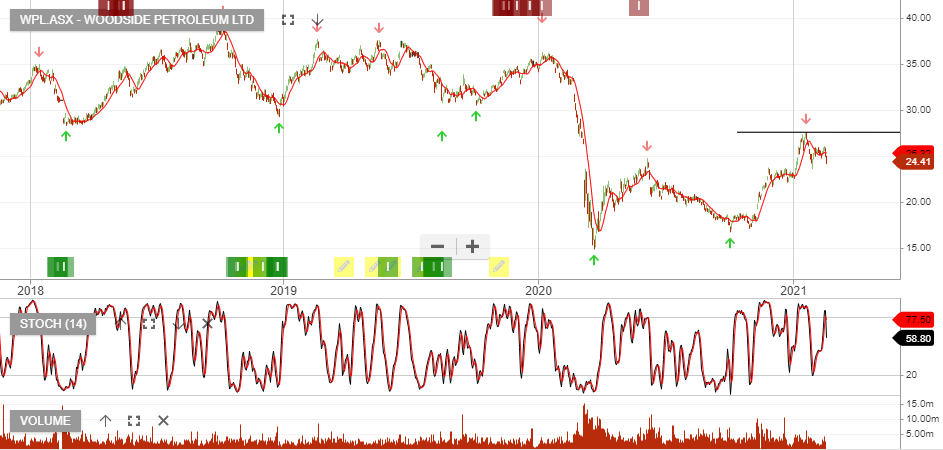

Woodside Petroleum

WPL:ASX remains under Algo Engine sell conditions, although we anticipate a switch to buying conditions in the months ahead.

Woodside reported sales revenue of US$3.6 billion, 26% below the prior year. Underlying NPAT (excluding impairments) of US$447.