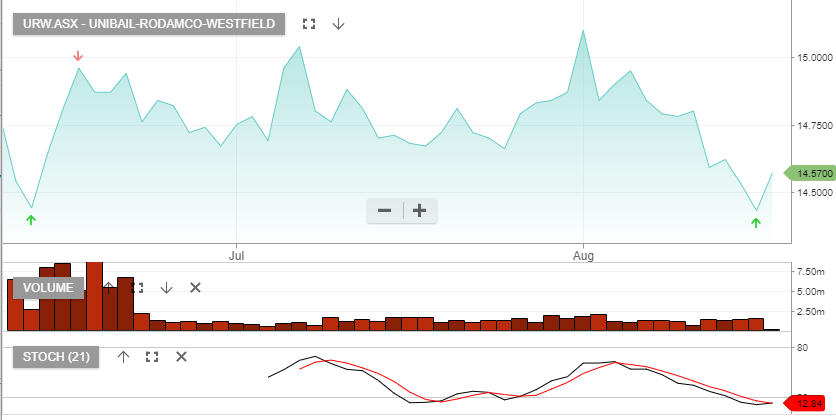

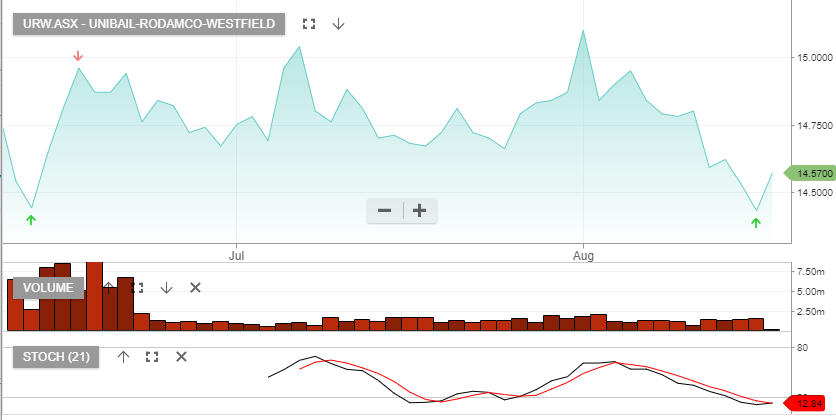

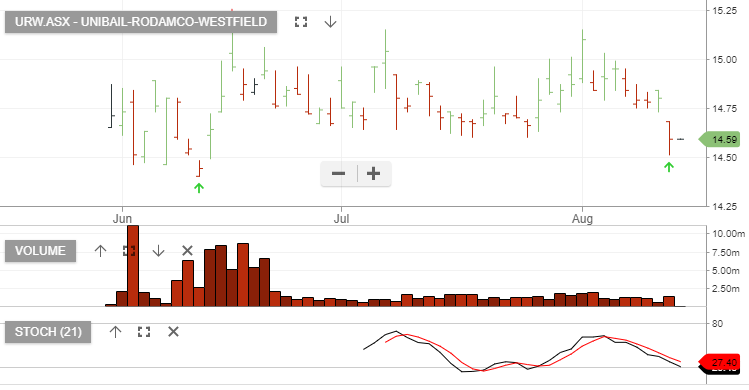

Unibail-Rodamco – buy ahead of result

We recommend buying Unibail ahead of the 2H18 earnings release on the 29th August.

We’re expecting positive forecasts following the merger with Westfield.

We recommend buying Unibail ahead of the 2H18 earnings release on the 29th August.

We’re expecting positive forecasts following the merger with Westfield.

As price action in Sonic Healthcare retraces back to $25, we recommend investors look to accumulate the stock and sell covered call options to enhance the yield.

Sonic goes ex-div on the 12th September.

A stronger consumer environment at the back end of the financial year has helped JB Hi-Fi.

Our Algo Engine generated a buy signal recently at $22.00 and the stock was added into our ASX100 model portfolio. We continue to prefer JBH over HVN.

JBH goes ex-div $0.46 on the 23rd August.

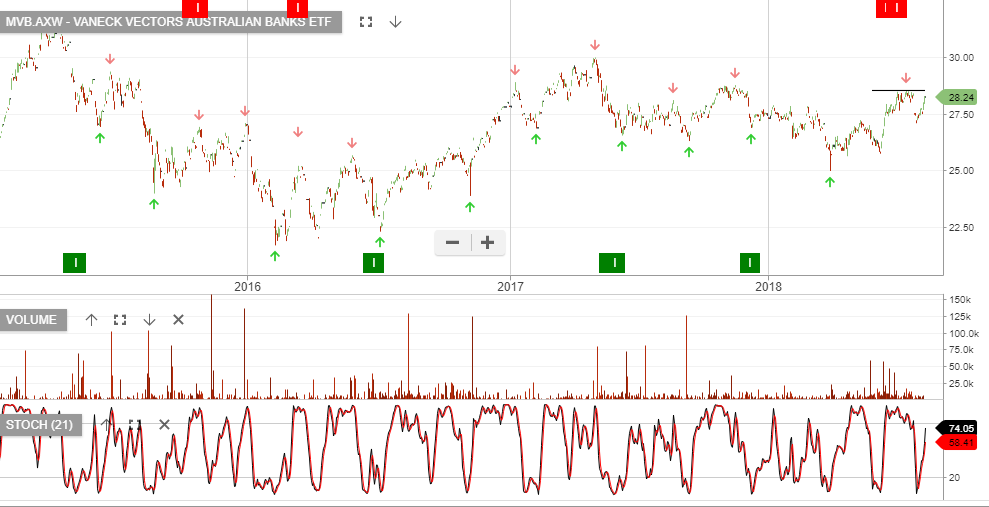

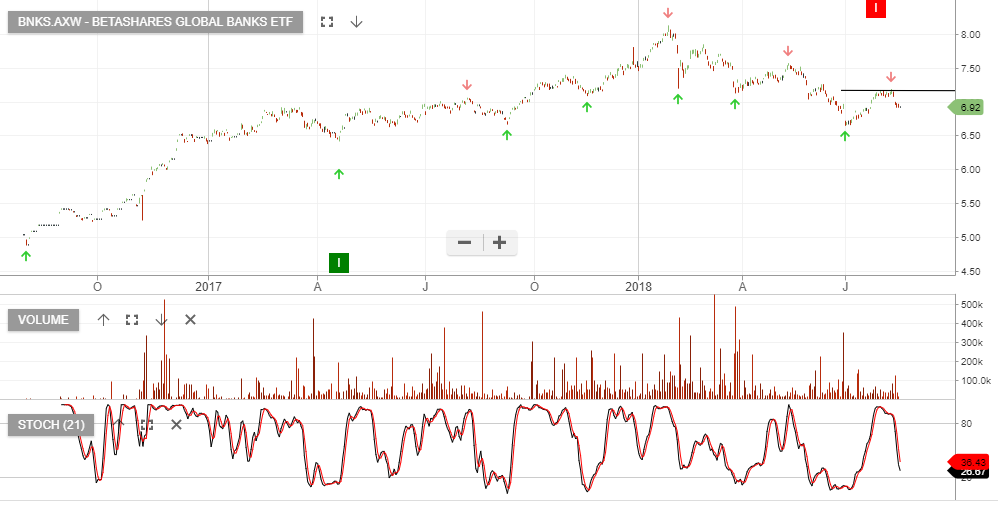

We continue to watch the lower high formations in the Australian bank names and expect the current rally to soon run into Resistance.

Low revenue growth, restructuring costs, and reduced product and regional footprint will cap earnings. We’re also watching credit quality data across credit cards, motor vehicle sales and home loans.

Trends within the Australian residential mortgage 90+ day past due loans, as a percentage of residential mortgage exposure-at-default, was mostly flat from the prior quarter. NAB’s Pillar 3 release shows only a slight uptick, whereas CBA’s result last week showed a greater increase in home loan 90+ day arrears.

There are some pockets of stress in the mortgage books, primarily in WA.

ETF covering Australian banks shows a retest of the recent highs.

Where as the ETF covering global banks shows a pronounced lower high formation.

Today’s earnings miss in IAG, along with lower guidance into FY19 has seen a sharp sell-off with price moving back to $7.50.

We see long term value for investors who accumulate the stock within the $7.25 to $7.50 range.

IAG goes ex-div $0.20 on the 6th of September.

We’re looking for a retracement in Woolworths’ share price back to $28.50 and recommend accumulating within the value range displayed below.

WOW goes ex-div $0.50 on the 7th of September. Adding a covered call will boost the cash flow to 10 – 12% on an annualised basis.

.

.

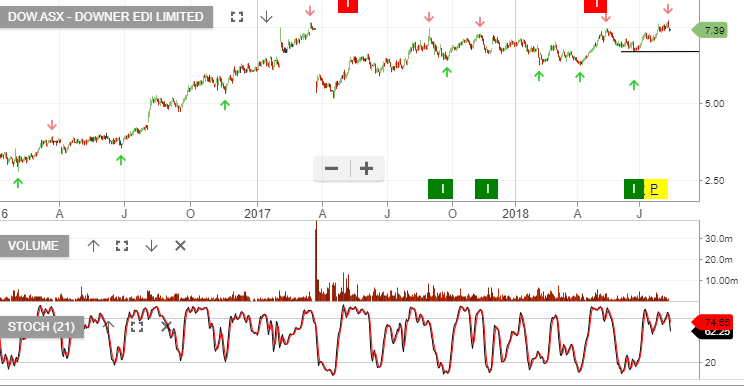

Downer EDI will report earnings on Thursday and any weakness in the share price ahead of the result, provides a buying opportunity.

We expect Thursday’s result to exceed market consensus, supported by positive industry trends. As displayed in CIMIC’s recent earnings result.

Downer goes ex-dividend $0.12 on the 11th of September.

Downer EDI

Unibail-Rodamco report 2H18 earnings on the 29th of August. Due to tax complications holding the ASX listed CDIs, we recommend investors consider building a position in the stock using a synthetic instrument such as a CFD.

This is an event driven opportunity based on the August result showing the early benefits of the cost synergies of the combined Westfield and Unibail businesses.

To establish a Saxo CFD account and take advantage of buying URW ahead of the result, please contact our office on 1300 614 002.

Unibail-Rodamco

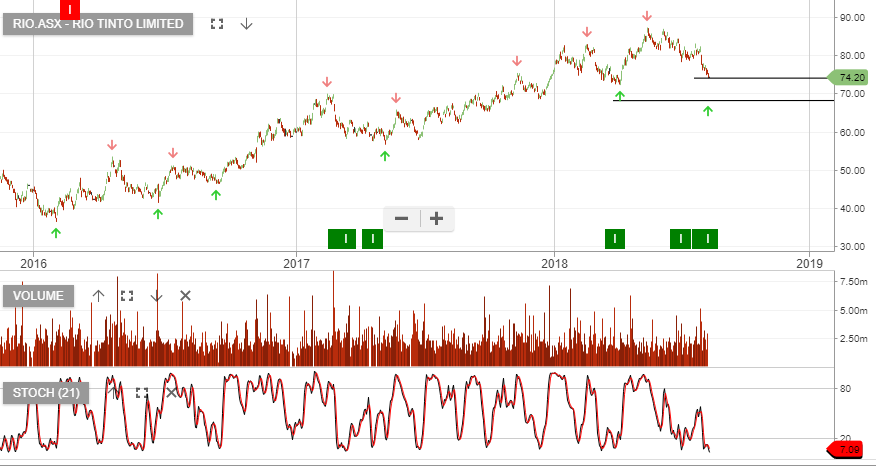

Our Algo Engine generated a buy signal in RIO and the chart below highlights the indicated “buy zone”.

Investors can look to accumulate within $68 – $74 range.

Rio Tinto

The CKI consortium has completed its due diligence and has now entered into a binding Implementation Agreement to acquire 100% of APA’s stapled securities for an all cash offer of $11.00 per share.

The offer is still subject to a number of conditions including approval from the ACCC and the FIRB.

APA goes ex div $0.21 on the 28th December.

APA