Oceana Gold – Review

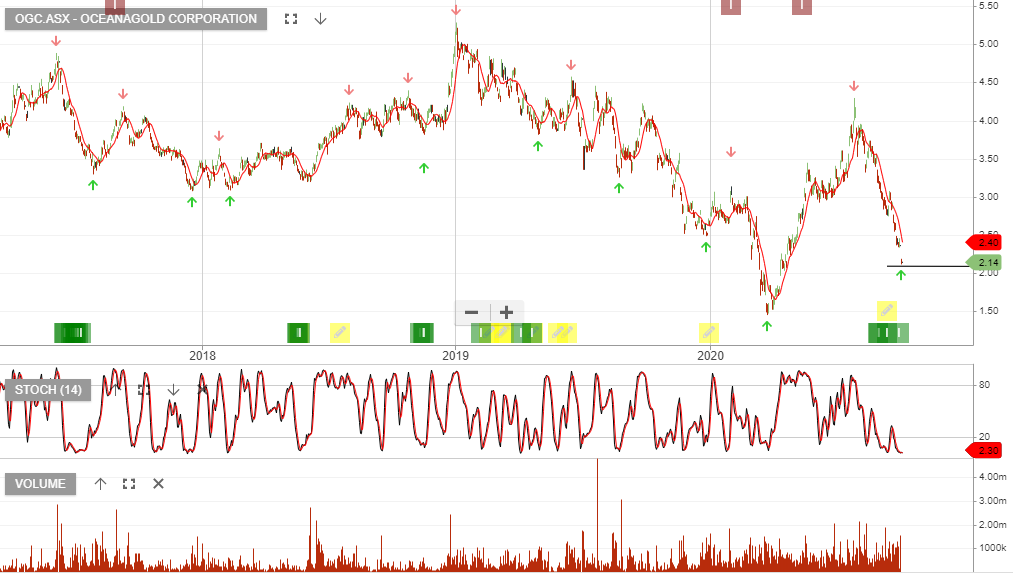

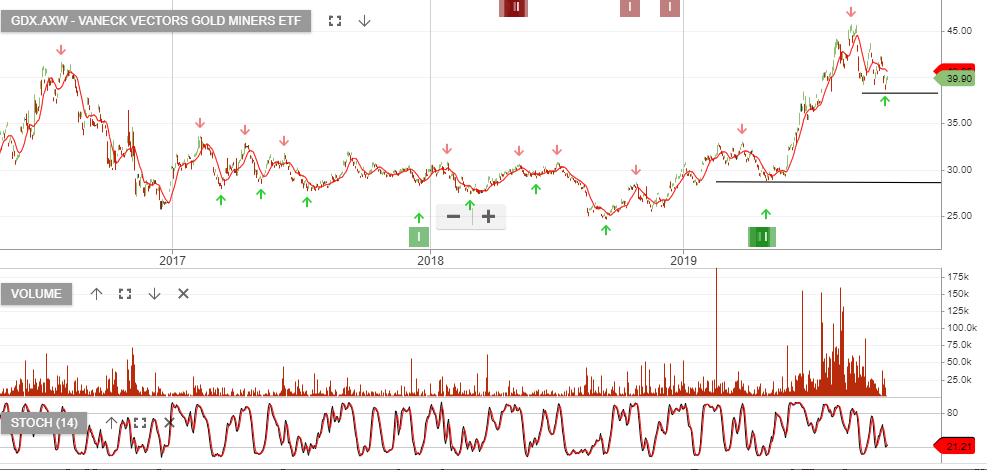

OceanaGold is under Algo Engine buy conditions.

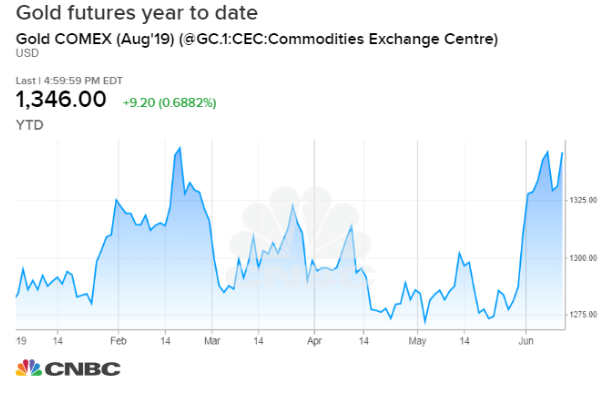

Newcrest and Gold Road remain our preferred allocations, although Oceana Gold offers among the best long-term production growth opportunities through the Haile, Waihi and Golden Point mines.

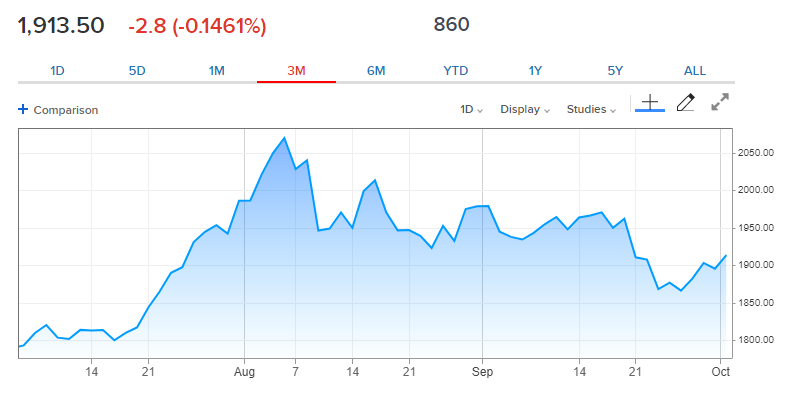

The 3QCY20 operational result was weak, compared to market expectations with short-term production below estimates. The soft quarter was largely driven by impacts of exceptional rainfall and Covid-19 staffing related matters at Haile.