OceanaGold – Algo Buy Signal

OceanaGold is under Algo Engine buy conditions and is seeing increased buying interest as the stock rallies from the $3.90 support level.

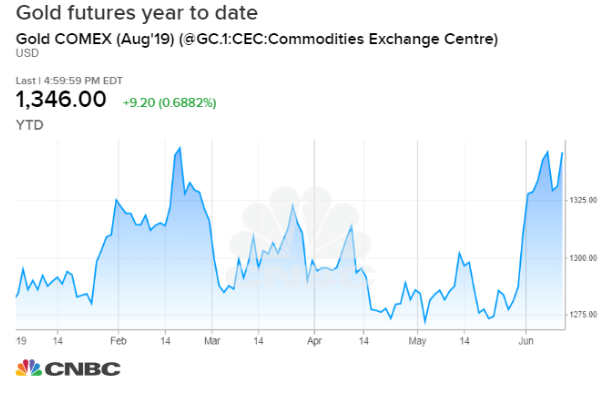

Gold prices hit a three-month high this month as investors flee to the safe-haven bullion amid escalated trade tensions and lower global interest rates. Additionally, if we see the US dollar weaken, gold will appreciate as it becomes cheaper for investors holding other currencies.

Buy OceanaGold and look for a rally to $4.50+