of 14309.

Micron Technology

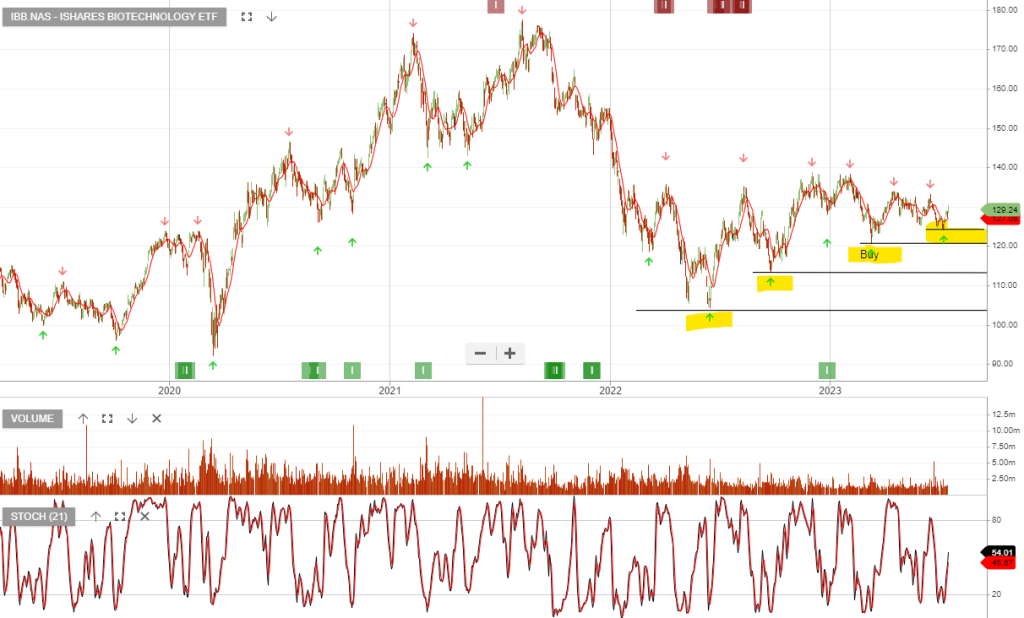

iShares Biotech

Gilead Sciences

Disruptive Innovations: OXY 118% return

Occidental Petroleum has been sold for a 118% gain, following a 575-day holding period.

S&P500 & Market Direction

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

US Earnings

June quarter earnings: The market is expecting average EPS to be down 7% compared to the same time last year.

Week 2.

Tuesday, July 18 – Bank of America, Novartis, Morgan Stanley, and Lockheed Martin.

Wednesday, July 19 – Goldman Sachs, Tesla, Netflix, IBM, U.S. Bancorp, United Airlines, Las Vegas Sands, and Nasdaq.

Thursday, July 20 – Johnson & Johnson, Abbott Laboratories, Taiwan Semiconductor Manufacturing, Philip Morris International, Travelers, American Airlines, Capital One, and CSX.

Friday, July 21 – American Express, Schlumberger, AutoNation, and Huntington Bancshares.

Week 1.

Thursday, July 13 – PepsiCo and Delta Air Lines

Friday, July 14 – UnitedHealth Group, JPMorgan Chase, Wells Fargo, BlackRock, and Citigroup.

Citi Group remains one of our preferred bank holdings and we’ll review the earnings in more detail, following Friday’s result.