Volpara Health – is it a buy?

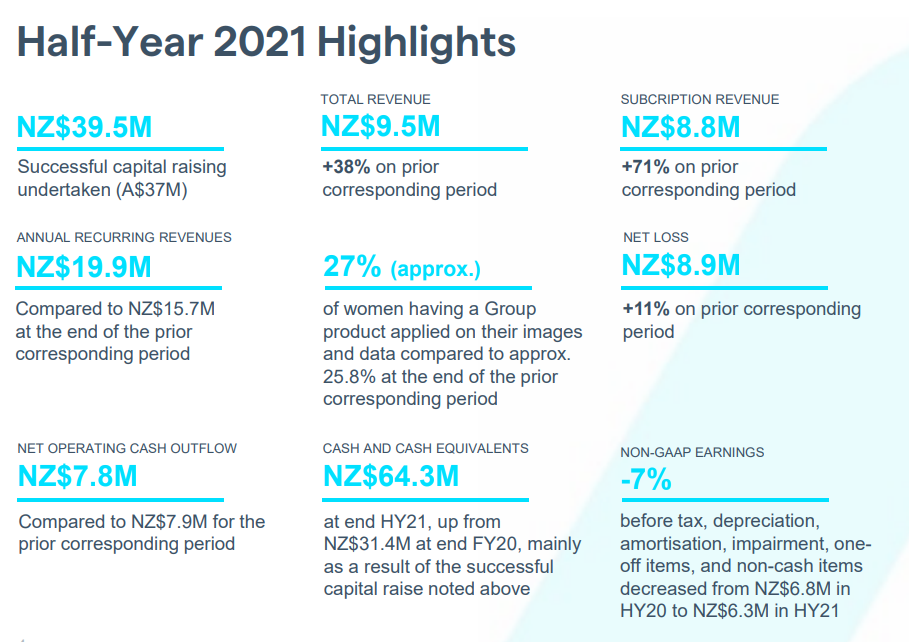

VHT:ASX is under Algo Engine buy conditions after forming a series of higher low formations above the $1.25 support level.

VHT:ASX is under Algo Engine buy conditions after forming a series of higher low formations above the $1.25 support level.

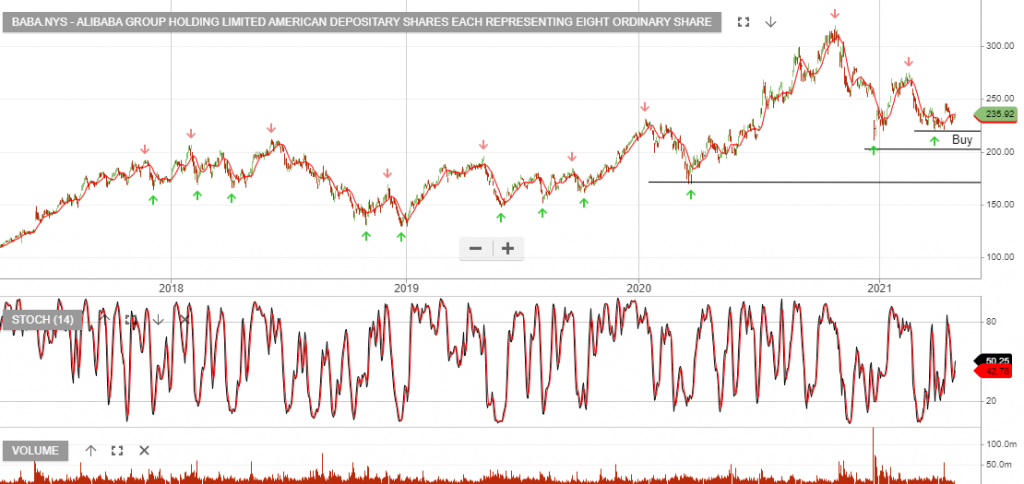

Alibaba is finding buying support above the recent $220 low.

WPL:ASX is under Algo Engine buy conditions and is a current holding in our ASX model portfolio.

ASX:IZZ is under Algo Engine buy conditions. We expect buying interest to increase near the $60 support level.

Buy IZZ at market.

CIM:ASX is likely to see improved earnings in FY22 and we expect to soon see a recovery in the share price.

CIMIC is a high risk counter trend investment with the prospect of a multi-year recovery, once earnings hit an inflection point.

24/4 CIMIC breaks above the 10-day average after forming a new trend low mid-week at $16.86.

Amcor is under Algo Engine buy conditions.

Investors may consider selling out-of-the-money call options to enhance the income.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

PDD:NAS is now under Algo Engine buy conditions. The company is China’s largest agriculture and interactive commerce platform.

Pinduoduo has surpassed Alibaba as China’s largest e-commerce company with 788 million active users according to its latest quarterly earnings report.

We expect buying interest to build above the $125 support level. Q121 earnings should show continued growth.

SNAP:NYS is under Algo Engine buy conditions following the entry signal at $48 in late March.

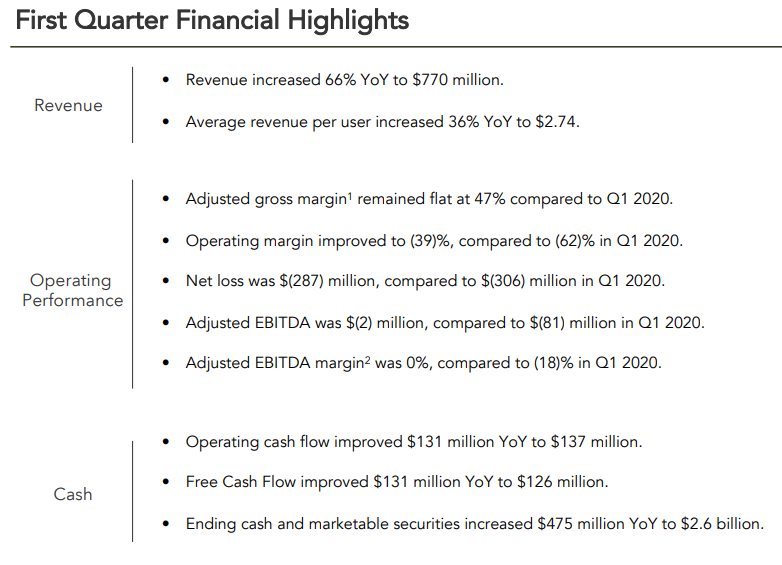

The stock price jumped a further 7.5% in Friday’s session, after the company reported accelerating revenue growth and strong user numbers during the first quarter.

Q2 2021 Outlook

Revenue is estimated to be between $820 million and $840 million, compared to $454 million in Q2 2020.

Adjusted EBITDA is estimated to be between $(20) million and break-even, compared to $(96) million in Q2 2020.