Brambles – Buy

Brambles is now approaching oversold levels and we suggest accumulating the stock as the short-term indicators turn higher.

Brambles is now approaching oversold levels and we suggest accumulating the stock as the short-term indicators turn higher.

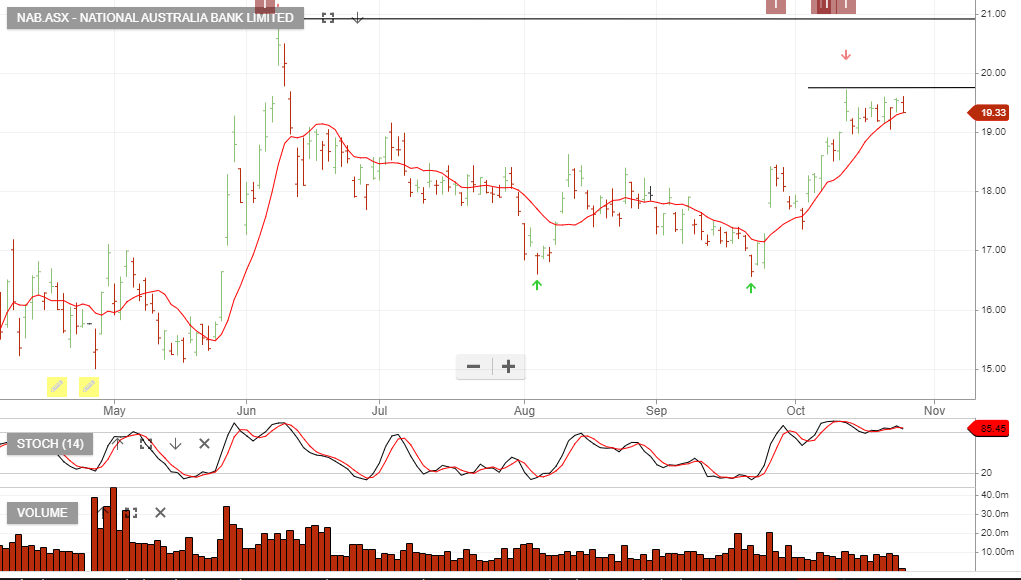

National Australia Bank is under Algo Engine sell conditions and we expect selling pressure to build at the $19.50 resistance level.

Bega Cheese has continued to see buying interest above the $5.00 support level.

Qube Holdings is under Algo Engine buy conditions and has now been added to our ASX model portfolio.

We see price support developing near the $2.50 price range. Watch the short-term momentum indicator for a turn higher.

We generally don’t buy stocks that are under Algo Engine sell conditions but occassionaly, oversold opportunities make it onto our radar.

AGL looks like it’s approaching oversold levels and investors should watch for a close above the 10-day average and a turn higher in the short-term indicators.

Coles supermarkets delivered comparable sales growth of 9.7% in the September quarter. Liquor sales across the Coles network rose 17.8%.

We suggest buying Coles and selling out of the money call options to enhance the income return.

For more detail on the strategy, please call our office on 1300 614 002.

Ramsay Health Care is under Algo Engine buy conditions and is a current holding in our model portfolio.

Valuation support within the $61 – $63 range.

Bega Cheese has continued to see buying interest above the $5.00 support level.

The chart below shows the range where we will be watching for the short-term momentum indicators to turn higher.

Brambles is now approaching the $10 support level and we suggest accumulating the stock within the $10 – $10.50 price range.

Or start a free thirty day trial for our full service, which includes our ASX Research.