Watch Last Night’s Webinar

If you missed our webinar last night, then catch up by watching it here.

If you missed our webinar last night, then catch up by watching it here.

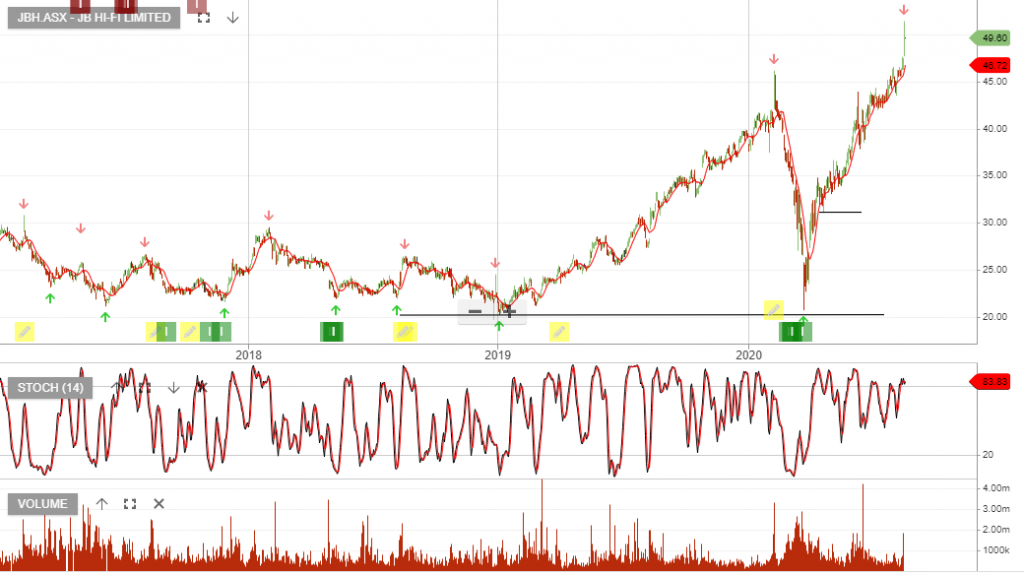

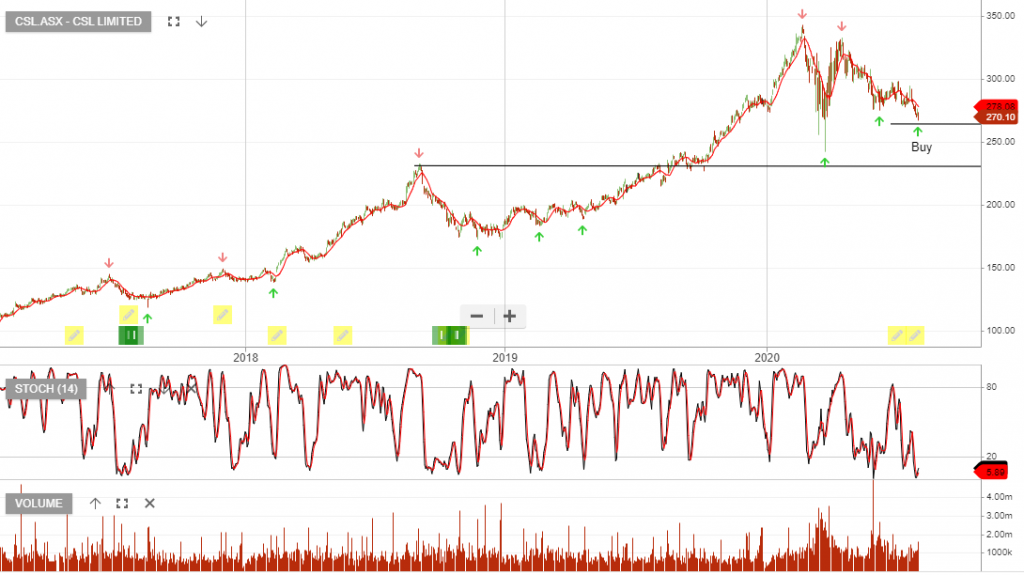

JB Hi-Fi is among the best-performing stocks within our ASX 100 model portfolio. The stock was added back on the 3rd of November 2017 after switching to Algo Engine buy conditions.

JB Hi-Fi delivered FY20 underlying NPAT of $332mn above the top end of the guidance range of $325 to $330 million.

The 2H20 dividend of $0.90 was above consensus. Overall, the result was ahead of expectations, however, near-term risks to discretionary spending are high.

Altium creates software to help people design circuit boards for electronic devices. Altium has aspirational targets of $US500 million in annual revenue and 100,000 subscribers by 2025.

FY20 EBITDA was better than consensus with FY20 revenue of $189m, + 10% on the same time last year, EBITDA $72m. The company generated record subscriber growth, surpassing its 50,000 subscriber goal.

Full-year unfranked dividend increased to $0.19 and earnings before interest and tax climbed 13% to $US64m for the year ended June 30.

A highlight for the company in the last 12 months was the launch of its cloud-based electronic design subscription platform Altium 365. For 2021, the company forecast revenue growth to be in the range of $200 – $212mn or an increase of 10%.

Lendlease LLC reported FY20 NPAT of -$310m. The sale of the engineering business unit to Acciona is expected to complete soon with a sale of $160m, lower than the original $180m announced.

Lendlease is facing subdued trading conditions as the company navigates the effects of COVID-19, with development, investment, and construction income all down over 50% for the June period.

Despite short-term uncertainty, the long-term value remains attractive and the company’s strong balance sheet should provide it with resilience.

Ampol has announced the separation of a REIT which will contain 203 freehold convenience retail sites, with Charter Hall and Singapore’s GIC acquiring a 49% stake for $682 million and Ampol retaining 51%.

The transaction values the property trust at $1.4 billion.

Ampol will receive net proceeds of $612 million and use them to pay down debt.

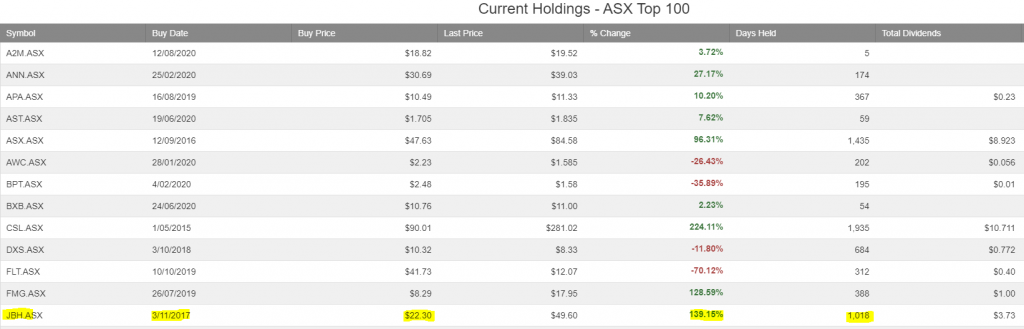

Spark Infrastructure is now under Algo Engine buy conditions.

Our next webinar begins tonight at 7pm, NSW time. Please register to be sent the webinar link.

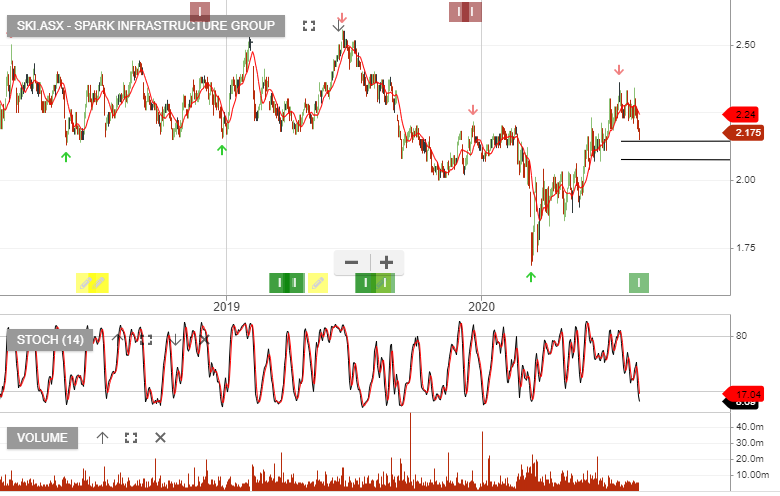

CSL is under Algo Engine buy conditions and remains one of the best-performing stocks in our ASX model portfolios.

The technical indicators show the recent higher low formation with support at $270.

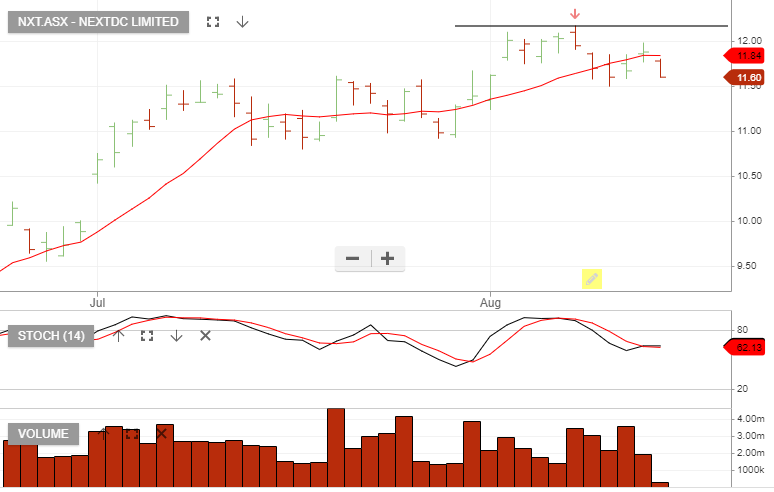

Nextdc is likely to come under increasing pressure as claims of accounting irregularities place pressure on the Board of Directors.

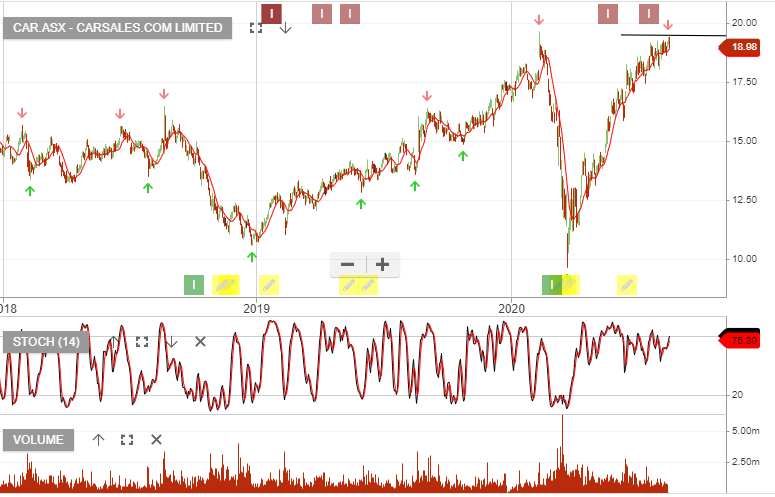

Carsales.Com is now under Algo Engine sell conditions which reflects the short-term overbought conditions.

Or start a free thirty day trial for our full service, which includes our ASX Research.