Ampol – Algo Buy

Ampol is under Algo Engine buy conditions.

Ampol is under Algo Engine buy conditions.

ORG:SX is under Algo Engine buy conditions and has now been added to our model portfolio.

The strong cash flows from APLNG will offset the lower expected earnings in energy markets.

22/12 Update: ORG has now rallied over 10%

ETFS Fang+ is under Algo Engine buy conditions with support at $17.20

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

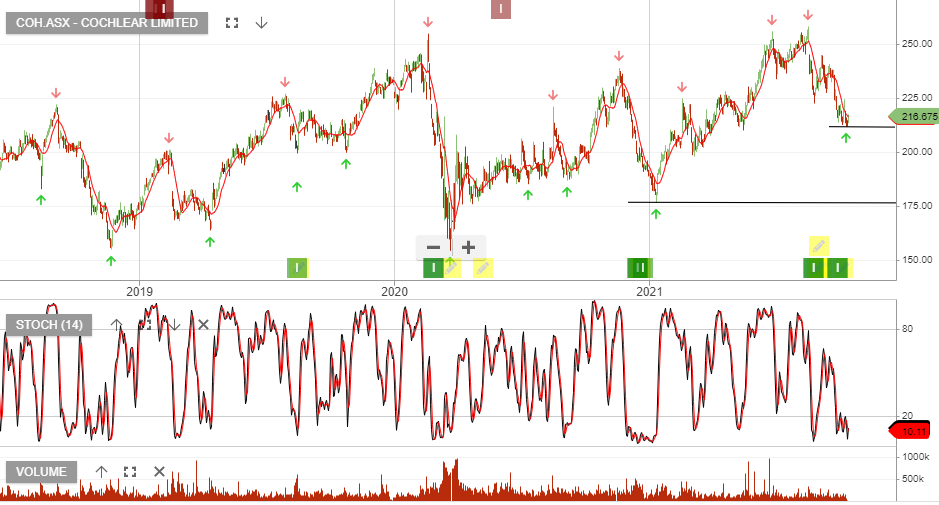

Cochlear is now under Algo Engine buy conditions and has been added to our ASX 100 model portfolio.

We expect 10% EPS growth over the next 12 months. Although, the stock remains expensive at 40x earnings and trading on a 1.8% yield.

Since writing the above post in Dec last year, COH has rallied from $175 to a high of $257. The subsequent pullback has seen buying interest rebuild at the higher low of $210.

This is the second cluster of Algo Engine buy signals and we’ve taken the opportunity to add to our original allocation.

16/12 Update: COH remains a buy at $215.

CSL has lobbed a US$11.7bn all cash public tender offer for Switzerland based specialty drug company Vifor Pharma.

The acquisition is being funded via a combination of a private placement, SPP and cash/debt, with commencement around 18 Jan-22.

Coinbase Global, Inc. – Class A Common is now under Algo Engine buy conditions.

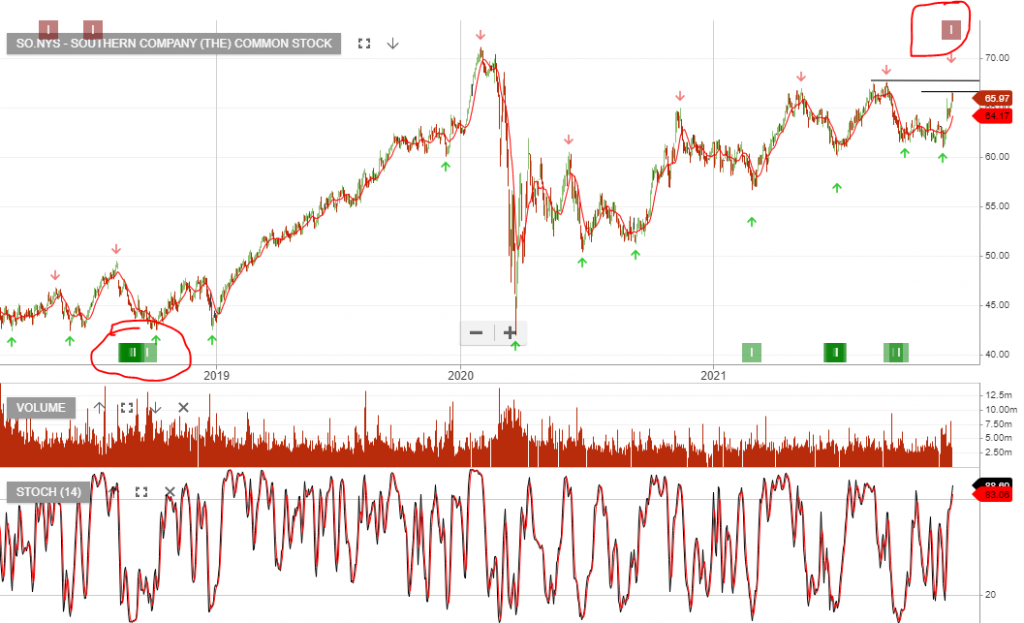

Southern Company (The) Common has been removed from the US S&P100 model portfolio after a 1209 day holding period and a realised gain of 64.4%.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

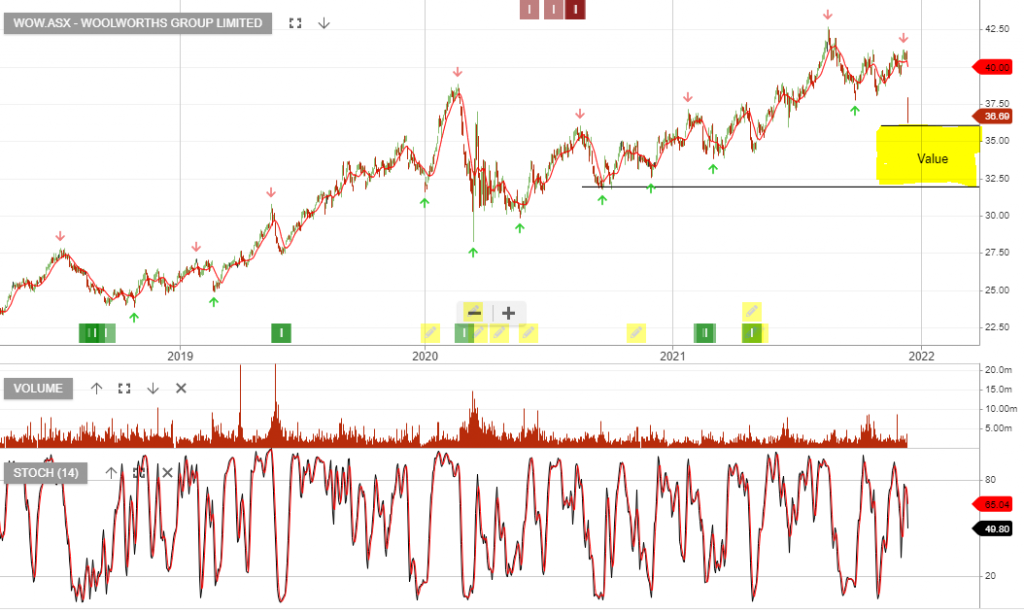

Woolworths Group announced a disappointing trading update which revealed COVID had weighed heavily on earnings during the first half. The retailer anticipates $215mil in COVID-related expenses and before tax profit to fall from $1.3bn to $1.2bn.

We see value in the stock within the highlighted price range.