Bendigo Bank – Reports Earnings on Monday

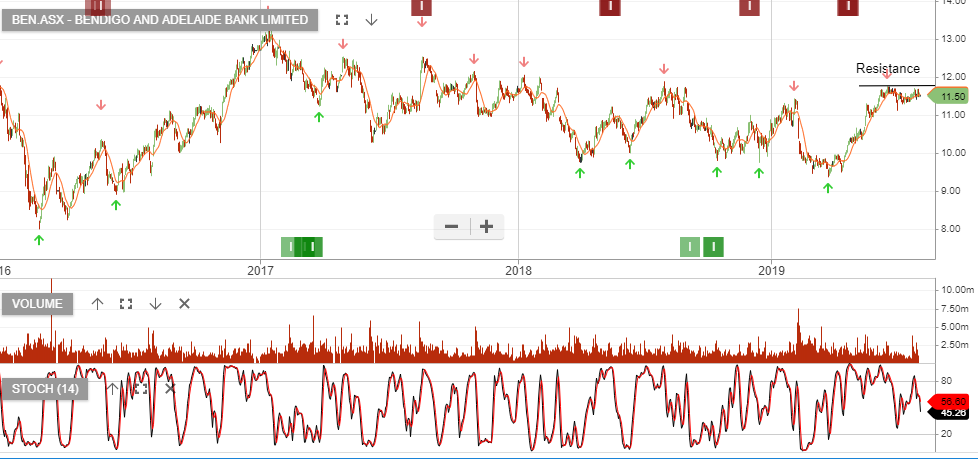

Bendigo and Adelaide Bank remains under Algo Engine sell conditions. The company reports their FY19 earnings on Monday 12th August and we expect a soft result, along with a cautious outlook.

Bendigo Bank and Computershare have been our two “high conviction” short trades. We’ve now covered Computershare but retain our short BEN positioning.