Bluescope Steel

BlueScope Steel has cut 1H24 EBIT guidance to A$620-670m. We’re buyers within the $15 – $17 price range and expect earnings to recover in 2025.

BlueScope Steel has cut 1H24 EBIT guidance to A$620-670m. We’re buyers within the $15 – $17 price range and expect earnings to recover in 2025.

Woolworths – 1Q24E Sales Preview – Due 25 October

Coles Group – 1Q24E Sales Preview – Due 26th October

Our preference remains Coles over Woolworths.

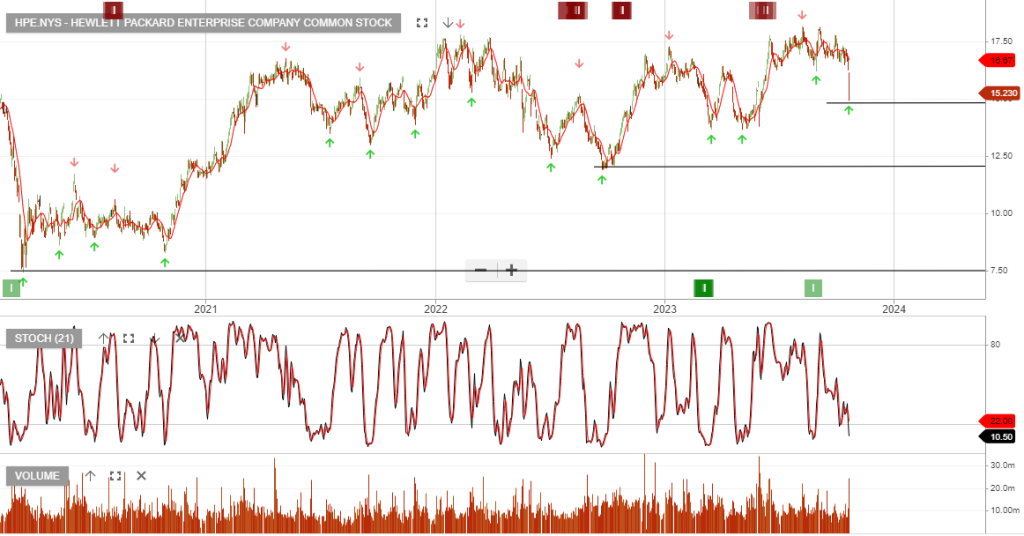

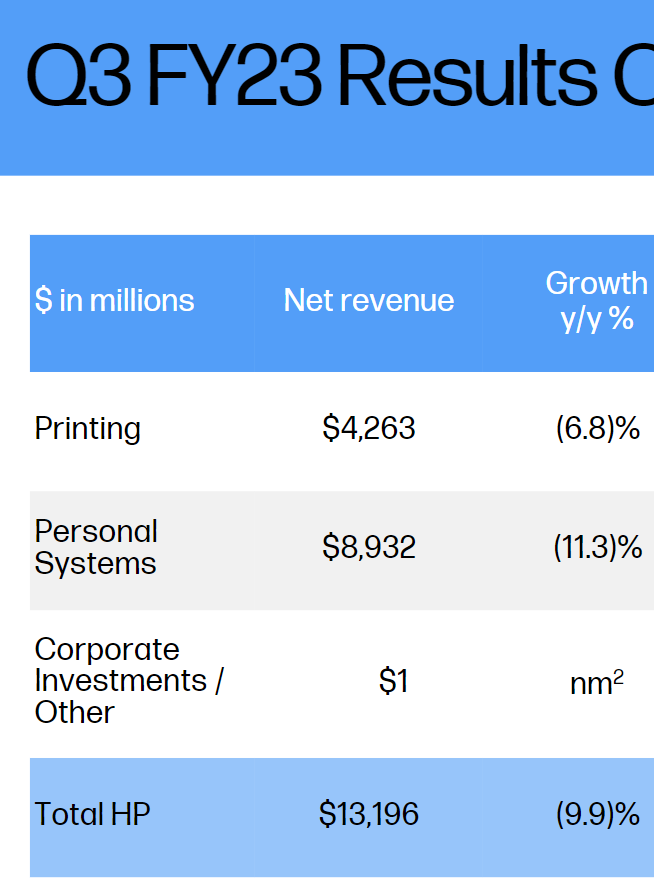

Hewlett Packard Enterprise Company Common is a recent addition, (added in 2022), to Berkshire Heathaway’s investment portfolio. The Q3 results were on the soft side but overall the HP investment remains an attractive tech exposure with significant upside.

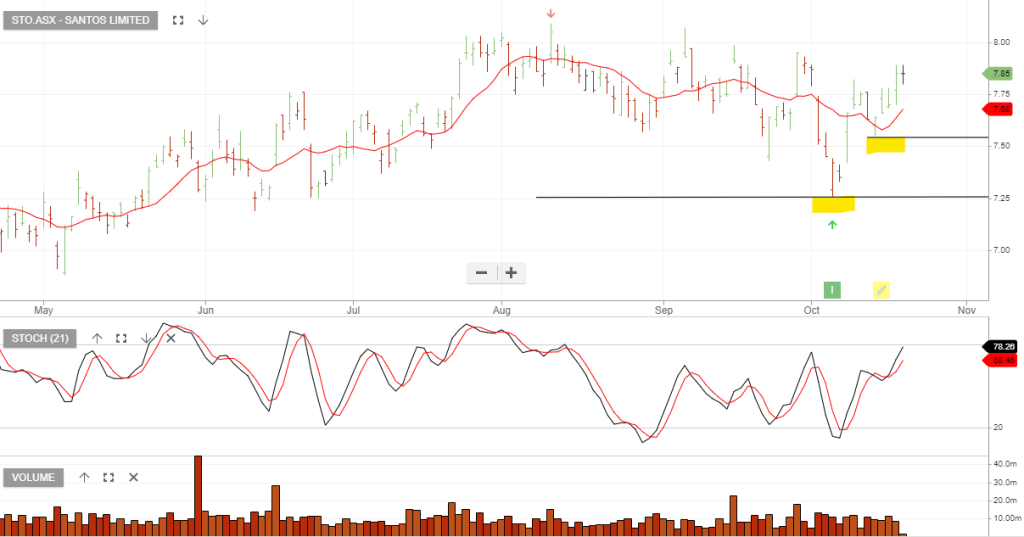

Santos remains our preferred oil & gas exposure.

We recommend that portfolio investors consider accumulating TLS near the $3.80 support level.

Amcor is oversold and we anticipate buying interest to rebuild near the $13.65 level.

The Lottery Corporation is moving towards oversold territory and we suggest adding this to your watchlists.

Or start a free thirty day trial for our full service, which includes our ASX Research.