Newcrest – Algo Buy

NCM is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

We see price support developing near the $25 – $26 level.

NCM is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

We see price support developing near the $25 – $26 level.

Northern Star Resources is under Algo Engine buy conditions and should be well supported by the cost-out story following the merger with Saracen.

NST announced 1HFY21 earnings with NPAT ahead of analysts forecasts.

$0.095 interim dividend.

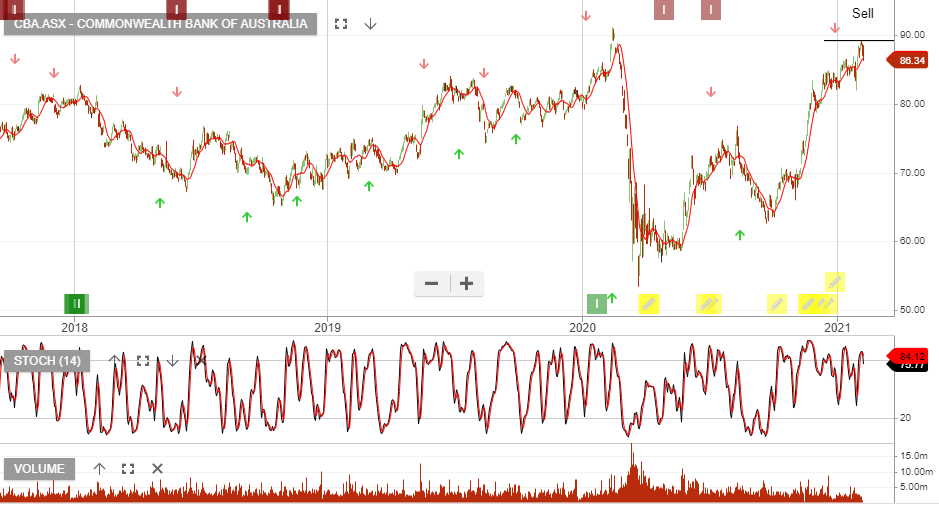

Commonwealth Bank of posted a 21% fall in half-year net profit to $4.88bn in the six months through December from $6.16bn a year earlier. Cash earnings fell 11% to $3.89bn.

An interim dividend of A$1.50 a share, down 25% on year.

We remain cautious on the local banks following the strong run-up in share values.

Computershare is under Algo Engine buy conditions and we’re somewhat pleased to see the 1H21 earnings down less than originally forecast.

A fall of 8% on the same time last year is still hardly inspiring and we, therefore, remain concerned about the lack of growth drivers for the business.

CPU remains under review.

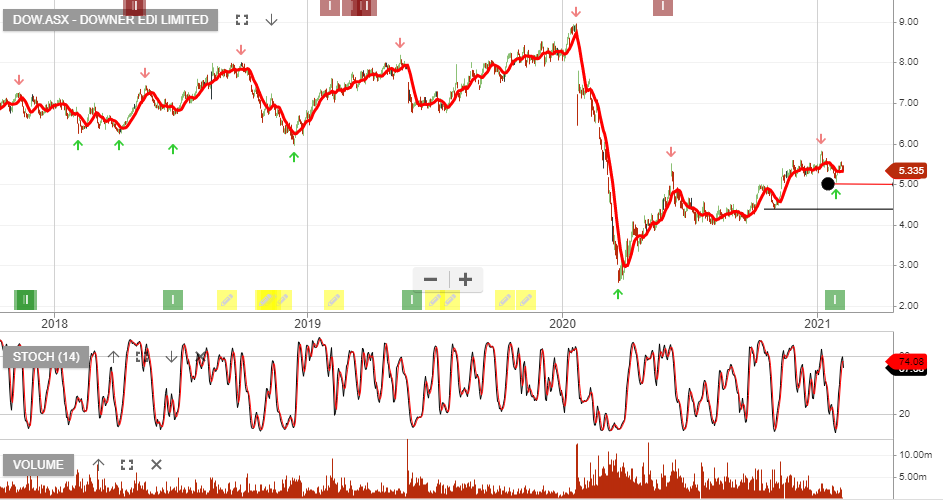

Downer EDI is now under Algo Engine buy conditions, following the entry signal at $5.15. The stock is now included in our ASX 100 model portfolio.

The company is making progress on its urban growth strategy and the divestments within the mining services sector are helping to sure up the balance sheet and de-risk the business outlook.

We see scope for double digit EPS growth into FY22 & FY23.

,

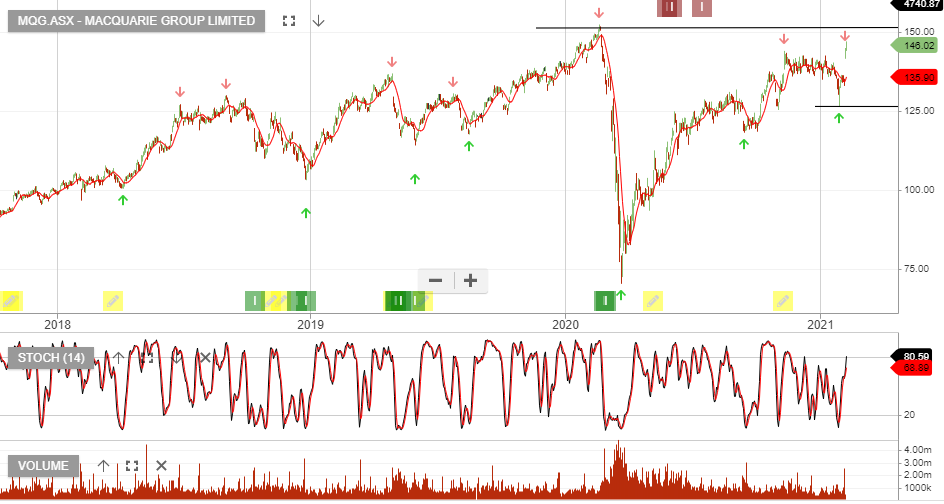

Macquarie Group are now guiding for FY21 to be slightly down on FY20. We take this to mean down 3 – 8% and note this is an improvement on the current consensus for FY21 NPAT to be down 23%.

MQG’s surplus capital position has increased to $8.1bn from 6.2bn.

Boral is under Algo Engine sell conditions.

Boral delivered EBITDA of $486 million in 1H21, down 1% vs the same time last year.

Better results in North America were offset by weaker performance in Australia. Net debt was reduced and no interim dividend.

The company did not provide guidance on earnings but did note improving housing demand in North America, offset by softer demand in Australia.

News is under Algo Engine sell conditions, however, we expect to see a switch in 2021 to buy conditions and will remain on watch for the buy signal alert.

2Q21 EBITDA came in well ahead of expectations with News Corp reporting 2Q21 EBITDA of $497m, up 40% on the same time last year.

Newscorp trades on 1% forward dividend yield.

Suncorp Group is under Algo Engine sell conditions.

1H21 earnings of $509m is well ahead of market consensus. We remain concerned with the risks of rising bad debts and a re-emergence in working claims headwinds.

Earnings were largely in line with market consensus, although revenue was better than expected. Guidance has been upgraded.

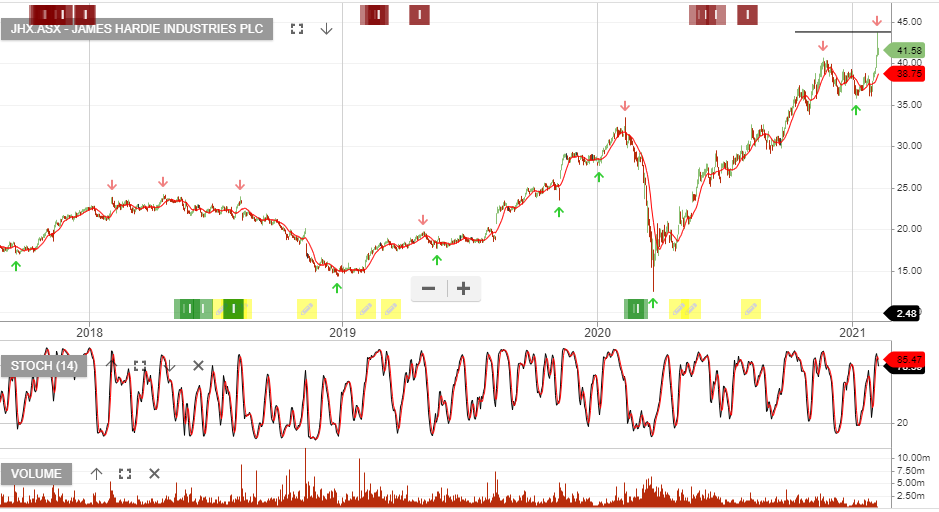

James Hardie’s 3Q21 NPAT of $123.3m was up 60% on the same time last year. FY21 NPAT guidance was upgraded from $380-420m to $440-450m.

JHX now trades on a forward yield of 1.8%. US70c special dividend was also announced.

We look for a switch to Algo Engine buy conditions in 2021.

Or start a free thirty day trial for our full service, which includes our ASX Research.