Rapid 7

RPD:NAS announces First Quarter 2023 Financial Results

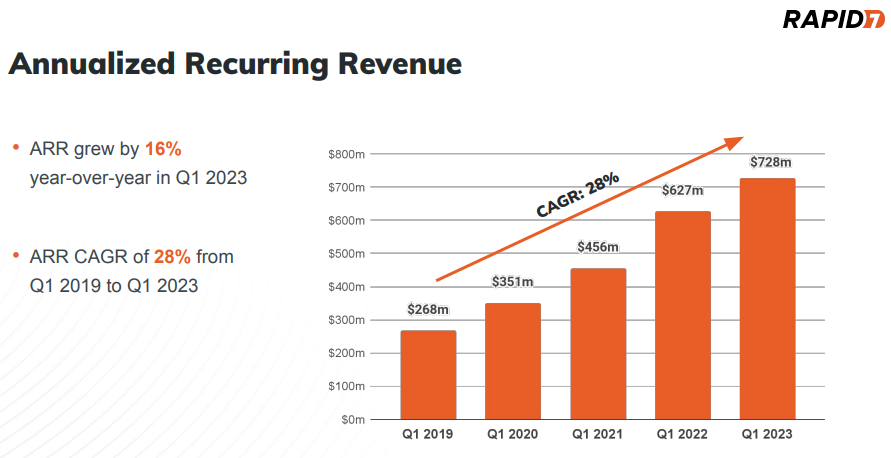

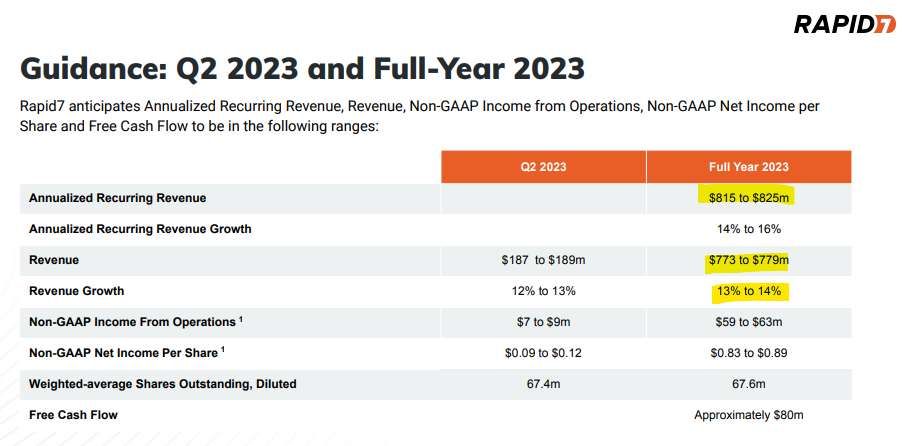

- Annualized recurring revenue (“ARR”) of $728 million, an increase of 16% year-over-year

- Total revenue of $183 million, up 16% year-over-year; Products revenue of $174 million, up 17% year-over-year

- GAAP operating loss of $24 million; Non-GAAP operating income of $11 million

- Surpassed 11,000 customers globally while growing total ARR per customer by 9% year-over-year