China New Economy ETF

VanEck Vectors China New Economy is likely to find buying support.

VanEck Vectors China New Economy is likely to find buying support.

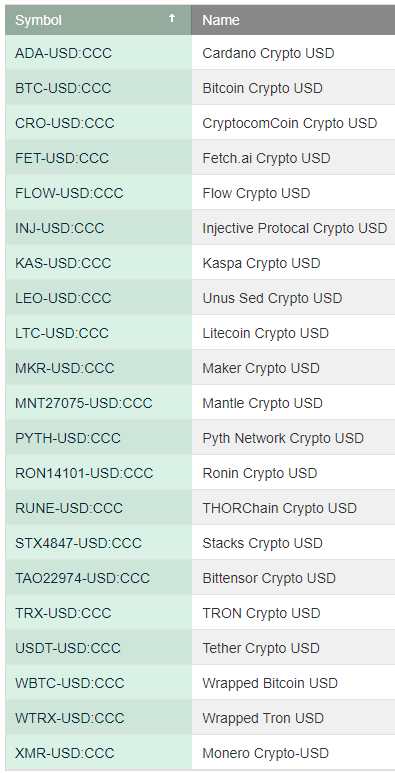

If you’re considering building a crypto investor portfolio, we’ve compiled our top 20 investments. Make an even allocation to each position and hold the portfolio until you see the Algo Engine switch to sell conditions.

If you need assistance, please call 1300 614 002.

Cleanaway Waste Management should be added to your watchlist. We expect a shift to Algo Engine buy conditions and buying support to build.

Pepper Money is rated a buy with the stop loss at $1.40

BetaShares Global Energy Companies has positive momentum after finding support at $6.35.

Stop loss @ $6.35

Mineral Resources is under Algo Engione buy conditions.

The sell-off in lithium following recent news about tariffs on Chinese electric vehicles has created a weakness in MIN’s share price. Iron ore and lithium markets are likely near support, and we’re watching for momentum to push the share price above the 10-moving average as our trade entry point.

Note: Mineral Resources has announced the early closure of the Yilgarn Hub in WA.

ASX Welcomes First-Ever Spot Bitcoin ETF as Speculation Grows for SOL and ADA ETF Applications

VanEck has extended its reach Down Under, offering Australians the opportunity to purchase their ASX-traded spot ETF, VBTC.

The new exchange-traded fund is being introduced by US investment management firm VanEck, with live trading planned for June 20th. The fund (ticker VBTC) will hold Bitcoin directly on behalf of investors, which the institutions’ APAC CEO believes will be a huge milestone for adoption Down Under.

“VBTC also makes Bitcoin more accessible by managing all the back-end complexity. Understanding the technical aspects of acquiring, storing and securing digital assets is no longer necessary.” – Arian Neiron, VanEck’s Asia-Pacific CEO and Managing Director

It will be interesting to see if the renaissance of crypto ETFs in the US will make its way to Australia. Popular US products like BlackRock’s IBIT smashed trading records after a month or two – can VanEck’s VBTC follow suit?