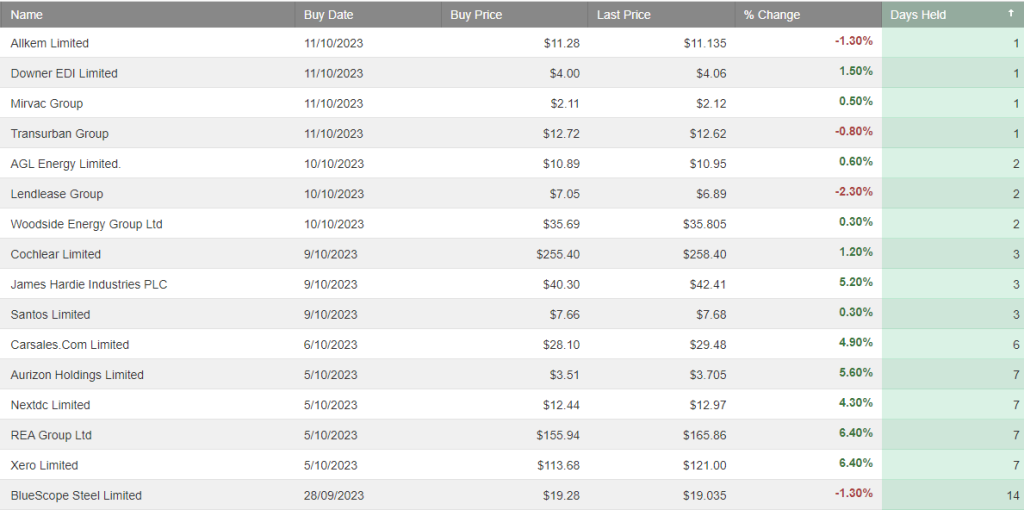

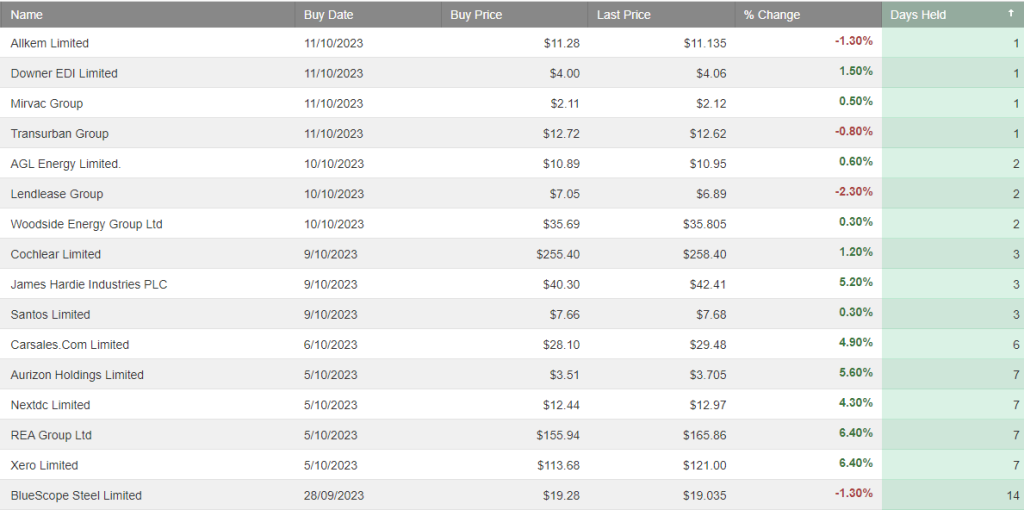

ASX 100 Trade Table

The ASX 100 Trade Table is up 14.4% YTD.

The ASX 100 Trade Table is up 14.4% YTD.

Global X S&P Biotech offers a great buying opportunity at $38.50

Cleanaway Waste Management is under Algo Engine buy conditions. We’re accumulating the stock in our investor portfolio within the $2 – $2.35 price range.

Aurizon Holdings is under Algo Engine buy conditions. Watch for this to drop into the Trade Table on a close above the 10-day average.

Global X S&P Biotech offers a great buying opportunity at $38.50

Cleanaway Waste Management is under Algo Engine buy conditions. We’re accumulating the stock in our investor portfolio within the $2 – $2.35 price range.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

BetaShares Cloud Computing is under Algo Engin buy conditions. Within big tech, we continue to like cloud, robotics, and cybersecurity as growth themes.

Northern Star Resources is under Algo Engine buy conditions and remains our preferred gold exposure along with GDX and GOR.

Global X Copper Miners is under Algo Engine buy conditions.

Or start a free thirty day trial for our full service, which includes our ASX Research.