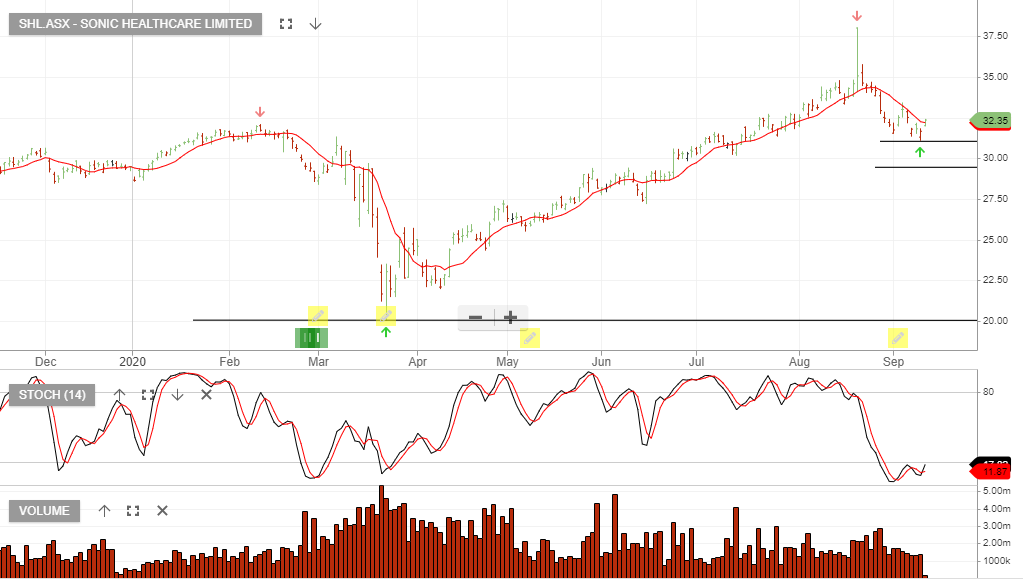

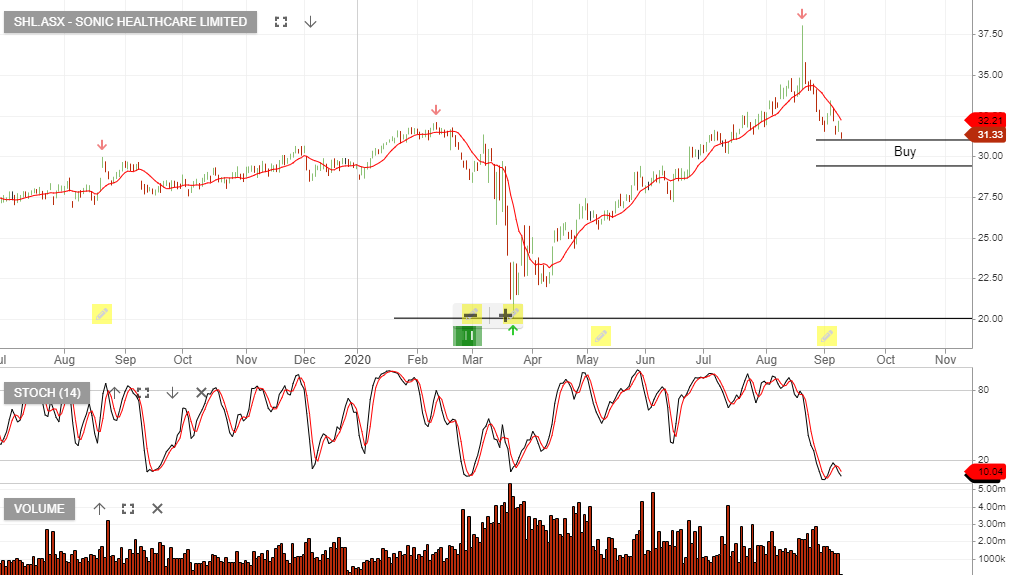

Sonic Healthcare – Update

We’ve now sold the $32.50 October calls for $1.00 credit.

We’ve now sold the $32.50 October calls for $1.00 credit.

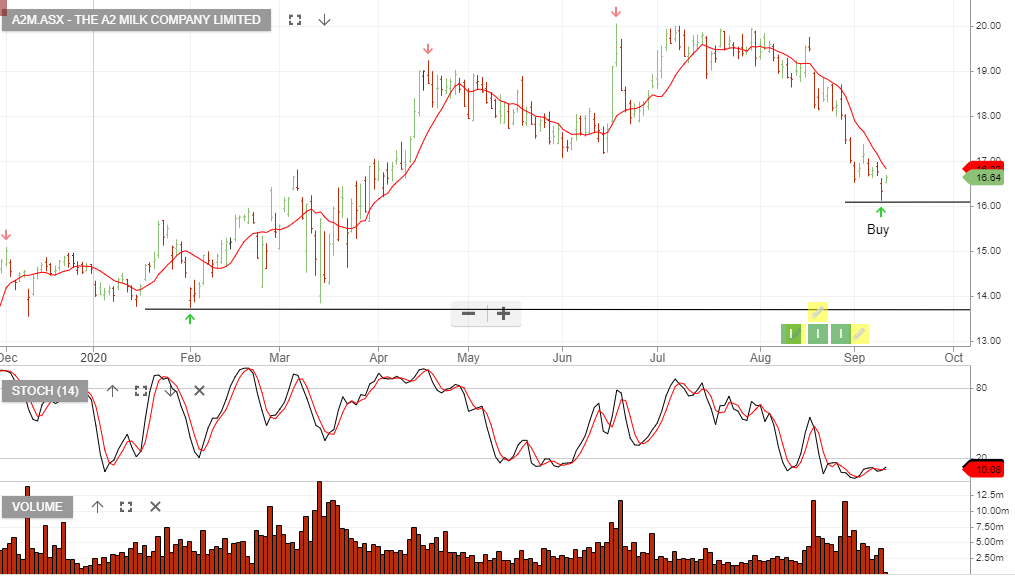

We’ve now sold the $17.50 October call options for $0.28.

APA is likely to find increased buying support between the $9.50 and $10.25, supported by 4.5% dividend yield and single-digit earnings growth.

About APA – Our 7,500-kilometre East Coast Grid of interconnected gas transmission pipelines provides the flexibility to move gas around eastern Australia, anywhere from Otway and Longford in the south, to Moomba in the west and Mount Isa and Gladstone in the north. In Western Australia and the Northern Territory, our pipelines stretch thousands of kilometres to supply gas to power major cities, towns and remote mining operations.

Apart from our interconnected natural gas pipelines, we own and operate the Ethane Pipeline which supplies ethane from the Cooper Basin production facility at Moomba, South Australia, to an ethylene plant in Botany, Sydney.

And it’s not just pipelines. We also own and operate the Mondarra Gas Storage and Processing Facility and the Emu Downs Wind Farm in Western Australia, Diamantina and Leichhardt Power Stations in Queensland, the Dandenong LNG Storage Facility in Victoria and the Central Ranges Gas Distribution Network servicing Tamworth in New South Wales.

Vaneck Vectors Gold Miners is under Algo Engine buy conditions.

GDX provides broad exposure to the leading global gold producers.

Gold Road Resources is under Algo Engine buy conditions and along with NCM is our preferred gold exposure.

The company provided financial statements for the 6 month period ending June 30, which displayed revenue $135mn, EBIT, $36mn and EPS of $0.026.

Key points include:

Gold Road repaid all debt whilst retaining the undrawn facility of A$100M (US$71M). Net cash and equivalents of A$84M (US$60M) at 30 June 2020.

71,865 ounces produced* at attributable AISC of A$1,233/oz (US$875/oz)2.

Quarterly free cash flow of A$23.8M (excl. unsold bullion

and dore).

The A2 Milk Company buy at market and apply a stop-loss on a break below $16.00.

Sonic Healthcare has found buying support at the top of our entry range. Adding a $32.50 October call option generates $0.95 of income.

Start accumulating Sonic Healthcare.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.