Bega Cheese

Bega Cheese remains under Algo Engine buy conditions and we highlight the recent higher low formed at $4.40.

The stock price continues to trade higher heading into the 2H20 earnings result.

Bega Cheese remains under Algo Engine buy conditions and we highlight the recent higher low formed at $4.40.

The stock price continues to trade higher heading into the 2H20 earnings result.

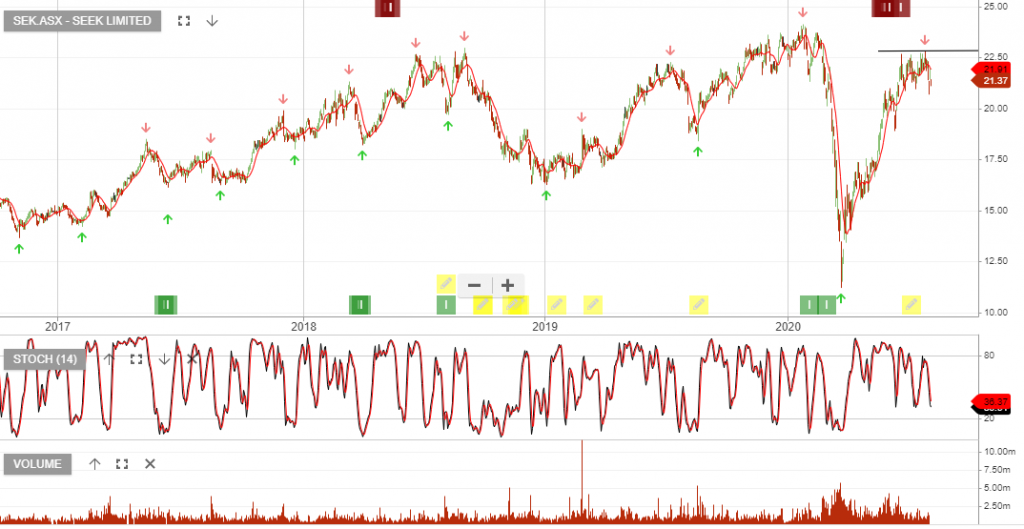

Seek is under Algo Engine sell conditions and we remain on the short-side of the trade.

Two negatives we focus on:-

1}Surprise need to raise money in the bond market; and

2} Announcing they were dumping the final dividend in a bid to preserve capital, blaming the “uncertain environment” for the decision.

The above post was from Monday. Following today’s earnings release, Seek is down 13%. Seek has been a high conviction “short” trade expressed on our blog and in our Monday night webinar.

We suggest covering the short and taking profit.

Did you miss last night’s webinar? Catch up by watching it here.

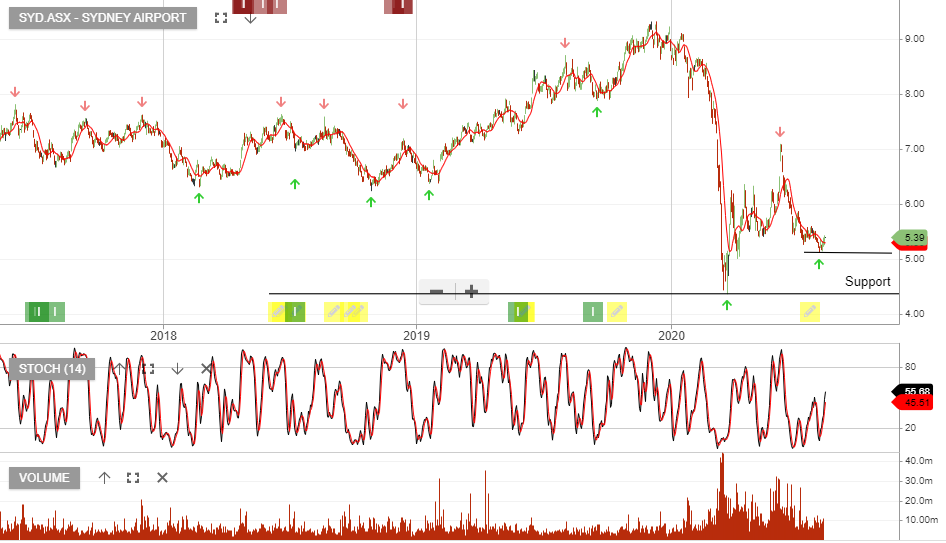

Sydney will raise up to $2bn through a renounceable one-for-5.15 rights issue at $4.56 a share, which is a 15% discount to the last close and underwritten by UBS.

SYD reported a half-year loss of $53.6 million, with no interim dividend declared. Revenue down 36% to $511m and EBITDA down 35% to $300m.

China’s iron ore imports reached a record high in July of 110m/t, up 24% on the same time last year.

James Hardie Industries FY21 profit guidance now stands at $US330m-$US390m. June quarter earnings were flat on the same time last year.

Aurizon Holdings FY20 earnings beat expectations with EBIT of $910m, this was within the mid point of FY20 guidance of $880-930m.

FY21 EBIT guidance was 6% lower than consensus. Forward yield remains attractive at 5.%. Little in the way of EPS growth and a 100% dividend payout ratio provides a cap to the upside.

AZJ has initiated a new $300m on-market buyback which will help underpin the stock price. This is a good candidate for an at-the-money buy-write to drive portfolio cash flow.

FY20 EBITDA of $492m was 5% below the same time last year. 36 x FY22 earnings looks expensive.

Good news is priced in and risks are now skewed to the downside. We add REA to our short sell list. Forward dividend yield 1%.

To participate in tonight’s webinar, please register here.

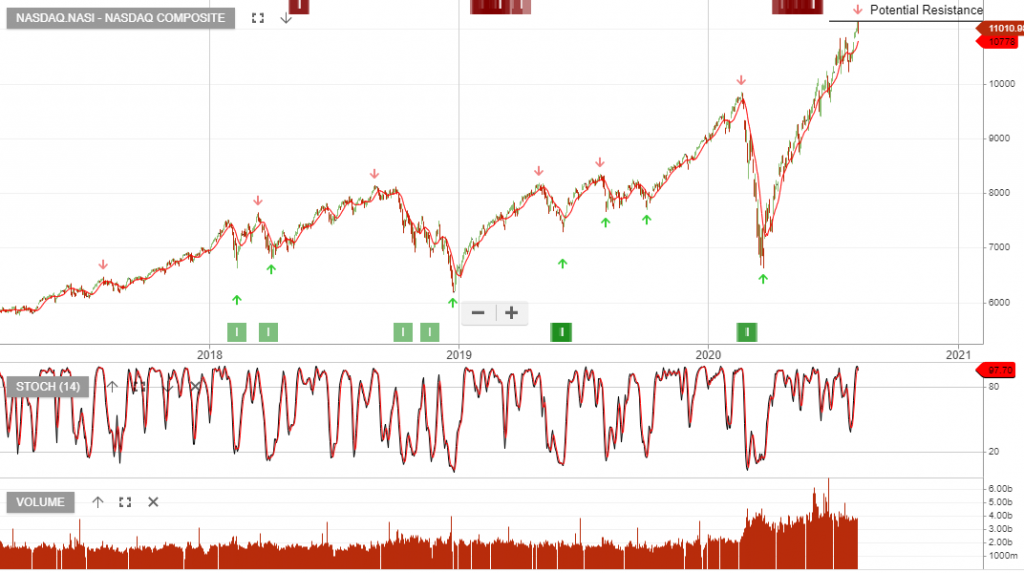

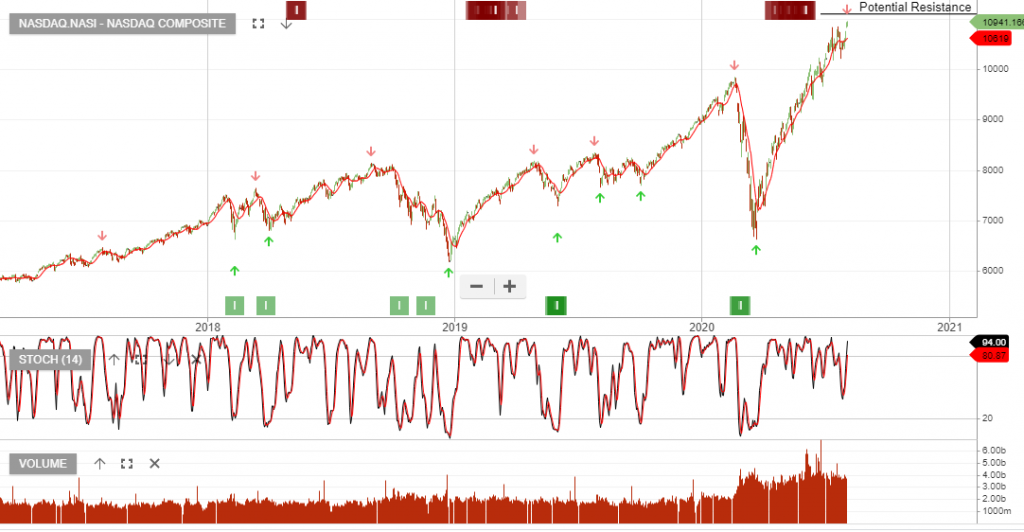

S&P500 revenue is down 10% in Q2 and profits are down 30%.

Is this next part true?

U.S. earnings recovery may be faster than in previous crises

U.S. companies’ profit growth forecasts for the next five years are still intact, according to Refinitiv data, suggesting that the impact inflicted on companies by the coronavirus pandemic is likely to be more fleeting than that in previous crises.

Or, do S&P500 earnings fall from average EPS $165 p/a, (2018 & 2019 numbers), to the new normal of $130 and stay there, placing stocks on an unsustainable forward PE ratio?

Join tonight’s webinar and we’ll share our analysis on the above questions and look at what stocks we’re buying and selling in the current market.

Q2 earnings for the S&P 500 are expected to decline by 44%, the worst drop since the fourth quarter of 2008, when profits fell 67%.

This week we’re watching the following results.

Monday Marriott International

Tuesday

Wednesday Cisco

Thursday Bristol-Myers.

Friday Applied Materials

NASDAQ remains above the 10-day average.

Or start a free thirty day trial for our full service, which includes our ASX Research.