Register for Tonight’s Webinar

Leon will once more host a live webinar, reviewing the opportunities in review.

To receive the live link, please register here.

The webinar will start at 7pm NSW time.

Leon will once more host a live webinar, reviewing the opportunities in review.

To receive the live link, please register here.

The webinar will start at 7pm NSW time.

Chinese gaming and social media group Tencent Holdings has bought a 5per cent stake in Afterpay Ltd. The stake was built from the end of March through April, a filing to the Australian Securities Exchange showed.

Origin and Santos are worth considering with a stop loss below the recent low.

James Hardie Industries is under Algo Engine buy conditions.

The share price has formed a higher low formation and rallied from the $17.50 support level.

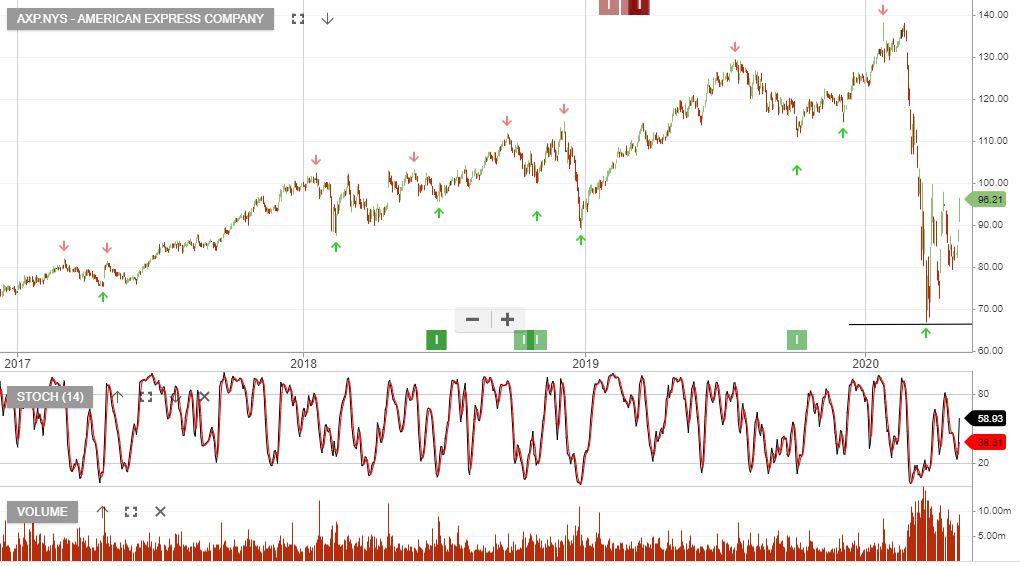

A strong performance from Amex and ConocoPhillips overnight, both names are current holdings in our US managed fund.

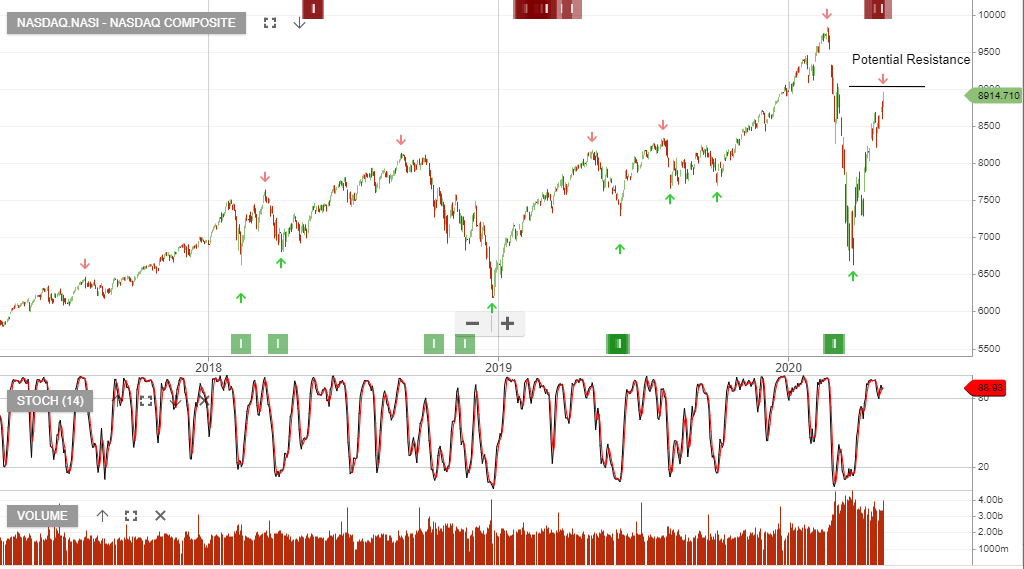

We continue to watch the NASDAQ for a break below the current uptrend, at which time we’ll increase index hedging.

Lendlease announced a raising of up to $1.15bn $9.80 per share.

The equity raising comprises a fully underwritten $950m institutional placement, along with up to $200m via a non-underwritten SPP. With the proceeds from the placement, liquidity will increase to $4bn and company gearing will fall to 10-15%, (assuming completion of the sale of the Engineering business).

A correction in commercial real estate will provide new opportunities for Lendlease but will also ensure a tough operating environment in the near-term.

Northern Star Resources March quarter production was weaker than market expectations. COVID-19 had an impact with reduced staffing slowing development and impacting mine schedules.

NST is confident the initial disruption to operations has passed and is expecting a stronger June.

We look to buy NST below $12.50

30U.S. corporations repurchased more than $5.1 trillion of their stock since 2010 according to S&P Global.

This share buyback activity happened nowhere else in the world anywhere even close to the scale that we have seen in the U.S.

With the S&P500 still trading at historically high valuations in face of economic weakness, corporate defaults & bankruptcies, discounted capital raisings, it’s likely the market requires a lower valuation range to consolidate within.

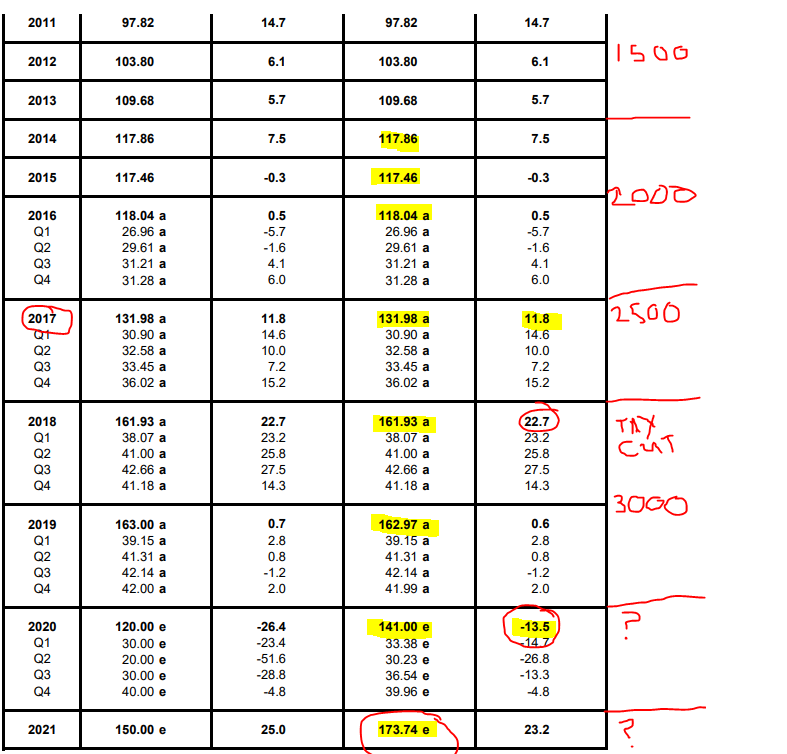

The table below helps link EPS ranges with where the S&P500 should be trading.

National Australia Bank 1H2020 profit falls by 51%.

The company also moved quickly to shore its balance sheet following the initial impact of COVID-19 related business provisions. NAB will raise $3.5bn via an institutional placement at $14.15 per share.

The placement will be done at a 10.5% discount.

Our bearish warnings on NAB are still yet to play out completely, as we see further raisings likely in the Sept quarter.