Citi Group

{NYS:C} is under Algo Engine buy conditions.

{NYS:C} is under Algo Engine buy conditions.

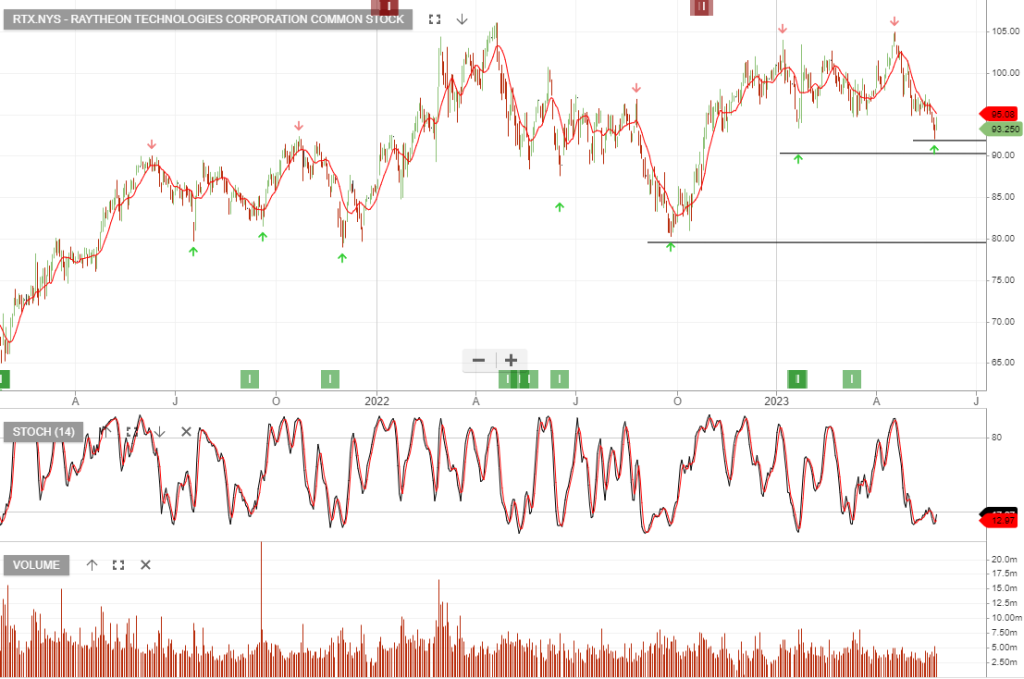

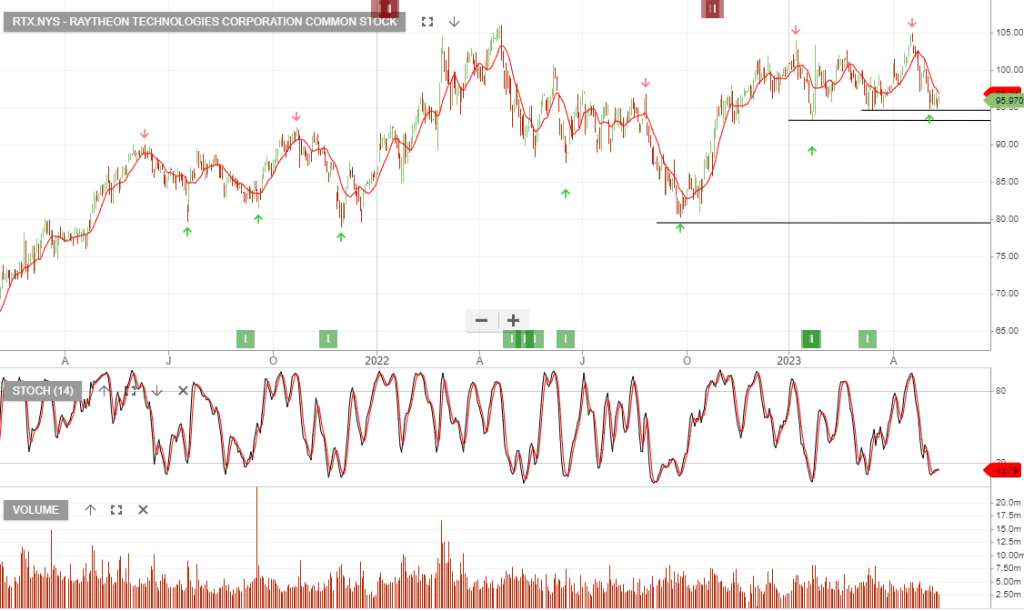

Raytheon Technologies Corporation Common is under Algo Engine buy conditions.

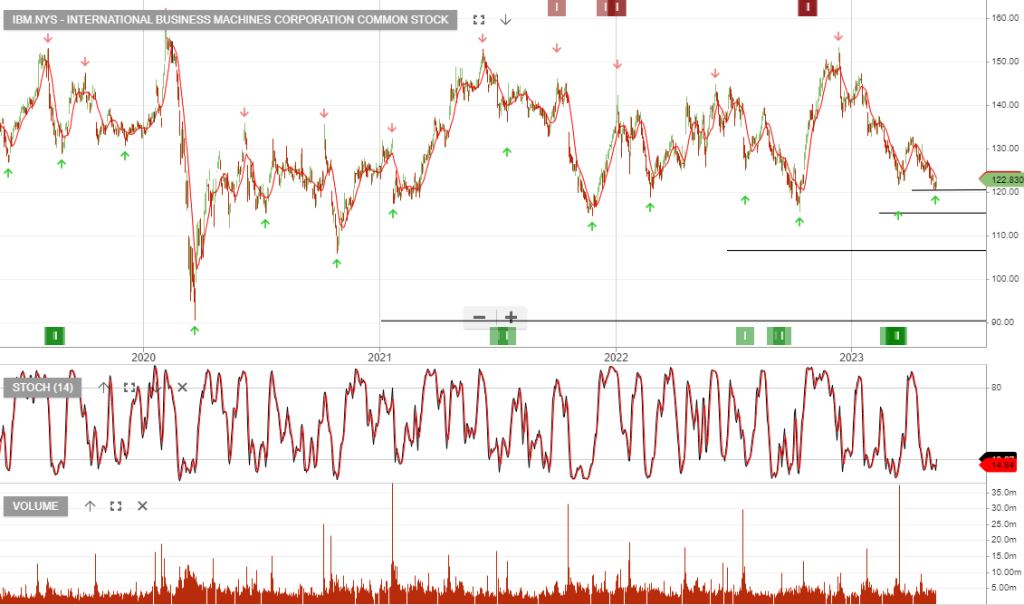

International Business Machines Corporation Common is under Algo Engine buy conditions.

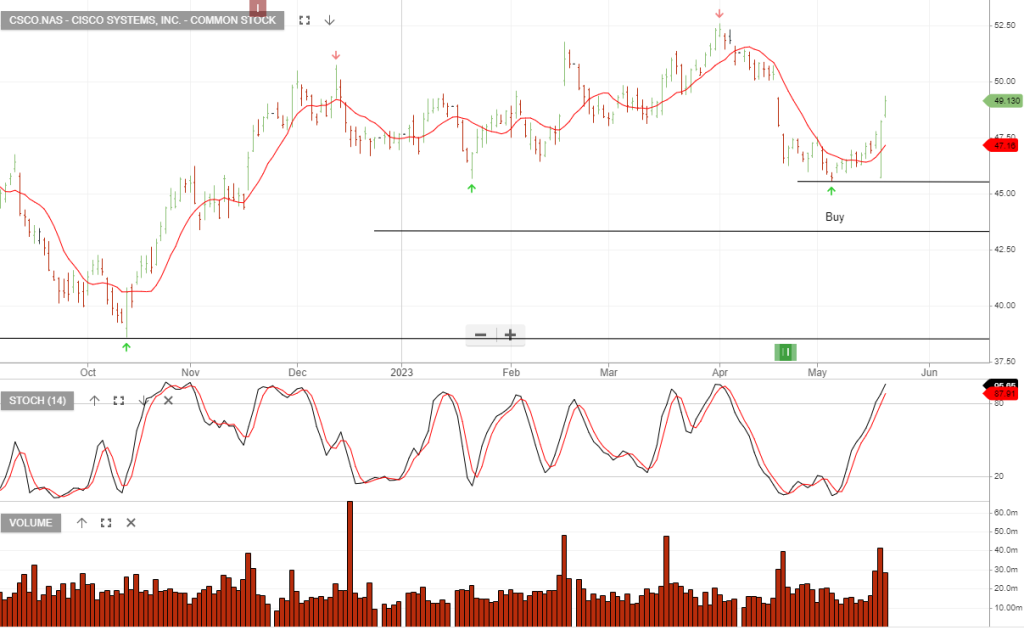

20/5 update: Cicso made a low at $45.55 and the momentum indicators have turned higher.

CSCO:NAS is now under Algo Engine buy conditions and investors should consider accumulating a position within the $43 – $47 price range.

IBM:NYS is under Algo Engine buy conditions.

GD:NYS is under Algo Engine buy conditions.

RTX:NYS is under Algo Engine buy conditions.

12/5 update: JD.COM released first quarter 2023 Highlights

Net revenues for the first quarter of 2023 were RMB243.0 billion (US$135.4 billion), an increase of 1.4% from the first quarter of 2022. Income from operations for the first quarter of 2023 was RMB6.4 billion (US$0.9 billion), compared to RMB2.4 billion for the same period last year.

JD.COM is at a price level where we expect buying interest to build.

PDD:NAS is likely to see increased buying support near the current trading range.