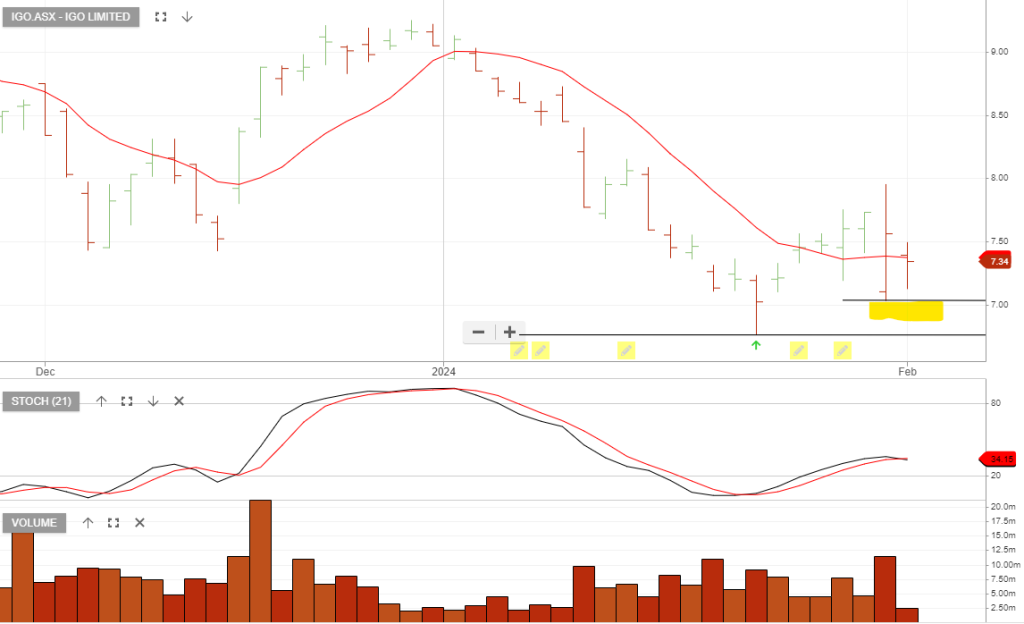

IGO Earnings

IGO reported an operationally in-line quarter, with 1H FY24 underlying EBITDA of A$515mn below expectations with higher lithium earnings offset by nickel & corporate/exploration expenses.

IGO needs to hold the higher low formation at $7.03. Otherwise, a stop loss should be applied.

BHP

BHP Group remains an open position in the ASX200 Trade Table.

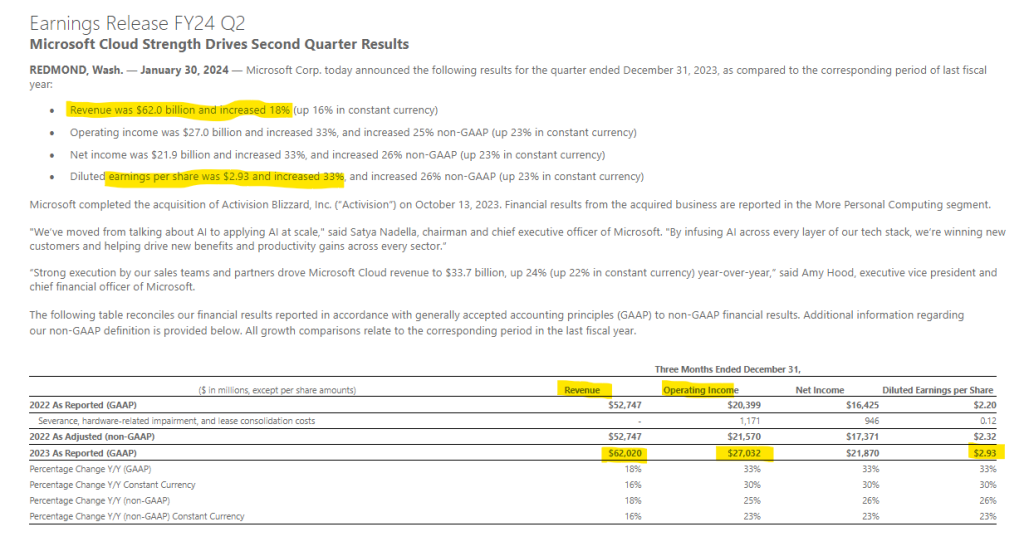

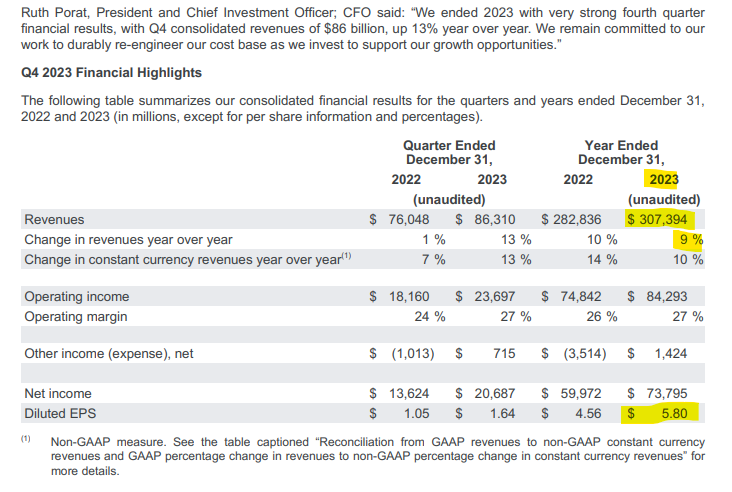

Mega-cap US tech

Mega-cap US tech stocks Microsoft, Alphabet, Amazon, and Meta will all report this week. Microsoft will be the most important earnings report and conference call as the launch of Copilot success and early adoption of AI is likely see earnings exceed the Street’s top-line revenue of $US61 billion and EPS of $US2.77.

Microsoft

Alphabet

Meta

Soul Pattinson

Washington H Soul Pattinson & Company continues to rally, following the bullish setup at $32.50.

Watch Last Night’s Webinar

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Intel

INTC:NAS is under Algo Engine buy conditions. We suggest accumulating Intel within the $40 – $44 price range. Patient investors can expect Intel shares to double over the next 3 – 5 years.

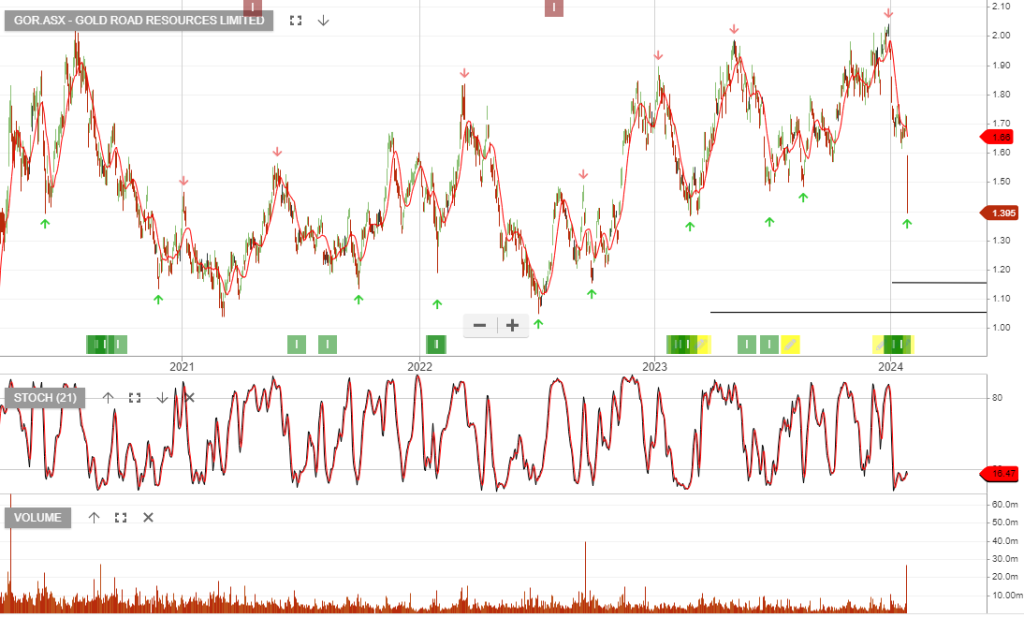

Gold Road

The miner reported a slip in gold production and downgraded its full-year guidance in its latest quarterly report.

Santos

STO shares remain heavily discounted, given superior free cash flow. Barossa project progression, completion of PNG selldown, and the potential merger proposal from WDS are all positive catalysts.

We expect STO to report a solid 4Q on 25th January and we look to buy STO on the current dip in price.