Ramsay Healthcare – Buy

Ramsay Health Care is under Algo Engine buy conditions and is a current holding in our model portfolio.

Valuation support within the $61 – $65 range.

Ramsay Health Care is under Algo Engine buy conditions and is a current holding in our model portfolio.

Valuation support within the $61 – $65 range.

APA is under Algo Engine buy conditions and we see support building at the recent $10.50 higher low formation.

APA goes ex-div 23c on 30 December.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Vanguard Global Infrastructure Index is in our “high conviction” portfolio and has now rallied from the $52 support level.

We see continued upside for the fund, which offers investors diversified exposure to infrastructure sectors, including transportation, energy and telecommunications.

Since writing the above post, Vanguard Global Infrastructure Index has rallied 10%.

Further upside is likely over the next 12 months and we see scope for another 10 to 20% increase from the current level.

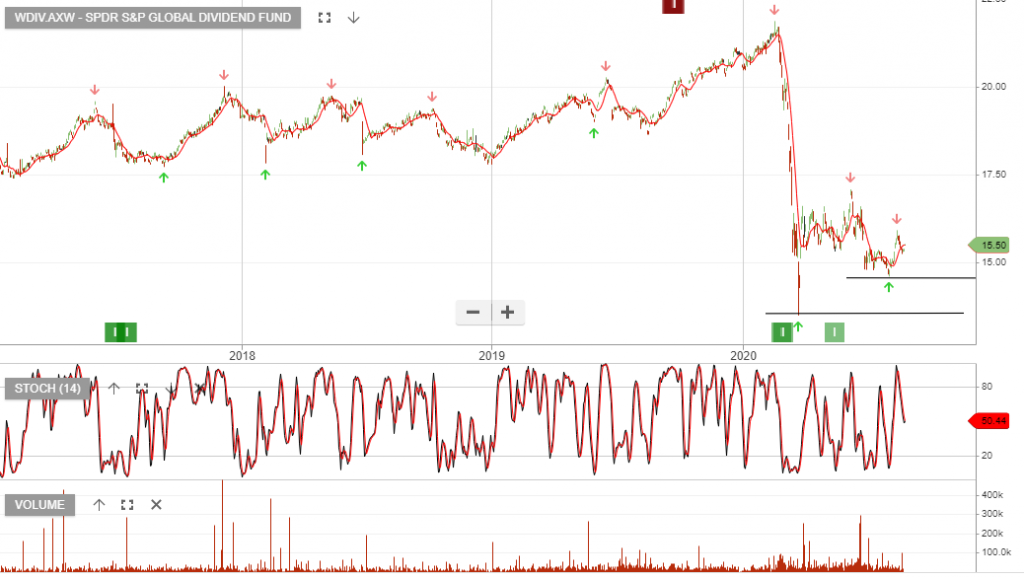

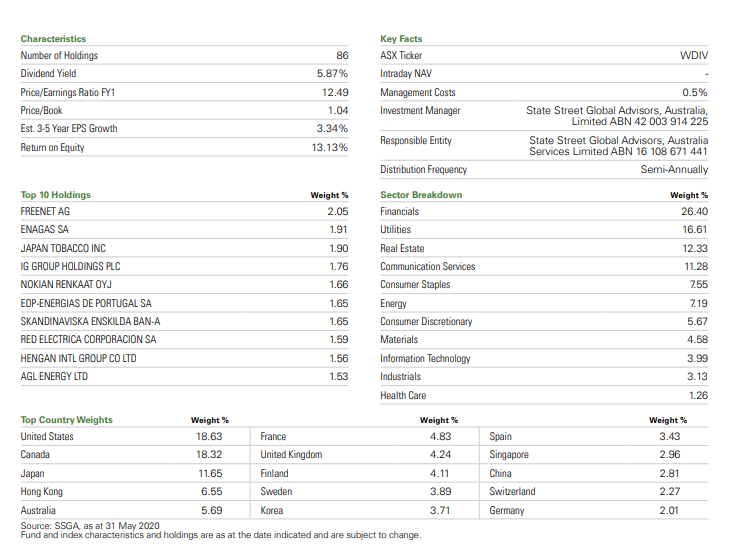

SPDR S&P GLOBAL DIVIDEND is a holding in our “ASX All ETF” model portfolio.

We see value at the current $15.50 price range.

The S&P Global Dividend Aristocrats is designed to measure the performance of high dividend yielding companies within the

S&P Global Broad Market Index (BMI) that have followed a policy of increasing or stable dividends for at least 10 consecutive years.

Buying momentum continues to build in the SPDR S&P Global Dividend with the price now $16.00

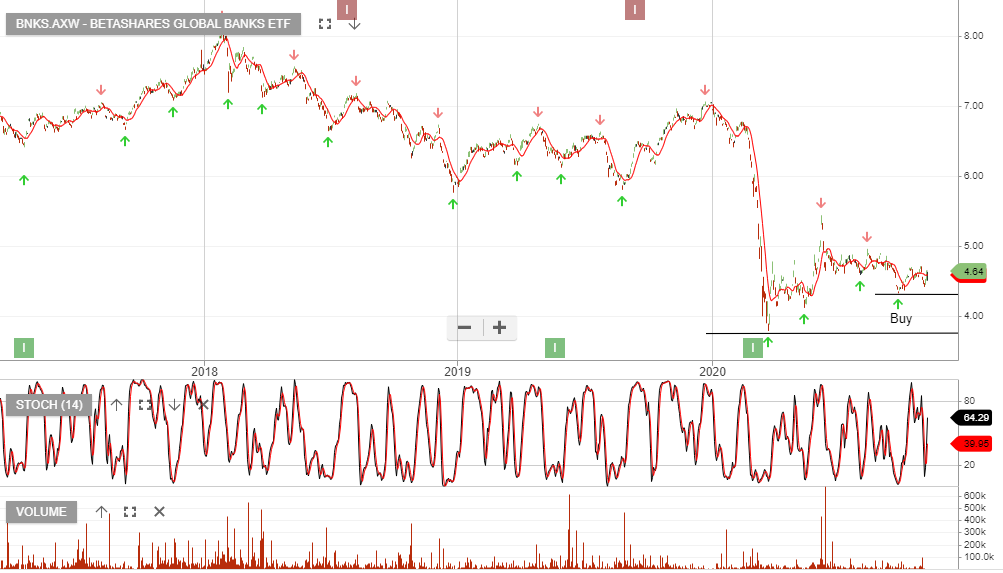

BetaShares Global Banks is our preferred bank exposure. Taking a global perspective and holding an overweight allocation to JP Morgan provides a low-risk profile and potentially greater upside.

Since writing the above post the BNKS ETF has rallied 20%

Vaneck Vectors Gold Miners is under Algo Engine buy conditions.

GDX provides broad exposure to the leading global gold producers. After the recent sell-off from $65 down to $50, we expect to see buying support begin to rebuild.

Gold Road Resources is under Algo Engine buy conditions and we expect buying interest to rebuild.

Regis Resources is outside the sphere of stocks we normally concentrate on, however, it’s under Algo Engine buy conditions and the technical set up looks encouraging.

Regis Resources is a purely Australian gold miner with operations at the Duketon Gold Project in the North Eastern Goldfields of Western Australia and the McPhillamys Gold Project in the Central Western region of New South Wales.

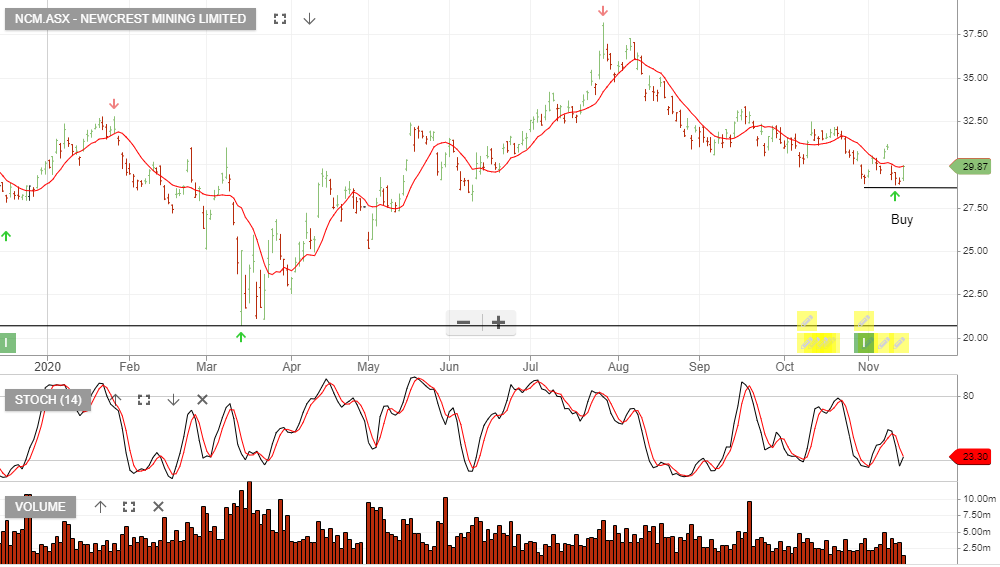

Newcrest Mining remains under Algo Engine buy conditions. We suggest investors accumulate NCM near the $29 support level.