XJO – Chart Review

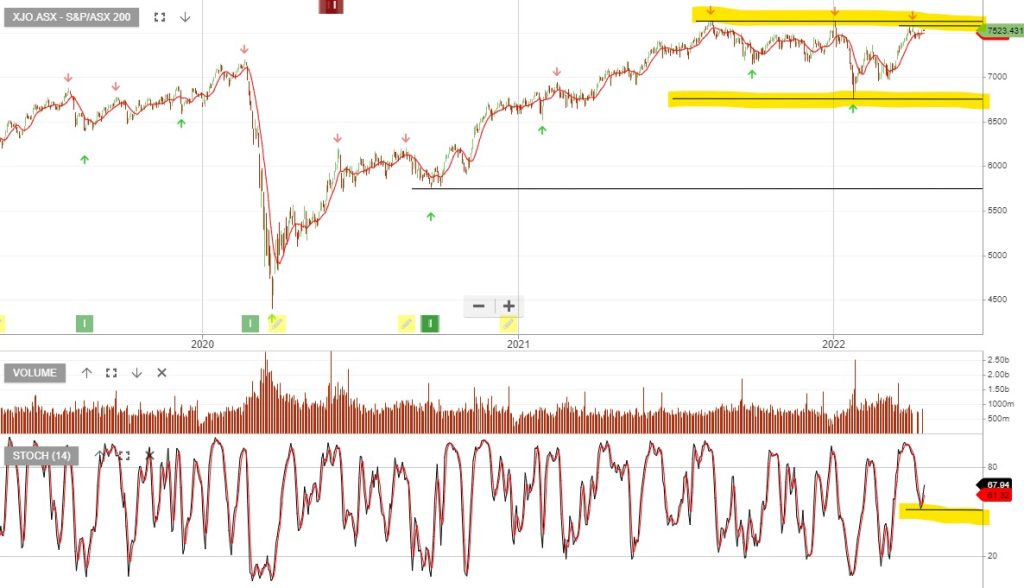

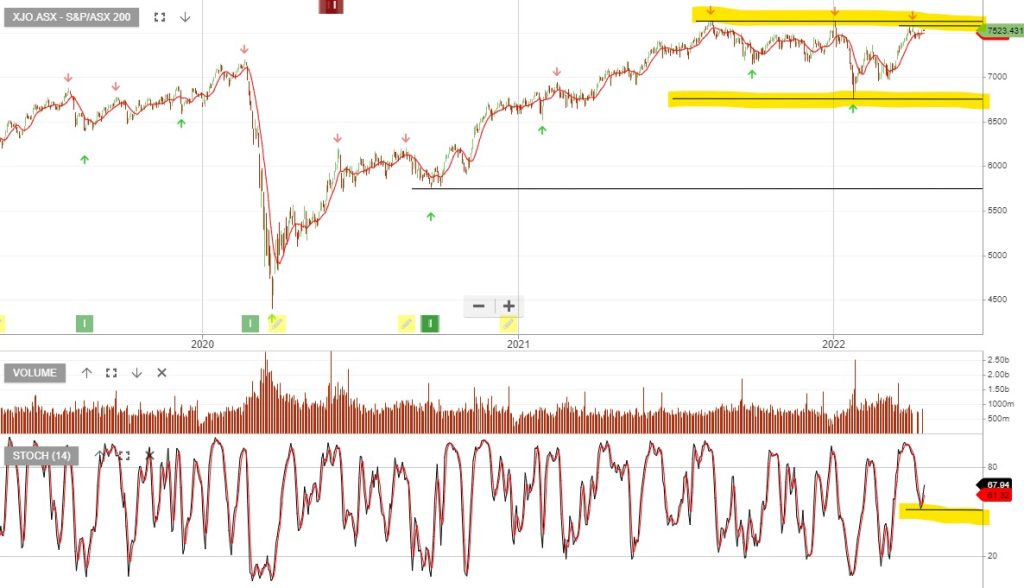

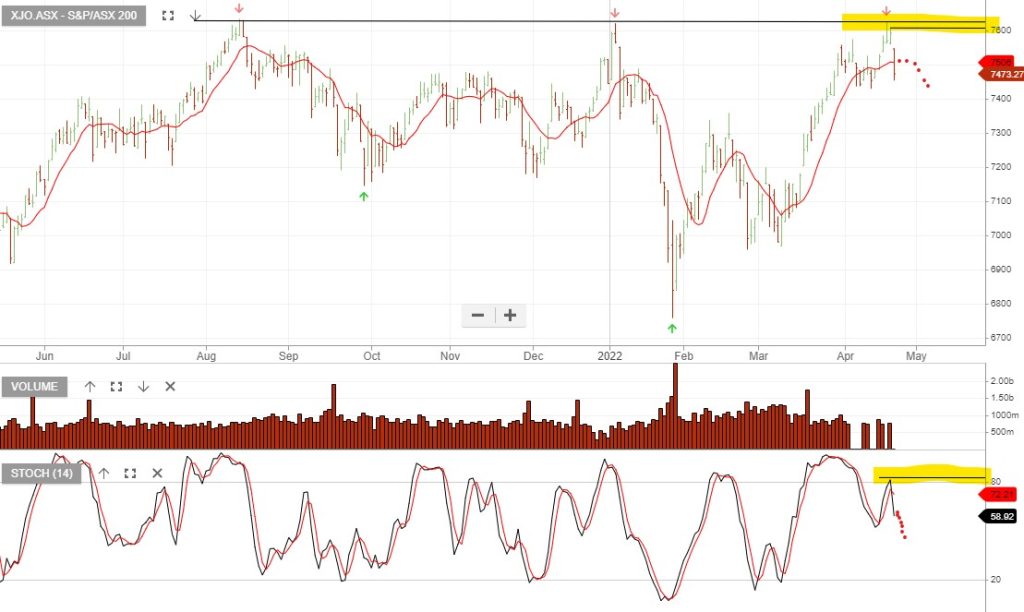

The XJO is now trading at the upper band of the consolidation channel that’s been in place since mid-last year.

23/4/2022 Update:

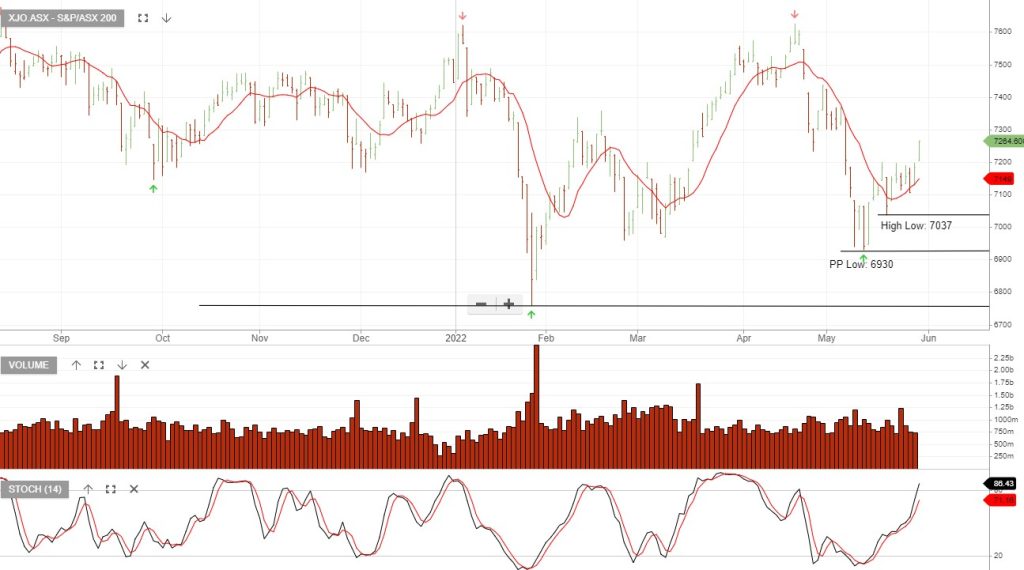

Update 14/5

30/5 update:

The XJO is now trading at the upper band of the consolidation channel that’s been in place since mid-last year.

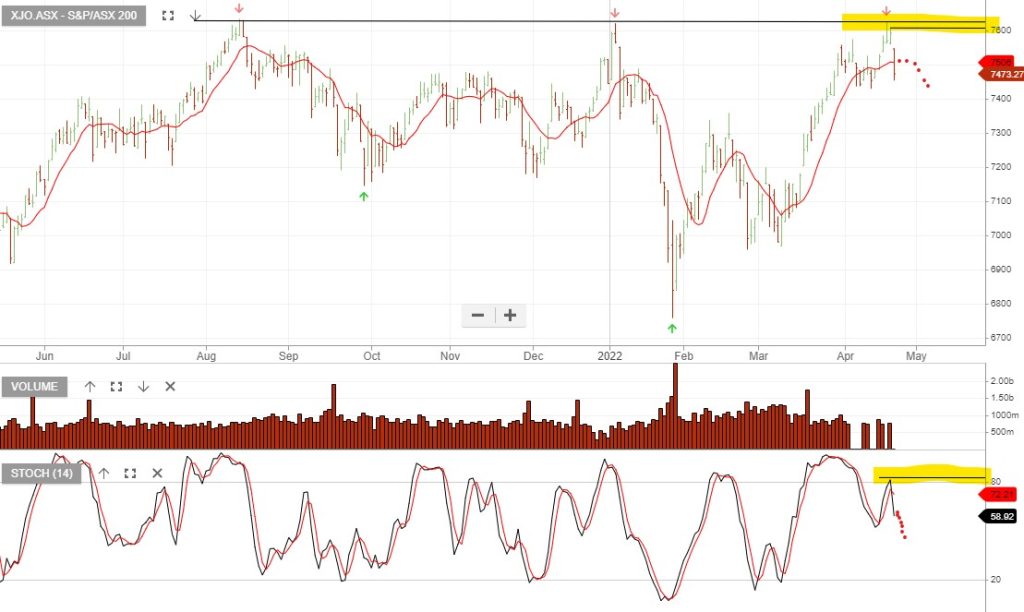

23/4/2022 Update:

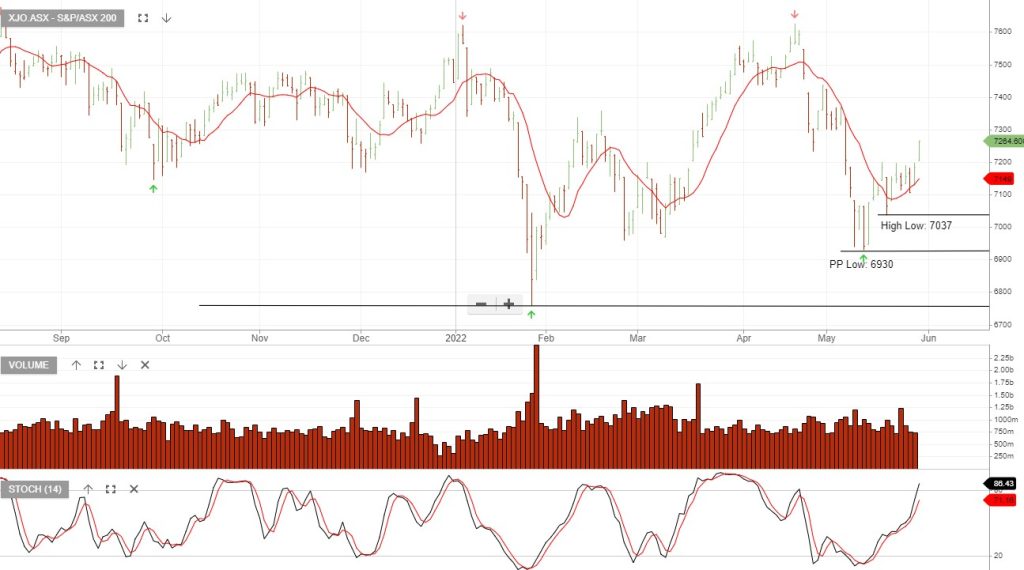

Update 14/5

30/5 update:

ASX:BL is under Algo Engine buy conditions. BSL provided a trading update and now expects EBIT for 2H FY22 to be $1.375-1.475bn.

The more robust outlook is driven by improved earnings expectations for North America with better-than-expected realised steel prices and spreads in the United States.

Based on FY23 earnings we have Bluescope on a 2.3% forward dividend yield.

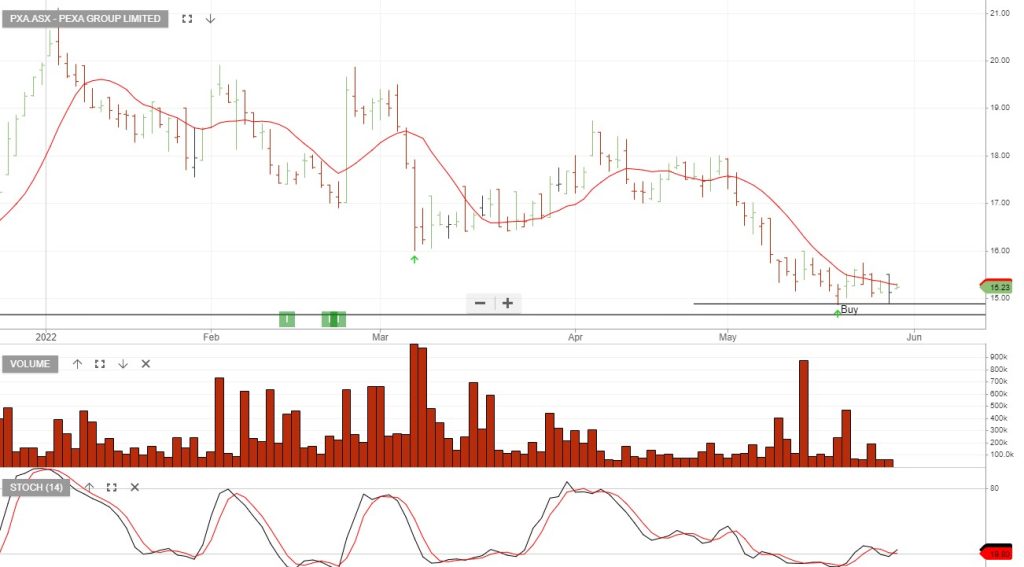

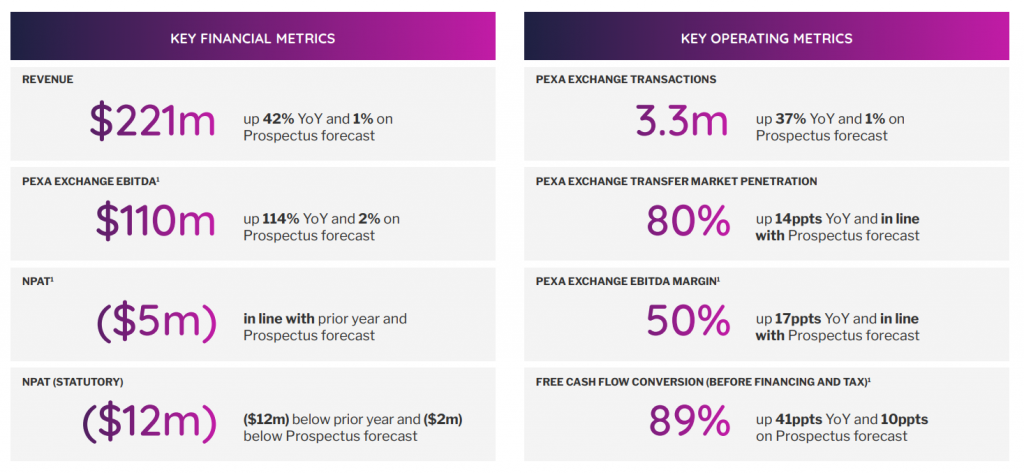

Pexa Group has helped transform conveyancing from a clunky paper-based process into a digital one.

FY21 underlying earnings doubled to $110 million and analysts are forecasting a further 20% increase in FY22.

CBA & Link are major shareholders.

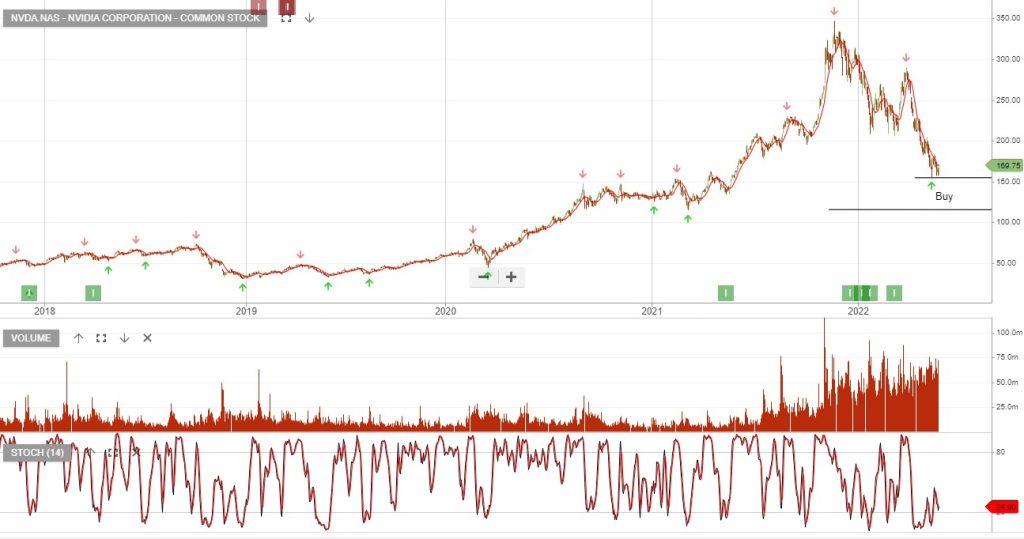

Nvidia will slow down its hiring pace and control expenses as the company deals with a challenging macroeconomic environment. Revenue for the March quarter came in at $8.29bn on EPS of $1.36.

Forecast revenue for the June quarter is expected to be $8.1 billion.

The company’s operating expenses increased 35% year-over-year. On the positive side, demand for its graphics processors used for gaming and artificial intelligence helped support sales growth of 46% year-over-year. Nvidia’s data center business, which sells chips for cloud computing companies and enterprises, grew 83% annually to $3.75 billion.

Nvidia said its board has authorized an additional $15 billion in share buybacks through the end of next year.

Rebasing investor expectations for BHP without the contribution from its petroleum business places the stock on a forward yield of 6% with flat to lower adjusted EPS into FY23.

Iron ore now represents around 50%, Copper 25%, with Coal and Nickel remaining other key exposures. We expect the eventual divestment of its remaining thermal coal assets.

Fisher & Paykel Healthcare Corporation is under Algo Engine buy conditions and we expect FY22 to be the low point in earnings, with FY23 and FY24 returning to double-digit EPS growth.

Tabcorp split into two businesses yesterday:

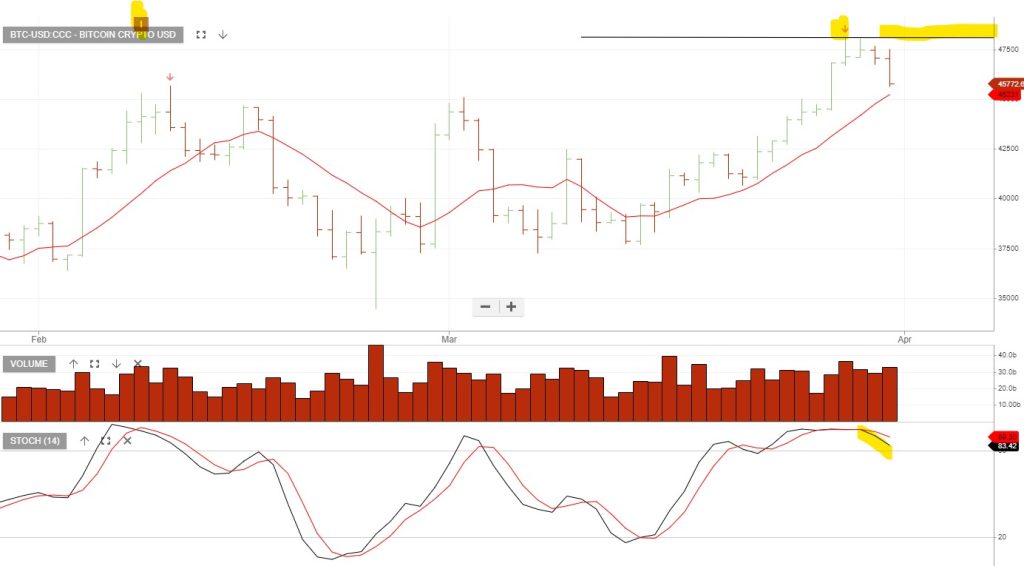

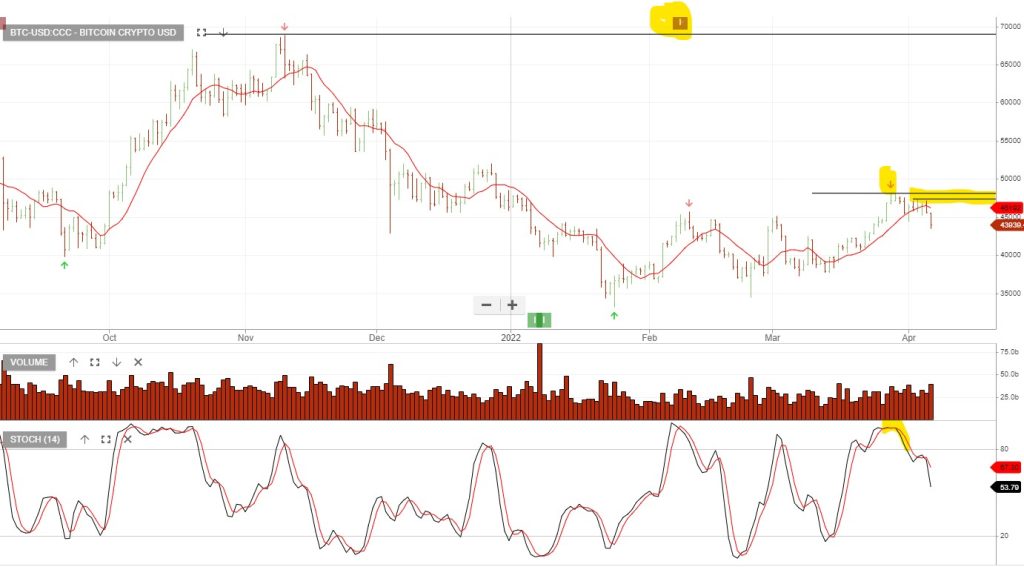

The rebound in the NASDAQ has been sharp and it’s possible we’re now looking at a level of overhead resistance. For crypto investors, this provides an opportunity to consider hedging or an outright short position.

The strategy requires a stop loss which means any short exposure is closed out if the market rally continues.

7/4/22 update: BTC-USD has rolled over and the technical setup remains negative.

23/4/22 update: The NASDAQ continues to move lower reflecting a risk-off sentiment, which is also impacting Bitcoin. BTC is under Algo Engine sell conditions and we remain short Bitcoin futures as an open trade.

26/5 update: Bitcoin has continued to trade lower and we now identify the overhead resistance at 30590 as the first level to watch for a potential price reversal. Since flagging the “short” setup in Bitcoin on 7 April, the crypto has lost 15,000 in the move from 45,000 down to 30,000.

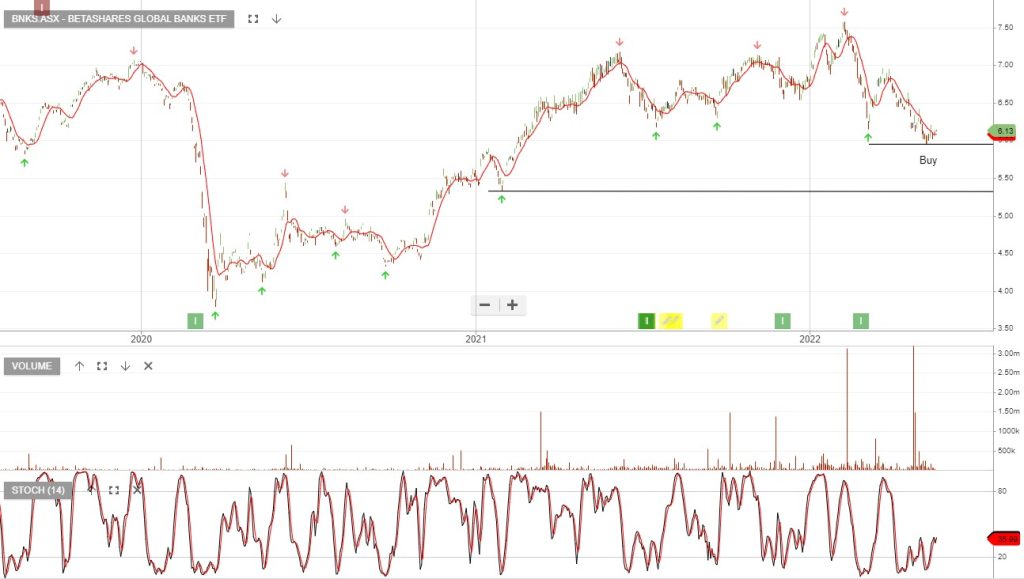

BetaShares Global Banks offers exposure to a recovery in global bank shares.

Gold Road Resources is under Algo Engine buy conditions.

Or start a free thirty day trial for our full service, which includes our ASX Research.