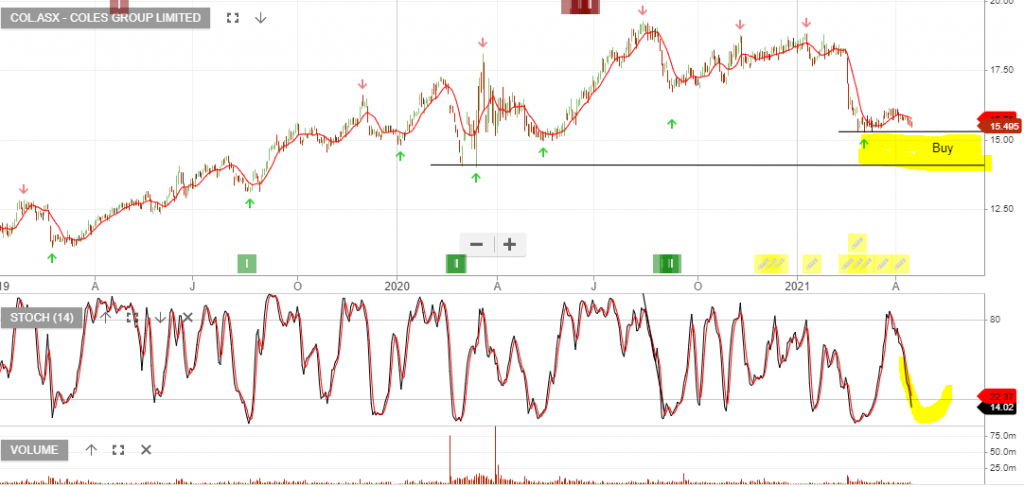

Coles – Buy

Coles Group is under Algo Engine buy conditions.

Investors should watch the short-term momentum indicators for a turn higher within the highlighted range.

Coles Group is under Algo Engine buy conditions.

Investors should watch the short-term momentum indicators for a turn higher within the highlighted range.

CSL:ASX is under Algo Engine buy conditions.

1H21 NPAT of US$1.8bn. FY21 guidance retained at US$2.2bn, which implies a weaker 2H21. We expect to see earnings upgraded prior to the completion of the 2H.

CSL trades on a forward yield of 1%.

Amcor is under Algo Engine buy conditions. We expect buying support to hold above $15.00.

Investors may consider selling out-of-the-money call options to enhance the income.

TCL:ASX is under Algo Engine buy conditions and has now rallied over 10% from our highlighted entry level.

We continue to see TCL as an attractive opportunity within the infrastructure space.

TCL goes ex-div $0.165 on 29 June.

CURE:AXW is under Algo Engine buy conditions and the current pullback provides another buying opportunity.

ETFS S&P Biotech ETF (ASX Code: CURE) offers investors exposure to U.S. biotechnology companies. These companies are engaged in research, development, manufacturing and/or marketing of products based on genetic analysis and genetic engineering.

.

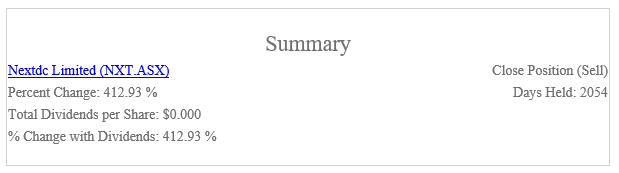

Our Algo Model has now closed out one of the best performing investments. After holding Nextdc for 2054 days, the realised gain was 412.93%.

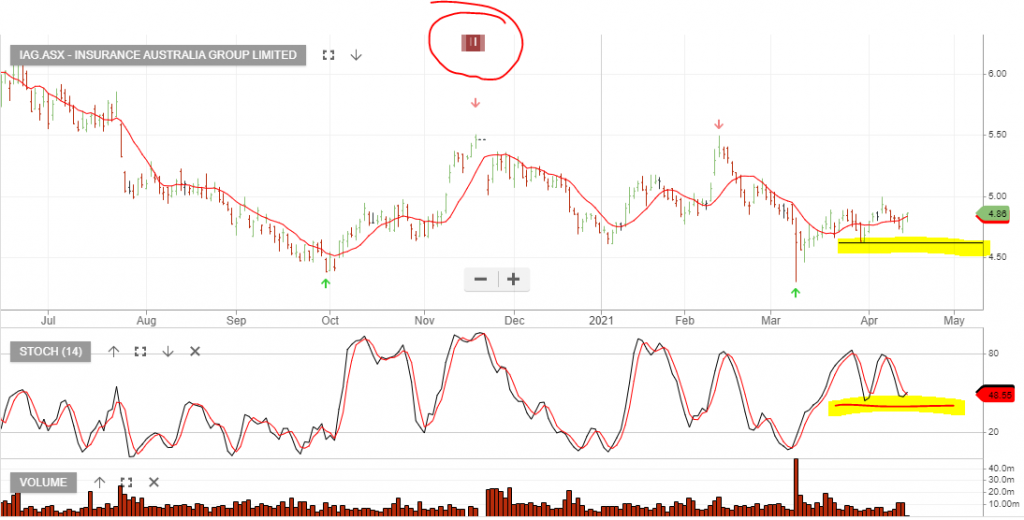

We add IAG to our “high risk” recovery basket, which also includes CIM & A2M.

We expect IAG to see improved earnings into FY22 & FY23. It’s likely we’re nearing the inflection point, where investors begin pricing in the anticipated recovery.

Buy IAG with stops below $4.60

Ampol has reported its financials for the 12 months ending 31 December 2020, with full year earnings of $401 million. Earnings were down from $607 million in the year prior.

1Q21 EBIT was A$150mn, but included an A$18mn FX gain.

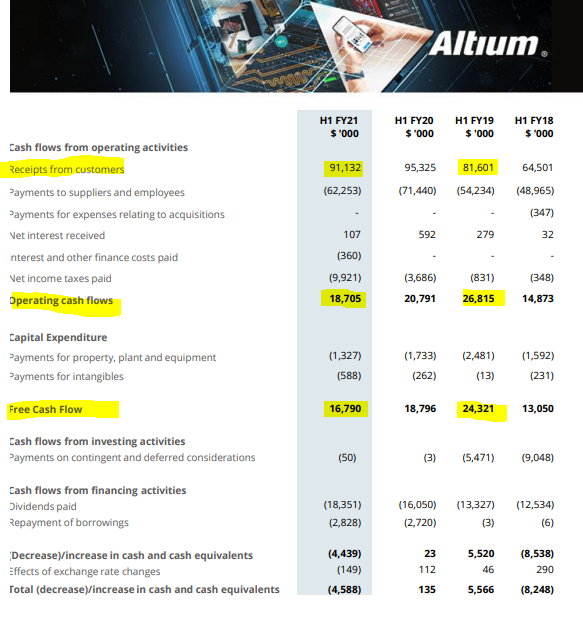

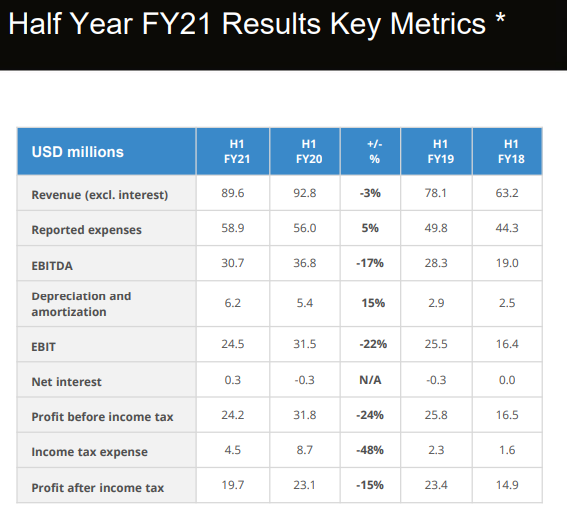

ALU:ASX is under Algo Engine buy conditions and has now rallied 20% from the recent low. Our interest in the business has increased and the stock is now under review.

RSG:ASX is under Algo Engine buy conditions and is a high-risk recovery opportunity.

RSG enters our radar, supported by a positive back drop for gold prices and the recent announcement that the Mali mine is now projected to produce between 250,000 to 300,000 ounces of gold.

15/4/21

Since writing the above post RSG has rallied 30%. The company has announced that Bibiani’s mining license has been restored.

Deleveraging of RSG’s balance sheet remains a priority and will be reliant on operational cash flows to achieve this.

RSG is a high risk gold play, whereas NST and GOR offer less balance sheet risk.