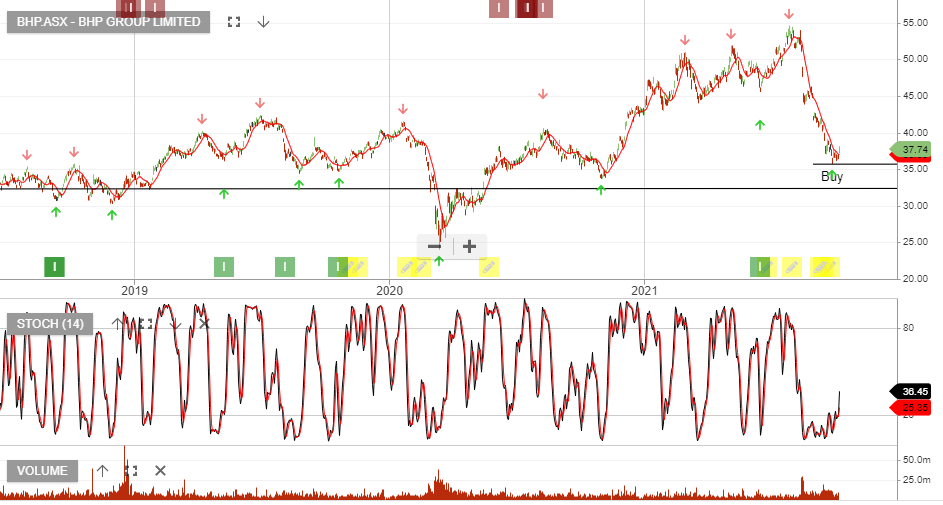

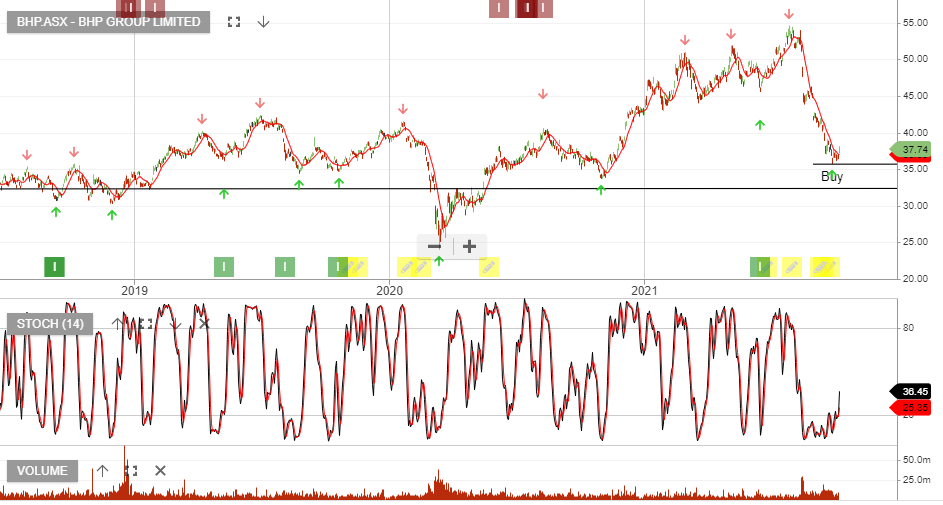

BHP – Algo Buy Signal

BHP Group is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

BHP Group is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

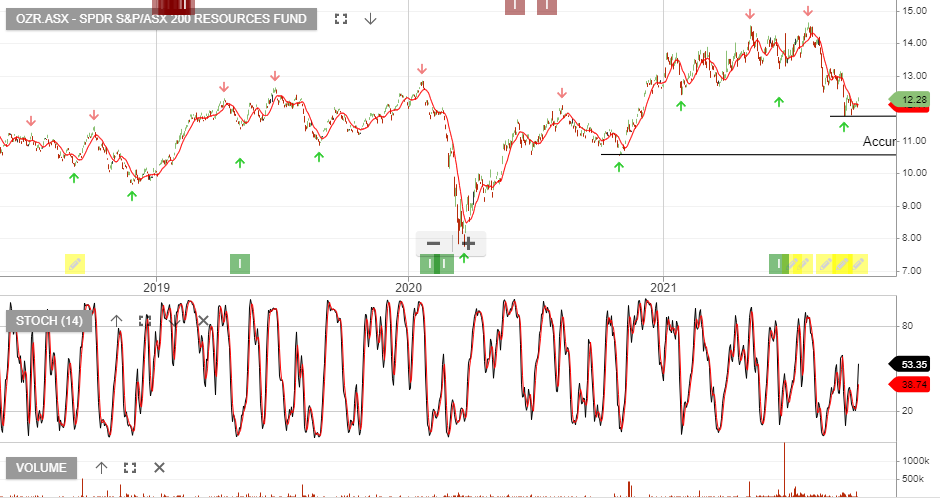

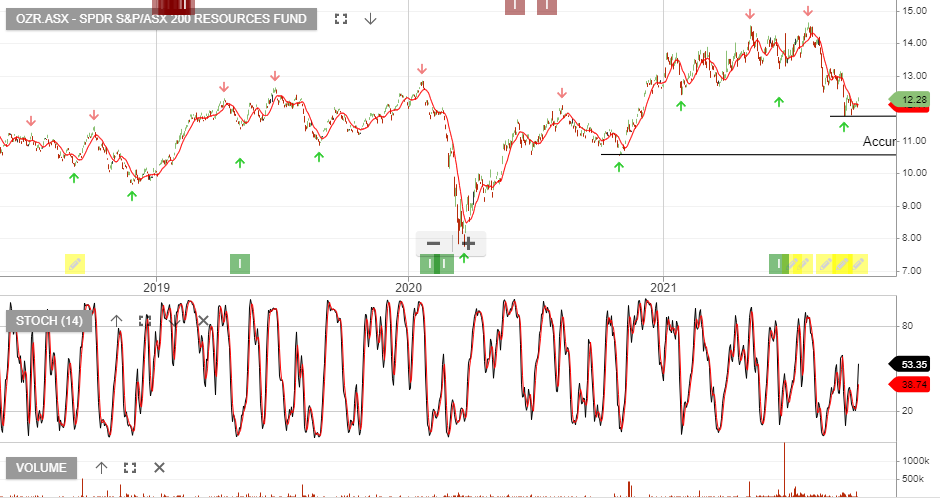

OZR:ASX is under Algo Engine buy conditions and we anticipate buying support to increase within the accumulation range of $10.50 to $12.50.

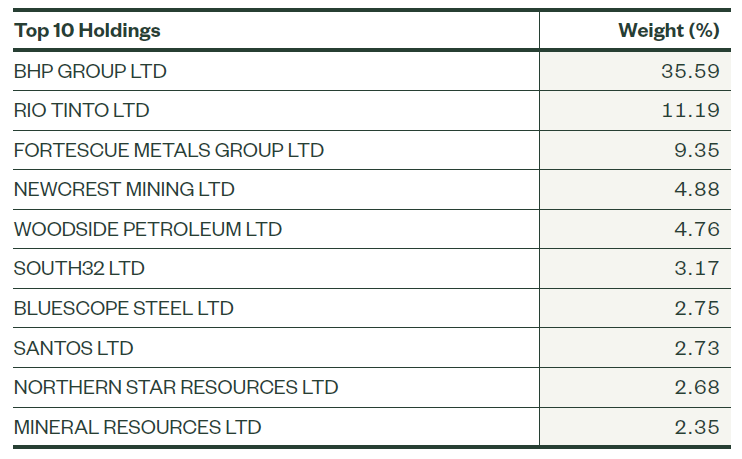

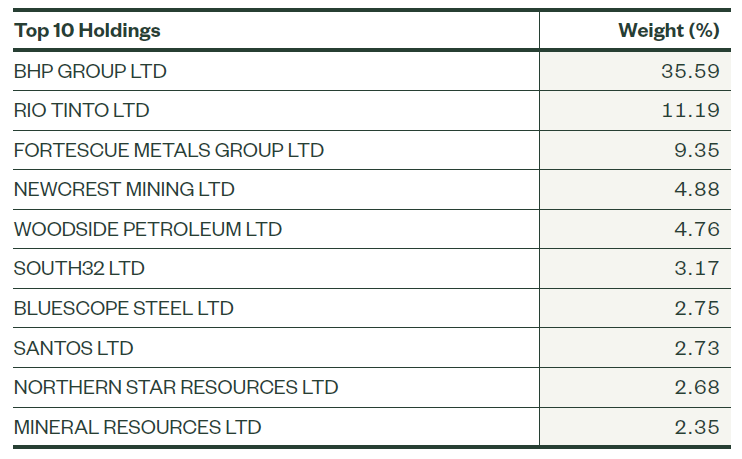

A sector sub-index of the S&P/ASX 200 Index, this index provides investors with exposure to the Resources sector of the Australian equity market as classified as members of the GICS® resources sector. Resources are defined as companies classified in the Energy sector (GICS® Tier 1), as well as companies classified in the Metals and Mining Industry (GICS® Tier 3).

OZR:ASX is under Algo Engine buy conditions and we anticipate buying support to increase within the accumulation range of $10.50 to $12.50.

A sector sub-index of the S&P/ASX 200 Index, this index provides investors with exposure to the Resources sector of the Australian equity market as classified as members of the GICS® resources sector. Resources are defined as companies classified in the Energy sector (GICS® Tier 1), as well as companies classified in the Metals and Mining Industry (GICS® Tier 3).

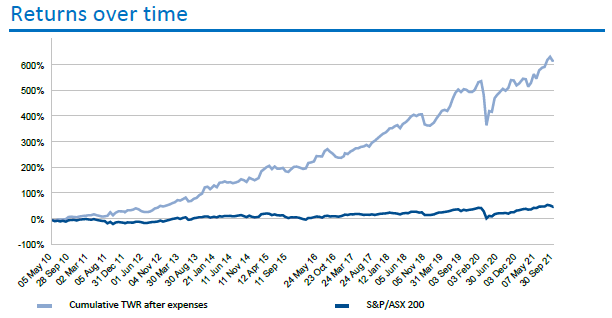

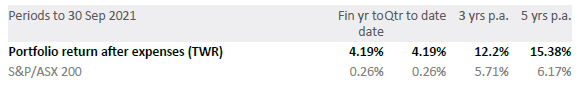

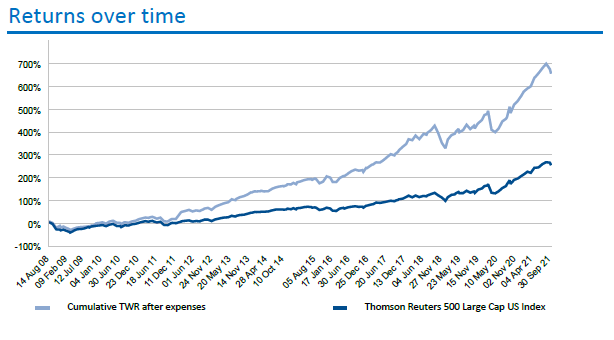

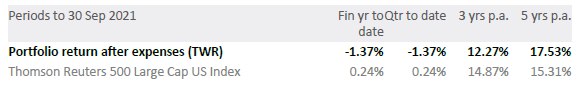

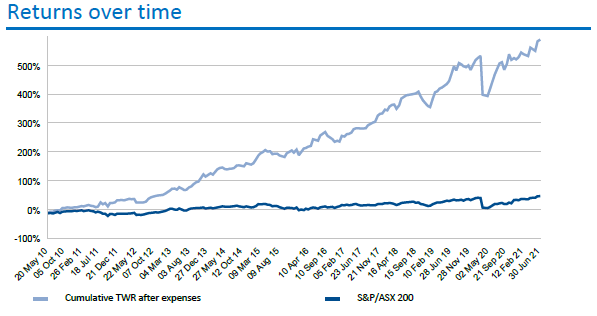

The updated 5-year performance data for all Algo Engine buy and sell signals for the period ending 30 September.

Model Name: ASX S&P100 is 15.38% p/a.

Model Name: ASX ALL ETF is 14.85%.

Model Name: US S&P100 is 17.53% p/a.

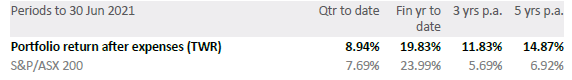

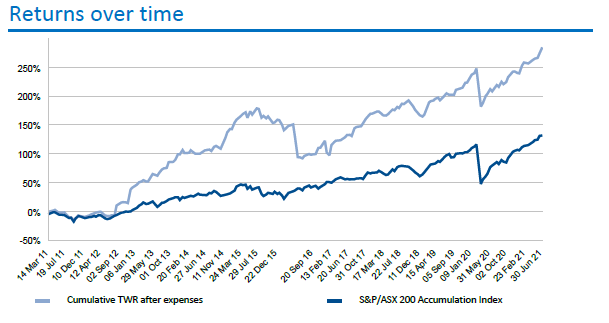

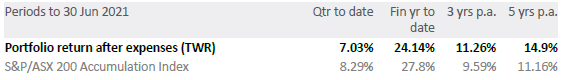

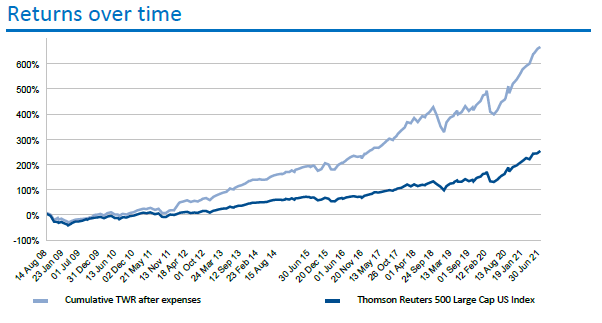

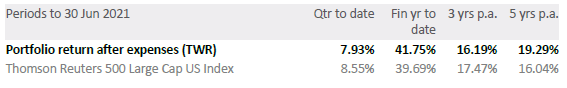

The updated 5-year performance data for all Algo Engine buy and sell signals for the period ending 30 June 2021

Model Name: ASX S&P100 is 14.87% p/a.

Model Name: ASX ALL ETF is 14.9%.

Model Name: US S&P100 is 19.29% p/a.

Disclaimer: This data illustrates the simulated 5 year historical time weighted rate of return of applying our algorithm based investment model over the ASX100 & US S&P100 listed securities. Past performance is no guarantee of future returns.

Link Administration Holdings reported FY21 profit of $112m. FY22 guidance is now low single-digit revenue growth and flat EBIT.

The downside in the share price is underpinned to a certain degree through the announced buyback of $150m.

The forward dividend yield is 2.7%.

Cochlear is under Algo Engine buy conditions.

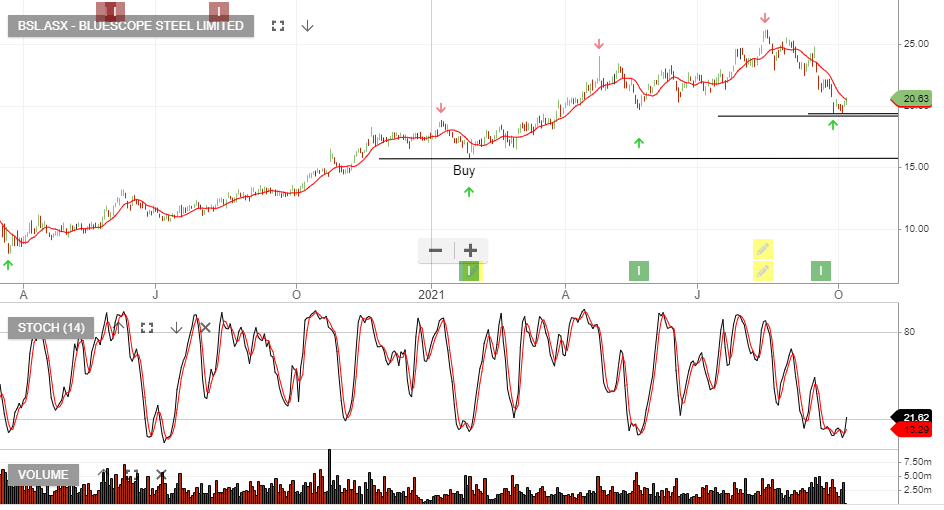

BlueScope Steel is under Algo Engine buy conditions.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

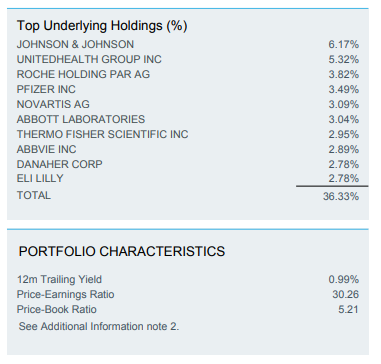

iShares Global Healthcare is now under Algo Engine buy conditions and has been added to our ASX ETF model.

The fund aims to provide investors with the performance of the S&P Global 1200 Healthcare Sector IndexTM, before fees and expenses. The index is designed to measure the performance of global biotechnology, healthcare, medical equipment and pharmaceuticals companies and may include large-, mid- or small-capitalisation stocks.

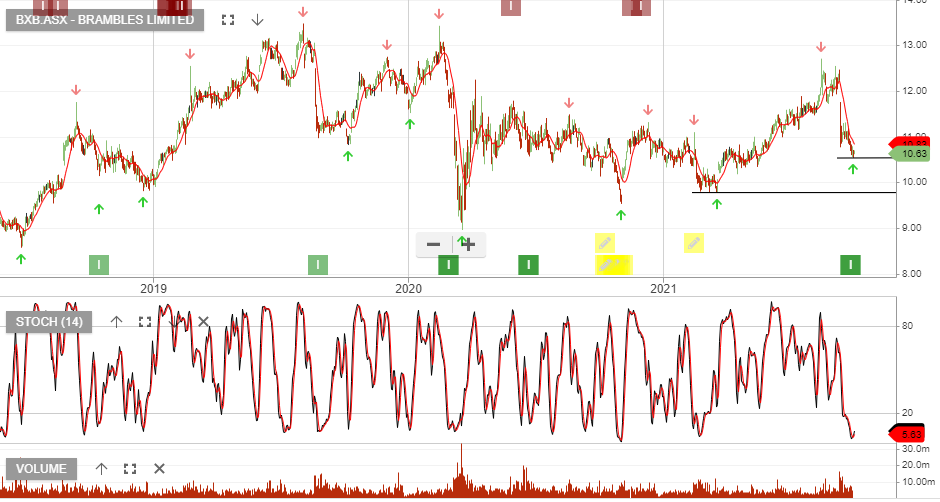

Brambles is under Algo Engine buy conditions and has now been added into our model portfolio.