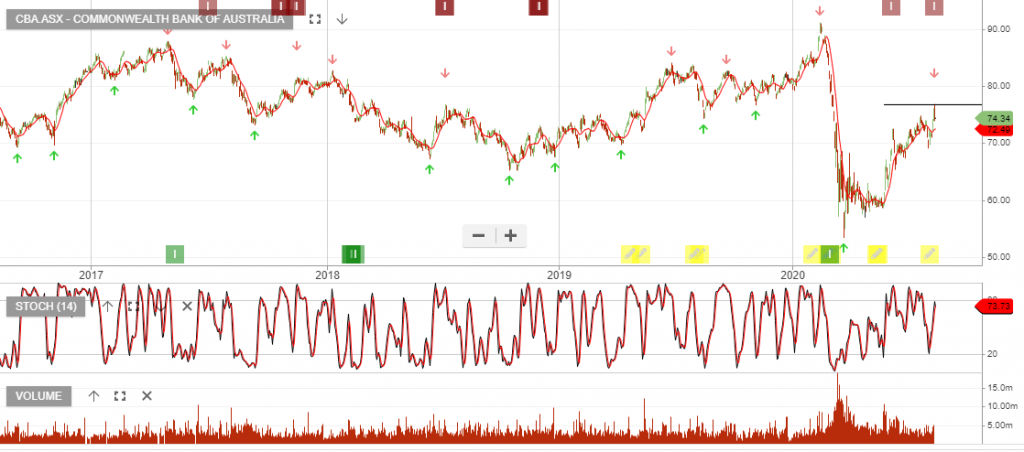

CBA – Valuation Review

Commonwealth Bank of remains under Algo Engine sell conditions and the only Australian Bank in our model is Westpac.

CBA trades almost 20x forward earnings which is a 30%+ premium to the other major banks.

Our deep value recovery play is the BNKS ETF which captures a broader global exposure.