PDD Holdings

PDD:NAS is likely to see increased buying support near the current trading range.

PDD:NAS is likely to see increased buying support near the current trading range.

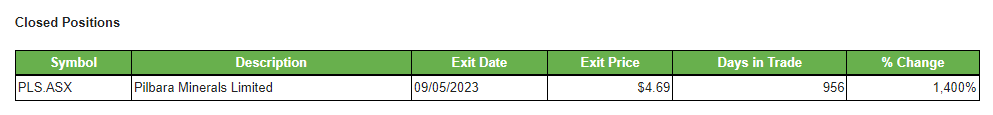

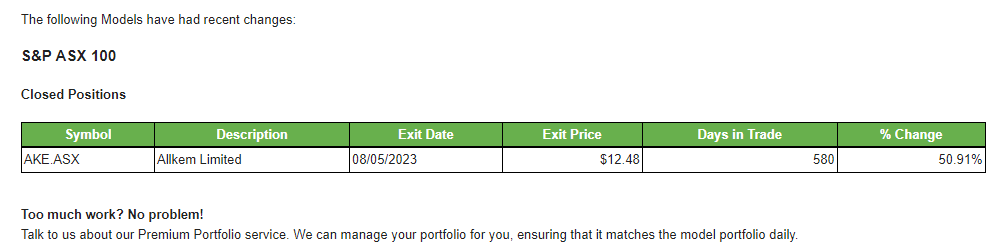

PLS:ASX was added as a buy, in September 2020 and our algo engine closed the trade yesterday for a 1400% gain.

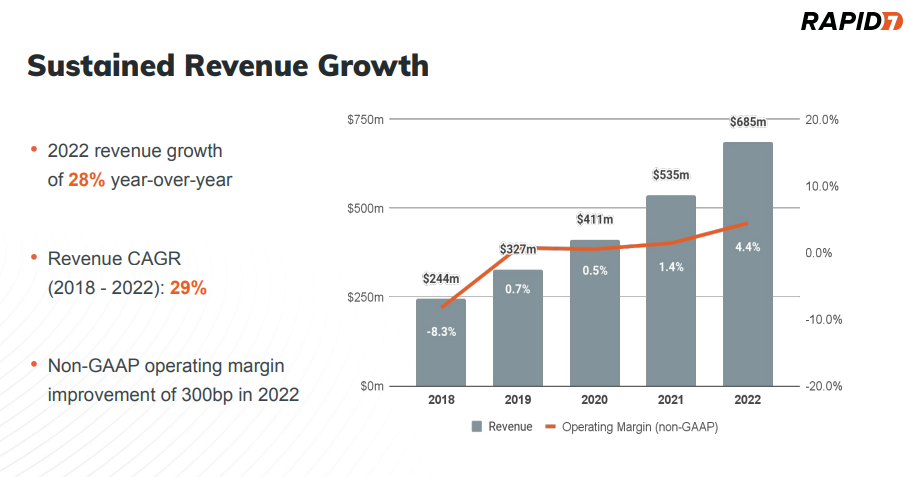

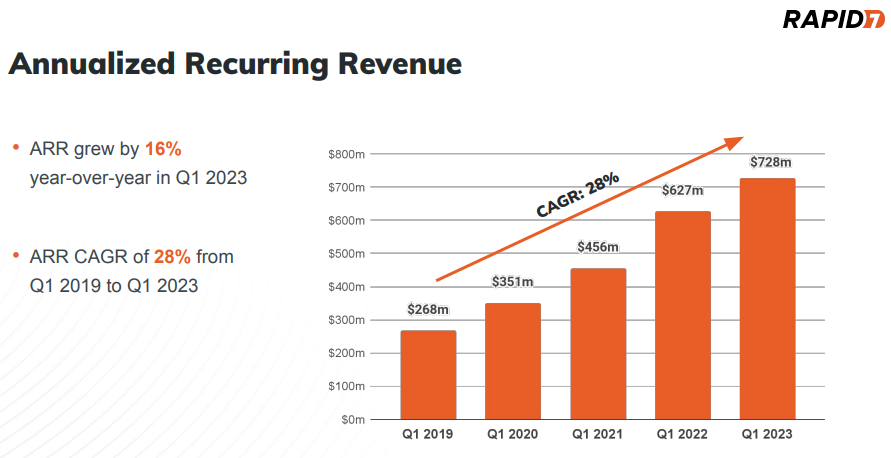

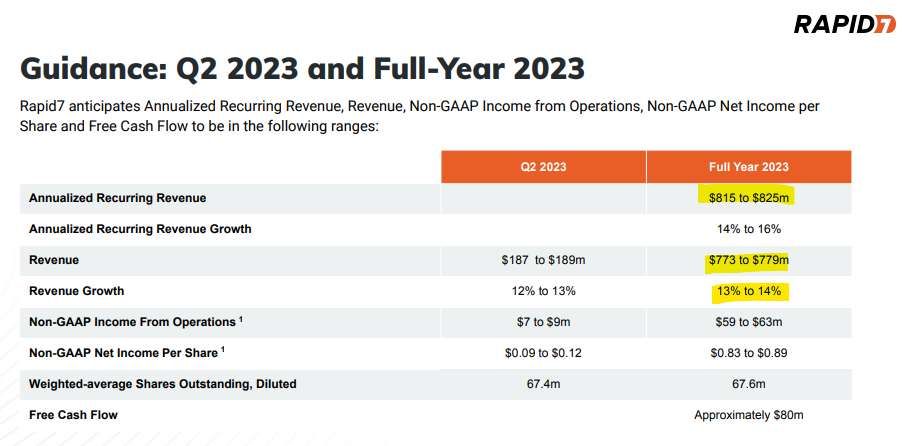

RPD:NAS announces First Quarter 2023 Financial Results

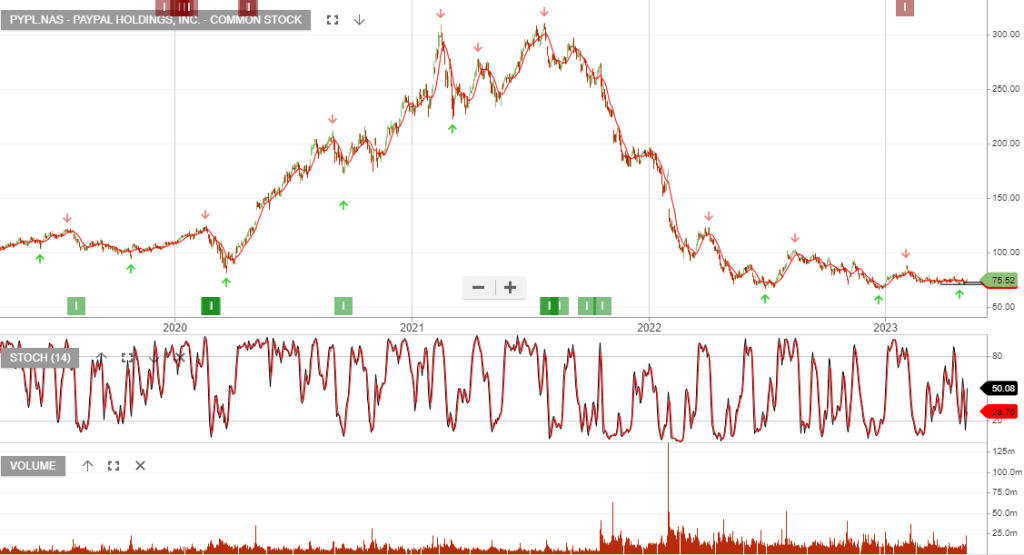

PYPL:NAS has been consolidating between $71 & $76 for the past 8 weeks. The stock offers value and may break to the upside of the channel.

Q1 payment growth of 10% to US$354.5bn, Q1 adjusted EPS of $1.17 vs. $1.10 expected, expects Q2 revenue growth of about 6.5% to 7.0%, raised full-year guidance. PayPal had an excellent start to 2023, delivered a stronger-than-expected performance in the first quarter, and increased full-year EPS guidance.

ZS:NAS raised the full-year revenue outlook to US$1.59bn vs. US$1.56bn expected, EBIT upgraded to US$220-224m vs. US$213-215m.

OKTA:NAS recently shifted to Algo Engine buy conditions and has been a focus trade for our Inner Circle members.

In case you missed it, you can watch last night’s free webinar here.

9/5 update: Cyber security stocks pop.

4/5 update: A look at the NASDAQ and US Technolgy Disruptors from both a long and short perspective.

19/4 update: New Inner Circle video

Lynas reports that it has been advised by Malaysian authorities that its licence to import and process lanthanide (rare earth) concentrate is now valid until 1 Jan 2024. This removes the requirement to shutdown the Malaysia cracking & leaching plant on 1 July 2023 and the plant will now operate until 1 Jan 2024.

Or start a free thirty day trial for our full service, which includes our ASX Research.