Downer EDI Boasts 13% Earnings Growth

Downer EDI re-affirmed 13% EPS earnings growth, which looks attractive against an average market growth rate of 5 – 7 %.

Macro conditions remain positive in DOW’s key markets across education, health, mining road & rail transport.

Based on FY20 EPS growth we now have DOW on a forward yield of 4.4%.

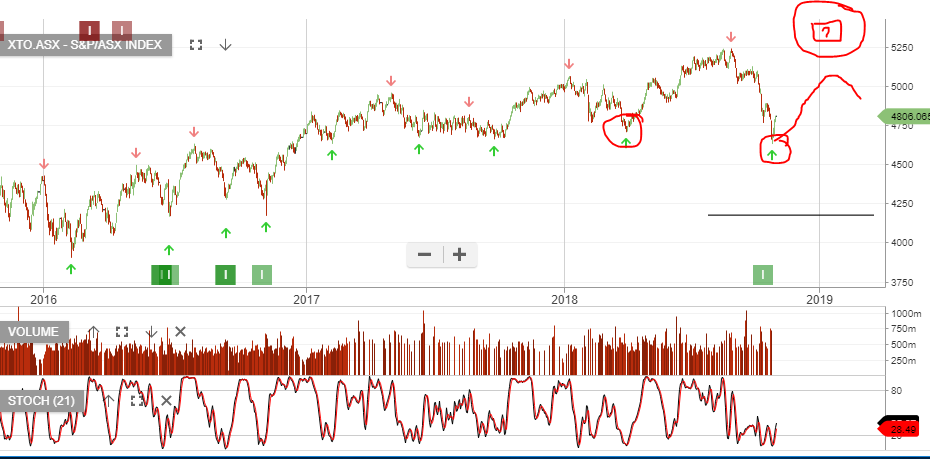

Internal momentum indicators are pointing higher and we see scope for an upside move into the $7.80/90 range.

Downer EDI