Woodside – Opportunity Approaches

Woodside Petroleum is a current holding in our ASX 100 model portfolio.

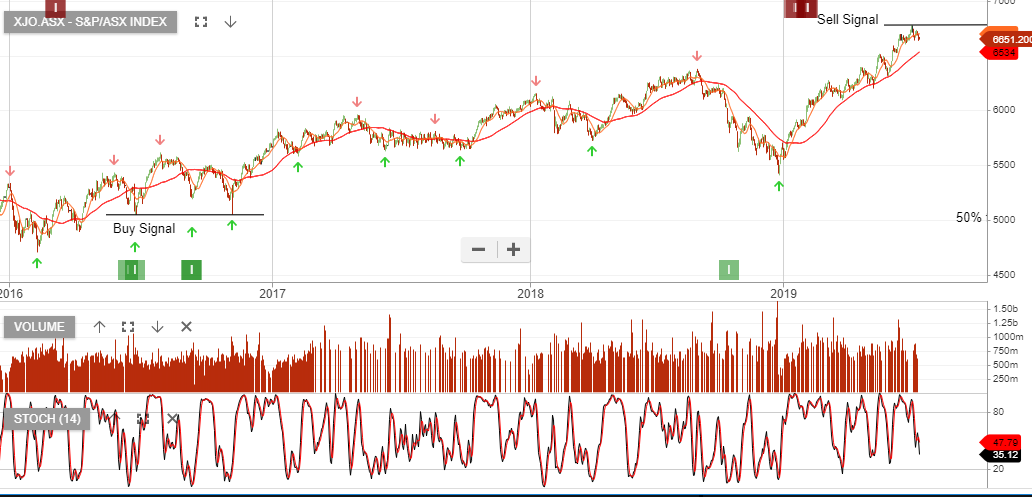

We see a new entry opportunity approaching in WPL and investors should watch the short- term indicators for a turn higher.

WPL has greater yield support versus STO and OSH.