BWP Trust

BWP offers a 5%+ yield and modest capital growth.

BWP offers a 5%+ yield and modest capital growth.

Beach Energy is likely to benefit from the stronger oil price.

IGO has formed a higher low formation and the buying momentum has pushed the price action above the 10-day average.

Monday, January 29 – Whirlpool and Nucor.

Tuesday, January 30 – General Motors, United Parcel Service, Sysco, Pfizer, Alphabet, Microsoft, Starbucks, Mondelez International, and Advanced Micro Devices.

Wednesday, January 31 – Phillips 66, Boeing, Mastercard, MetLife, Qualcomm, and Boeing.

Thursday, February 1 – Merck, Honeywell, Altria, Amazon, Apple, Meta Platforms, Royal Caribbean Cruises and Post Holdings.

Friday, February 2 – Exxon Mobil, Chevron, AbbVie, and Charter Communications.

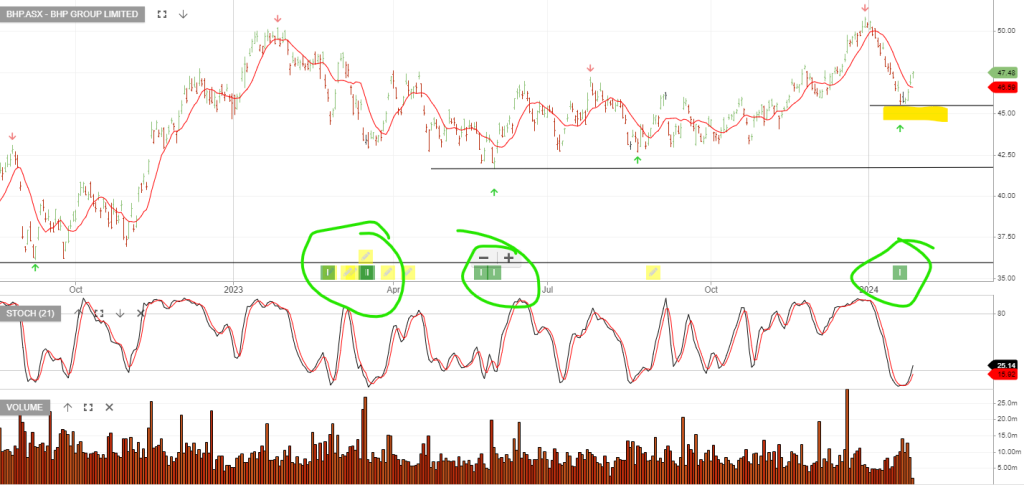

BHP Group has been in the model portfolio since February last year. We’ve had subsequent buy signals and we’re now presented with another Algo Engine buy signal, which has also generated an entry into the ASX 200 Trade Table.

The Trade Table suggests a stop loss at $45.55

Beach Energy is setting up for a trade with the stop loss below the $1.50 higher low support level.

We have three new holdings in the ASX200 Trade Table.

Following the price pullback and switch to Algo Engine buy condition for Bitcoin, we’ve seen four new holdings drop into our longer-term investor model.

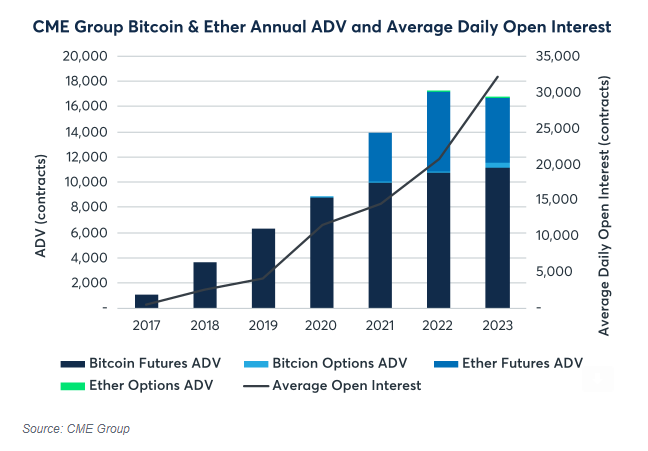

As market events approached, participants continued to seek CME Group’s regulated products to manage risk and exposure.

CME Group saw continuous daily open interest records in Bitcoin futures. Cryptocurrency options have also continued to increase in volume and open interest throughout the end of the year as more clients looked to manage the market events. Both Bitcoin and Ether futures and options open interest rounded out the year at record highs as their prices increased 160% and 97% since the beginning of the year.

Bitcoin is now under Algo Engine buy conditions.