WPL – Buy

WPL:ASX is under Algo Engine buy conditions and is a current holding in our ASX model portfolio.

WPL:ASX is under Algo Engine buy conditions and is a current holding in our ASX model portfolio.

CURE:AXW is under Algo Engine buy conditions and the current pullback provides another buying opportunity.

ETFS S&P Biotech ETF (ASX Code: CURE) offers investors exposure to U.S. biotechnology companies. These companies are engaged in research, development, manufacturing and/or marketing of products based on genetic analysis and genetic engineering.

.

ASX:IZZ is under Algo Engine buy conditions. We expect buying interest to increase near the $60 support level.

Buy IZZ at market.

DOW:ASX is now under Algo Engine buy conditions. The company has guided towards double-digit earnings growth into FY22 & FY23.

24/4 Downer EDI has found support and buying interest has increased above $5.00.

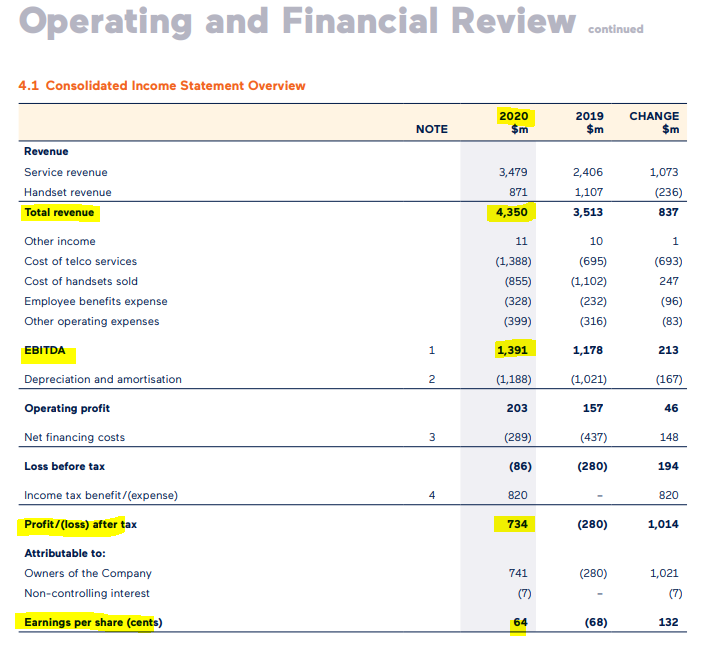

As the merger was effective for accounting purposes from 26 June 2020, TPG Telecom’s reported results for 2020 include a full twelve months of TPG Telecom Limited (formerly named VHA) and a contribution of six months and four days from TPG Corporation Limited (formerly named TPG Telecom).

Reported revenue for the year increased 24% from 2019 to $4.35 billion and reported EBITDA increased by 18% to $1.39 billion. We reported NPAT of $734 million, which includes a one-off, non-cash credit to income tax expense of $820 million.

In the first six months post-merger, the Group has generated $342 million

of net cash flow. The TPG Telecom Board resolved to pay a final dividend for 2020 of 7.5 cents per share.

Brambles Limited today reported sales revenue from continuing operations of US$3,794.1 million for the first nine months of the financial year ending 30 June 2021 (FY21), representing an increase of 8% at actual FX rates on the prior corresponding period.

BXB are on track to deliver FY21 sales, earnings and cash flow guidance, representing EBIT growth between 5 – 7%.

We see scope for BXB to trade back to $11 – $12.

ASX:IZZ is under Algo Engine buy conditions. We expect buying interest to increase near the $60 support level.

Buy IZZ at market.

WPL:ASX is under Algo Engine buy conditions and is a current holding in our ASX model portfolio.

CURE:AXW is under Algo Engine buy conditions and the current pullback provides another buying opportunity.

ETFS S&P Biotech ETF (ASX Code: CURE) offers investors exposure to U.S. biotechnology companies. These companies are engaged in research, development, manufacturing and/or marketing of products based on genetic analysis and genetic engineering.

.

Or start a free thirty day trial for our full service, which includes our ASX Research.