Northern Star – Buy

Northern Star Resources is under Algo Engine buy conditions. The expected rally from sub $10 is now underway.

7/7 Buy NST: We highlight Northern Star as our preferred gold play.

10/6 Buy NST

Northern Star Resources is under Algo Engine buy conditions. The expected rally from sub $10 is now underway.

7/7 Buy NST: We highlight Northern Star as our preferred gold play.

10/6 Buy NST

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

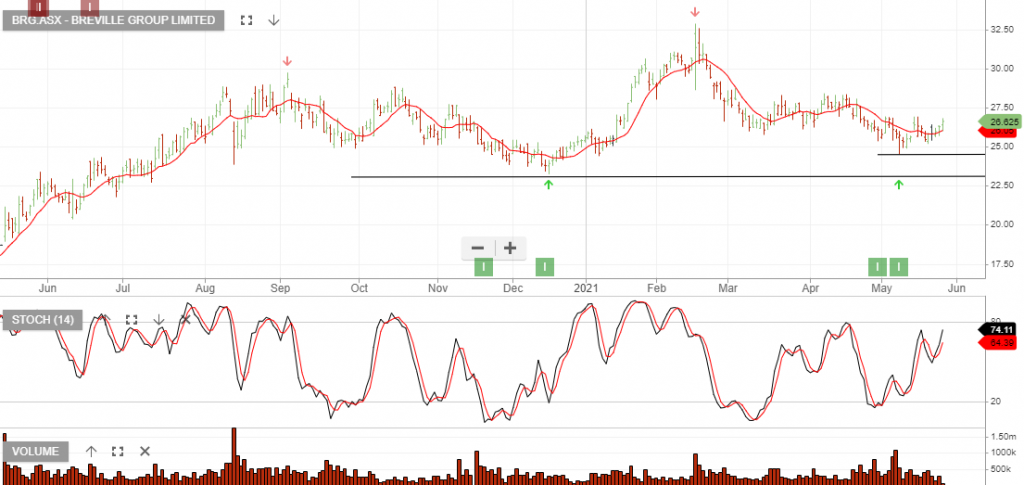

Breville Group is now under Algo Engine buy conditions and we see price support building at $25.00

7/6 BRG update: We remain long BRG and continue to hold the position whilst the price action remains above the 10-day average.

Buy TPG Telecom above the $5.06 higher low formation.

Traders should consider applying a stop loss below the recent pivot low of $4.81 or on a break of $5.06.

TPG offers solid free cash flow with an improving dividend story into FY22 and FY23.

Northern Star Resources is under Algo Engine buy conditions. The expected rally from sub $10 is now underway.

7/7 Buy NST: We highlight Northern Star as our preferred gold play.

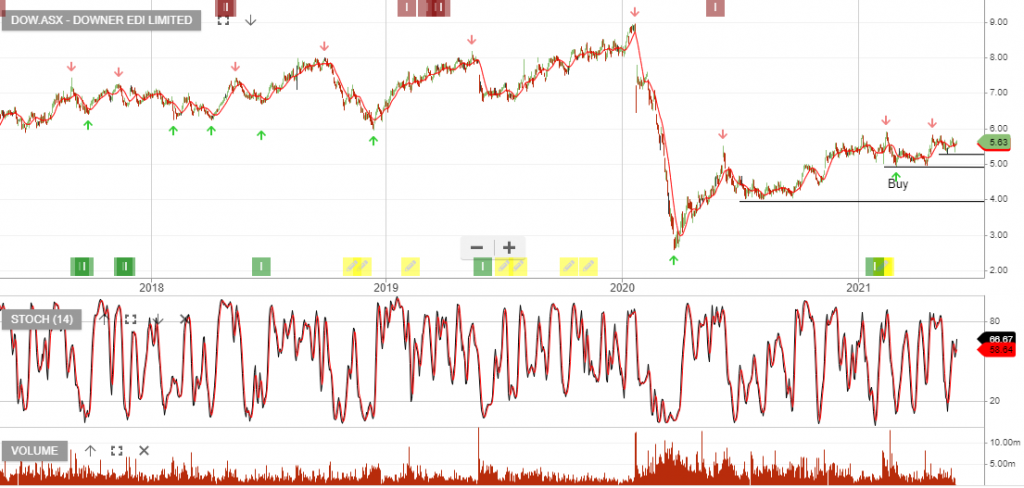

DOW:ASX is now under Algo Engine buy conditions. The company has guided towards double-digit earnings growth into FY22 & FY23.

Downer EDI has found support and buying interest has increased above $5.00.

Origin Energy has broken out of a prolonged downtrend as the negative earnings cycle appears to be nearing the bottom.

The market has low expectations for FY22 earnings with EBITDA down almost 40% on FY21 and DPS falling from $0.14 to $0.10 placing the stock on an expected yield of 2.2%.

We see upside for Origin and suggest a stop loss below the recent $3.87 low.

WPL:ASX is under Algo Engine buy conditions and is a current holding in our ASX model portfolio.

Buy WPL above the $21.50 support level.

4/6 Update: WPL has now rallied 10% from the pivot low and we see further upside potential supported by strong energy prices.

Bega Cheese is under Algo Engine buy conditions and is a current holding in our ASX model portfolio.

Accumulate within the $5.50 – $5.70 price range.

4/6 Update: Bega has now rallied from Wednesday’s $5.64 low to be trading today at $5.90. Traders – stay long BGA whilst the price action remains above the 10 day average.

Investors – You may choose to simply hold the stock for yield and the likely compound 5 – 9% EPS growth.