Orica – Weak 1H21

ORI:ASX flagged a weak 1H21 due to COVID, along with China’s ban on Australian thermal coal imports and FX headwinds impacting the 1H21 result.

The next update will be at its 1H21 result on 13 May.

ORI:ASX flagged a weak 1H21 due to COVID, along with China’s ban on Australian thermal coal imports and FX headwinds impacting the 1H21 result.

The next update will be at its 1H21 result on 13 May.

SHL:ASX is under Algo Engine buy conditions and is a current holding in our ASX model portfolio.

If we strip out the jump in FY21 profits from COVID testing and look at what FY22 and FY23 normalized business conditions look like, we still get to a valuation that supports the current share price.

FY22 revenue is likely to be around $7.6bn on EBITDA of $1.7bn. EPS will be 30 – 40% up on FY20, which will support a forward yield of 3.5%.

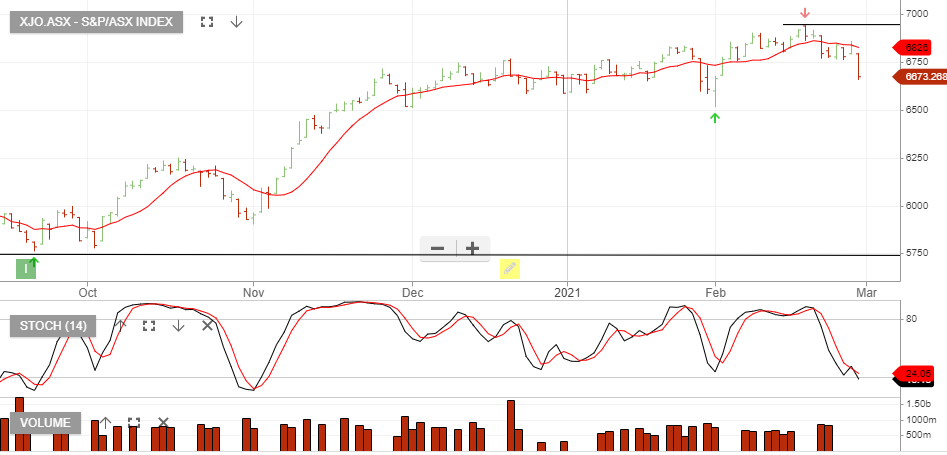

The XJO index has hit resistance at 6940 points and is now trading below the 10 day average.

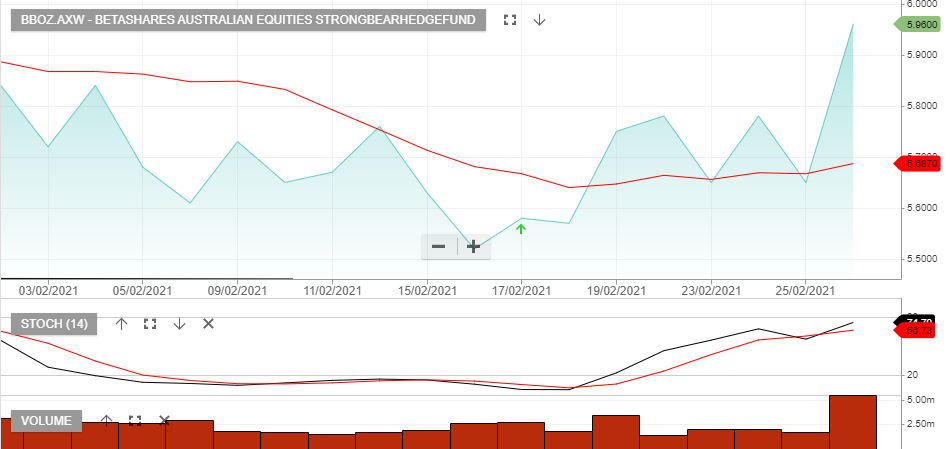

BBOZ provides an opportunity to profit from a downside move in the index, should selling momentum continue.

We’ll cover more on this during Monday night’s webinar. To create a free trial to our research service please visit the following link and join us for the next four weeks free of charge. https://www.investorsignals.com/research/

Chart XJO

Chart BBOZ

Coles Group is under Algo Engine buy conditions.

Monitor Coles for a swing higher in the short-term momentum indicators within the $14.50 to $15.50 price range.

Goodman is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

We expect 10% EPS growth into FY22 and the 2% plus dividend yield remains well supported.

Watch the short-term indicators for a turn higher between $15.50- & $16.50

{ASX:CWY) is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

We see price support between $2.00 and $2.20. Watch the short-term indicators for a turn higher, within this support range.

Coles Group is under Algo Engine buy conditions.

Monitor Coles for a swing higher in the short-term momentum indicators within the price zone displayed below.

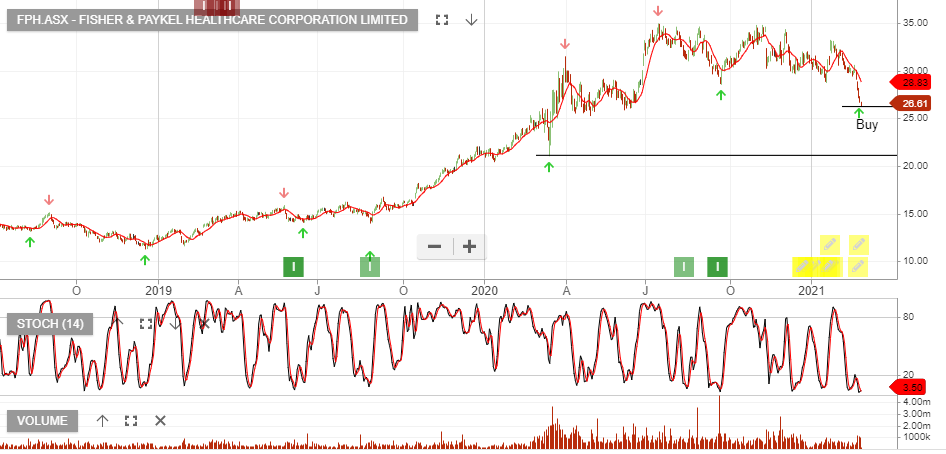

Fisher & Paykel Healthcare Corporation is under Algo Engine buy conditions and is now within our highlighted range.

Watch the short-term momentum indicators for a turn higher.

Northern Star Resources is under Algo Engine buy conditions.

SLF:AXW is under Algo Engine buy conditions and is a current holding in our ASX ETF model portfolio.

SLF, LLC and GMG are our preferred property exposures.