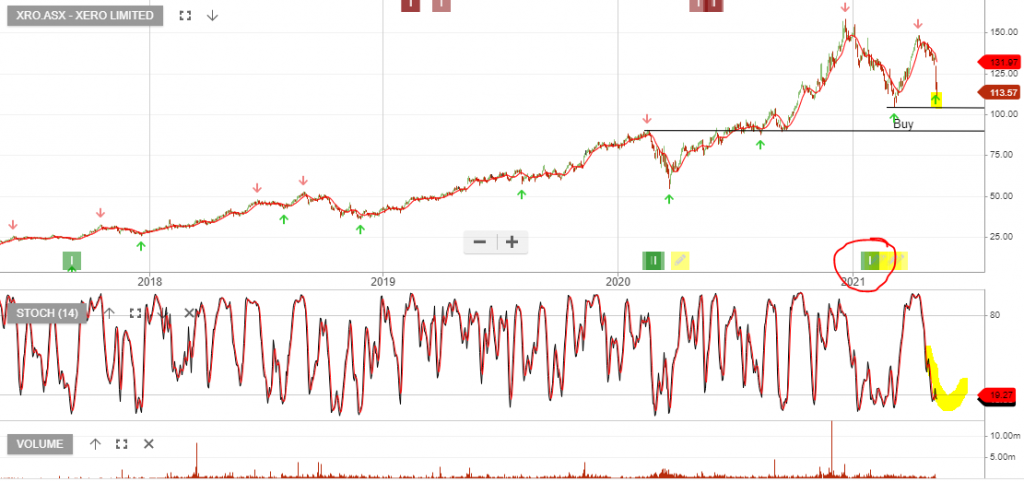

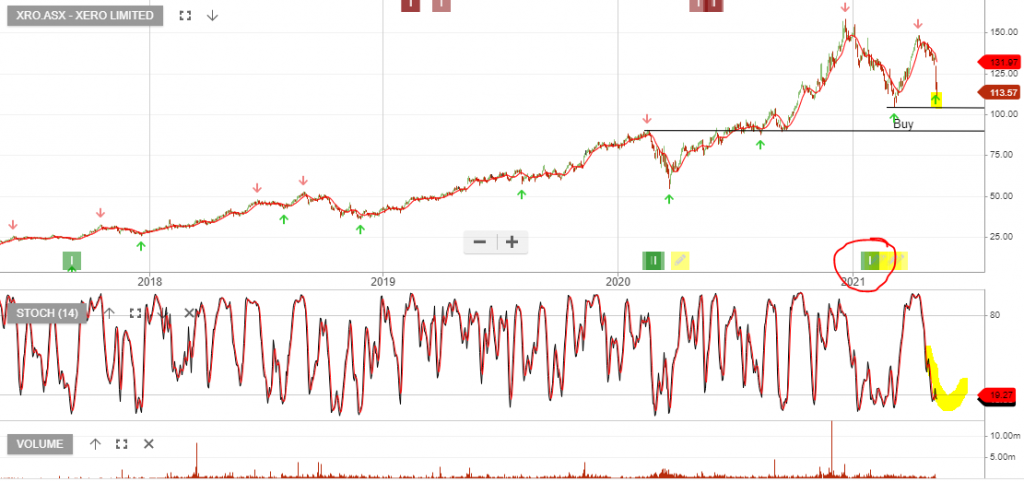

Xero – Buy Signal

Xero is under Algo Engine buy conditions and is a current holding in our ASX 100 model.

Xero is under Algo Engine buy conditions and is a current holding in our ASX 100 model.

WPL:ASX is under Algo Engine buy conditions and is a current holding in our ASX model portfolio.

CIM:ASX is likely to see improved earnings in FY22 and we expect to soon see a recovery in the share price.

CIMIC is a high risk counter trend investment with the prospect of a multi-year recovery, once earnings hit an inflection point.

24/4 CIMIC breaks above the 10-day average after forming a new trend low mid-week at $16.86.

10/5 Dec 21 $20 call options are now trading at $1.10.

14/5 CIMIC is now trading $19.84 and the Dec $20 calls have jumped from $1.10 to $1.50.

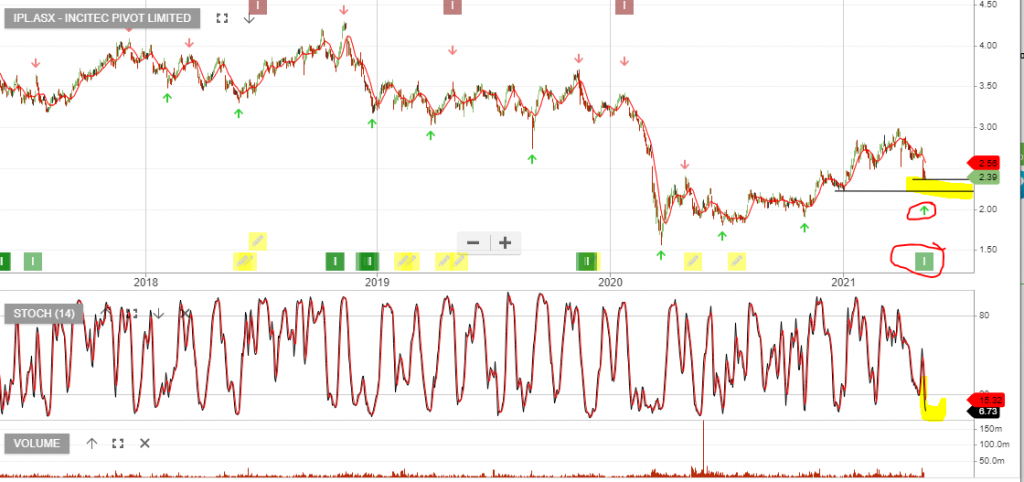

IPL:ASX is now under Algo Engine buy conditions and has been added to the ASX 100 model portfolio.

Traders should begin tracking IPL for a turn higher in the short-term momentum indicators and look for buying interest to increase near the $2.30 to $2.40 support level.

ASX:IZZ is under Algo Engine buy conditions. We expect buying interest to increase within the $55 – $60 price range.

Traders may wait for the third factor to align, an upturn in the momentum indicators. Watch for the stochastic to move higher or the price action on the main chart to cross above the 10-day average.

IPL:ASX is now under Algo Engine buy conditions and has been added to the ASX 100 model portfolio.

Traders should begin tracking IPL for a turn higher in the short-term momentum indicators and look for buying interest to increase near the $2.30 support level.

Pro Medicus remains under algo engine buy conditions after rallying from the November entry level at $30.

The current retracement from $50 to $39 means investors should now be watching the short-term momentum indicators for a turn higher. We continue to like the long-term growth profile of Pro Medicus.

For more detail on the strategy, please call our office on 1300 614 002.

ASX:IZZ is under Algo Engine buy conditions. We expect buying interest to increase within the $55 – $60 price range.

Traders may wait for the third factor to align, an upturn in the momentum indicators. Watch for the stochastic to move higher or the price action on the main chart to cross above the 10-day average.

CURE:AXW is under Algo Engine buy conditions and the current pullback provides another buying opportunity.

ETFS S&P Biotech ETF (ASX Code: CURE) offers investors exposure to U.S. biotechnology companies. These companies are engaged in research, development, manufacturing and/or marketing of products based on genetic analysis and genetic engineering.

.

Pro Medicus remains under algo engine buy conditions after rallying from the November entry level at $30.

The current retracement from $50 to $41 means investors should now be watching the short-term momentum indicators for a turn higher. We continue to like the long-term growth profile of Pro Medicus.

For more detail on the strategy, please call our office on 1300 614 002.

Or start a free thirty day trial for our full service, which includes our ASX Research.